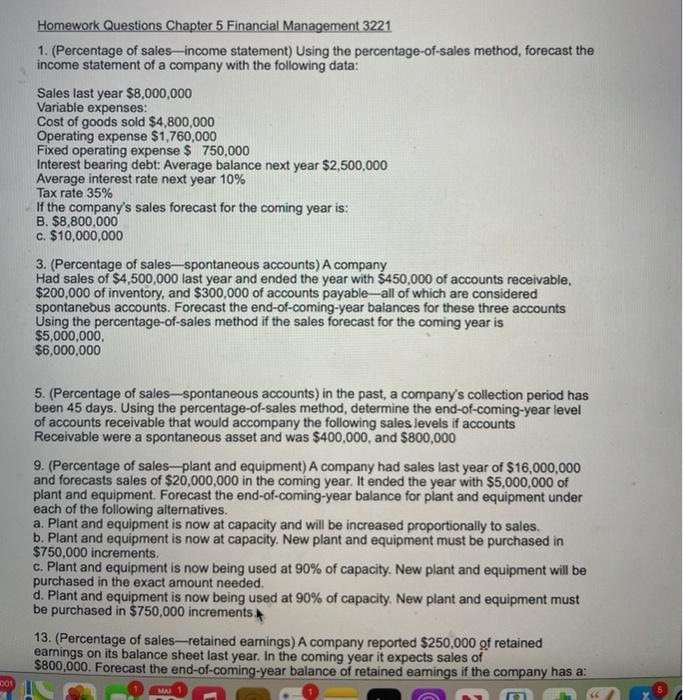

Homework Questions Chapter 5 Financial Management 3221 1. (Percentage of sales--income statement) Using the percentage-of-sales method, forecast the income statement of a company with the following data: Sales last year $8,000,000 Variable expenses: Cost of goods sold $4,800,000 Operating expense $1,760,000 Fixed operating expense $ 750,000 Interest bearing debt: Average balance next year $2,500,000 Average interest rate next year 10% Tax rate 35% If the company's sales forecast for the coming year is: B. $8,800,000 c. $10,000,000 3. (Percentage of sales-spontaneous accounts) A company Had sales of $4,500,000 last year and ended the year with $450,000 of accounts receivable. $200,000 of inventory, and $300,000 of accounts payable--all of which are considered spontaneous accounts. Forecast the end-of-coming-year balances for these three accounts Using the percentage-of-sales method if the sales forecast for the coming year is $5,000,000 $6,000,000 5. (Percentage of sales-spontaneous accounts) in the past, a company's collection period has been 45 days. Using the percentage-of-sales method, determine the end-of-coming-year level of accounts receivable that would accompany the following sales levels if accounts Receivable were a spontaneous asset and was $400,000, and $800,000 9. (Percentage of sales-plant and equipment) A company had sales last year of $16,000,000 and forecasts sales of $20,000,000 in the coming year. It ended the year with $5,000,000 of plant and equipment. Forecast the end-of-coming-year balance for plant and equipment under each of the following alternatives. a. Plant and equipment is now at capacity and will be increased proportionally to sales. b. Plant and equipment is now at capacity. New plant and equipment must be purchased in $750,000 increments. c. Plant and equipment is now being used at 90% of capacity. New plant and equipment will be purchased in the exact amount needed. d. Plant and equipment is now being used at 90% of capacity. New plant and equipment must be purchased in $750,000 increments 13. (Percentage of sales-retained earnings) A company reported $250,000 of retained earnings on its balance sheet last year. In the coming year it expects sales of $800,000. Forecast the end-of-coming-year balance of retained earnings if the company has a: 001 MAI