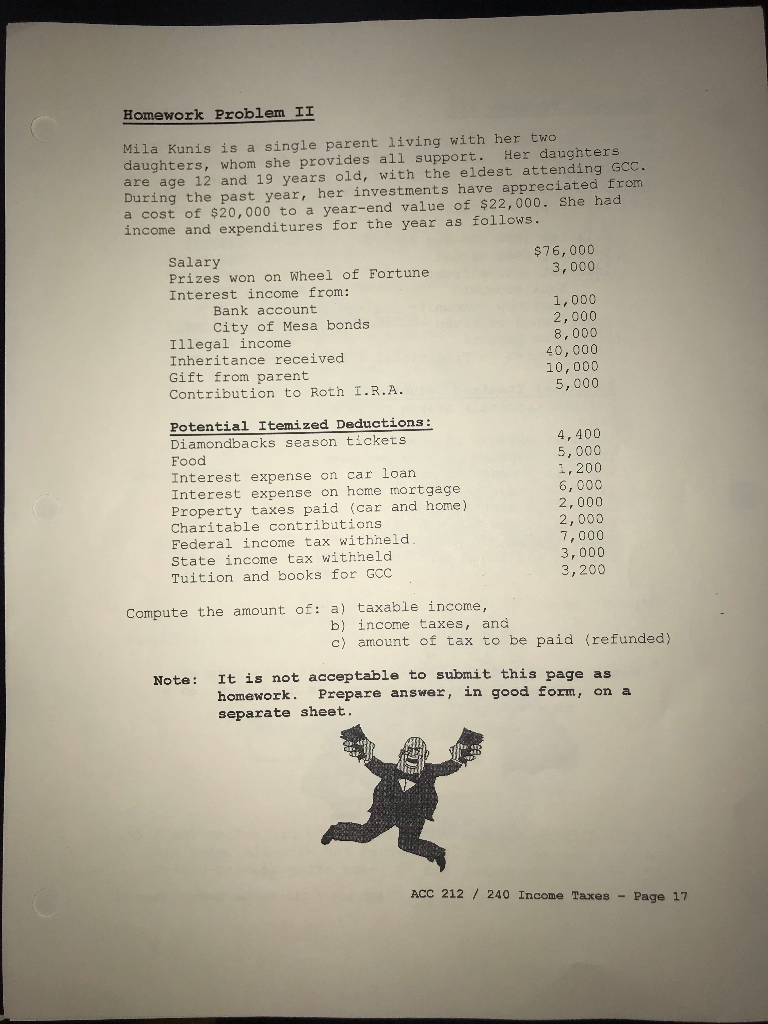

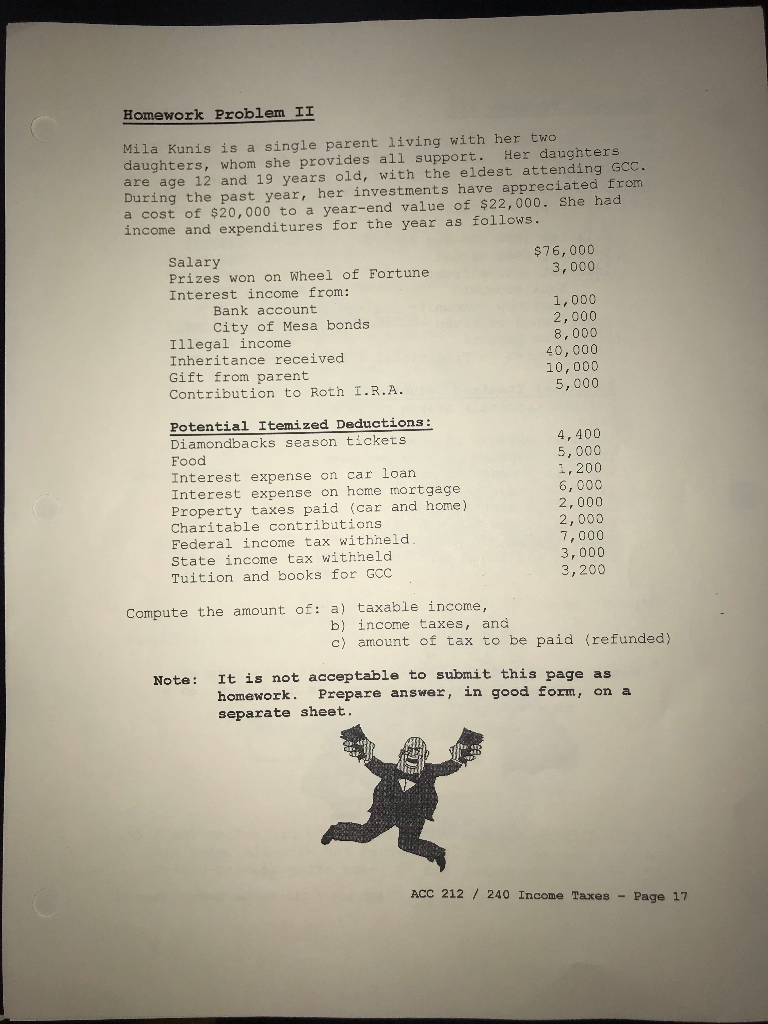

Homework Problem II Mila Kunis is a single parent living with her twO daughters, whom she provides all support. are age 12 and 19 years old, with the eldest attending GCC. During the past year, her investments have appreciated from a cost of $20,000 to a year-end value of $22,000. She had income and expenditures for the year as follows. Her daughters $76,000 3,000 Salary Prizes won on Wheel of Fortune Interest income from: 1,000 2,000 8,000 40,000 10,000 5,000 Bank account City of Mesa bonds Illegal income Inheritance received Gift from parent Contribution to Roth I.R.A Potential Itemized Deductions Diamondbacks season tickets 4,400 5,000 Food Interest expense on car loan Interest expense on home mortgage Property taxes paid (car and home) Charitable contributions 1,200 6,000 2,000 2,000 7,000 3,000 3,200 Federal income tax withheld State income tax withheld Tuition and books for GCC Compute the amount of: a) taxable income, income taxes, and b) c) amount of tax to be paid (refunded) Note It is not acceptable to submit this page as homework separate sheet. in good form, on a Prepare ans wer, ACC 212 / 240 Income Taxes Page 17 Homework Problem II Mila Kunis is a single parent living with her twO daughters, whom she provides all support. are age 12 and 19 years old, with the eldest attending GCC. During the past year, her investments have appreciated from a cost of $20,000 to a year-end value of $22,000. She had income and expenditures for the year as follows. Her daughters $76,000 3,000 Salary Prizes won on Wheel of Fortune Interest income from: 1,000 2,000 8,000 40,000 10,000 5,000 Bank account City of Mesa bonds Illegal income Inheritance received Gift from parent Contribution to Roth I.R.A Potential Itemized Deductions Diamondbacks season tickets 4,400 5,000 Food Interest expense on car loan Interest expense on home mortgage Property taxes paid (car and home) Charitable contributions 1,200 6,000 2,000 2,000 7,000 3,000 3,200 Federal income tax withheld State income tax withheld Tuition and books for GCC Compute the amount of: a) taxable income, income taxes, and b) c) amount of tax to be paid (refunded) Note It is not acceptable to submit this page as homework separate sheet. in good form, on a Prepare ans wer, ACC 212 / 240 Income Taxes Page 17