Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework Questions (Assignment should be typed; minimum 11-point font) Using the case study, Advanced Medical Technology (AMT), address the following questions. 1. Make the

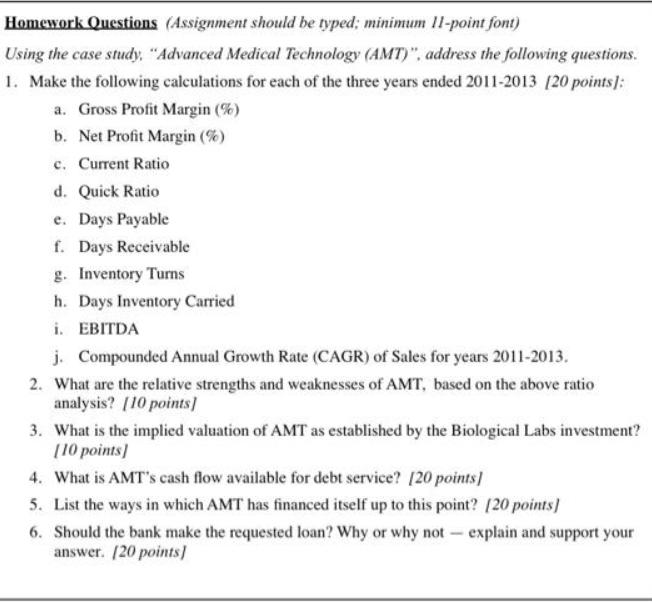

Homework Questions (Assignment should be typed; minimum 11-point font) Using the case study, "Advanced Medical Technology (AMT)", address the following questions. 1. Make the following calculations for each of the three years ended 2011-2013 [20 points]: a. Gross Profit Margin (%) b. Net Profit Margin (%) c. Current Ratio d. Quick Ratio e. Days Payable f. Days Receivable g. Inventory Turns h. Days Inventory Carried i. EBITDA j. Compounded Annual Growth Rate (CAGR) of Sales for years 2011-2013. 2. What are the relative strengths and weaknesses of AMT, based on the above ratio analysis? [10 points] 3. What is the implied valuation of AMT as established by the Biological Labs investment? [10 points] 4. What is AMT's cash flow available for debt service? [20 points] 5. List the ways in which AMT has financed itself up to this point? [20 points] 6. Should the bank make the requested loan? Why or why not explain and support your answer. [20 points]

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Year Gross Profit Margin Net Profit Margin Current Ratio Quick Ratio Days Payable Days Receivable Inventory Turns Days Inventory Carried EB...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started