Answered step by step

Verified Expert Solution

Question

1 Approved Answer

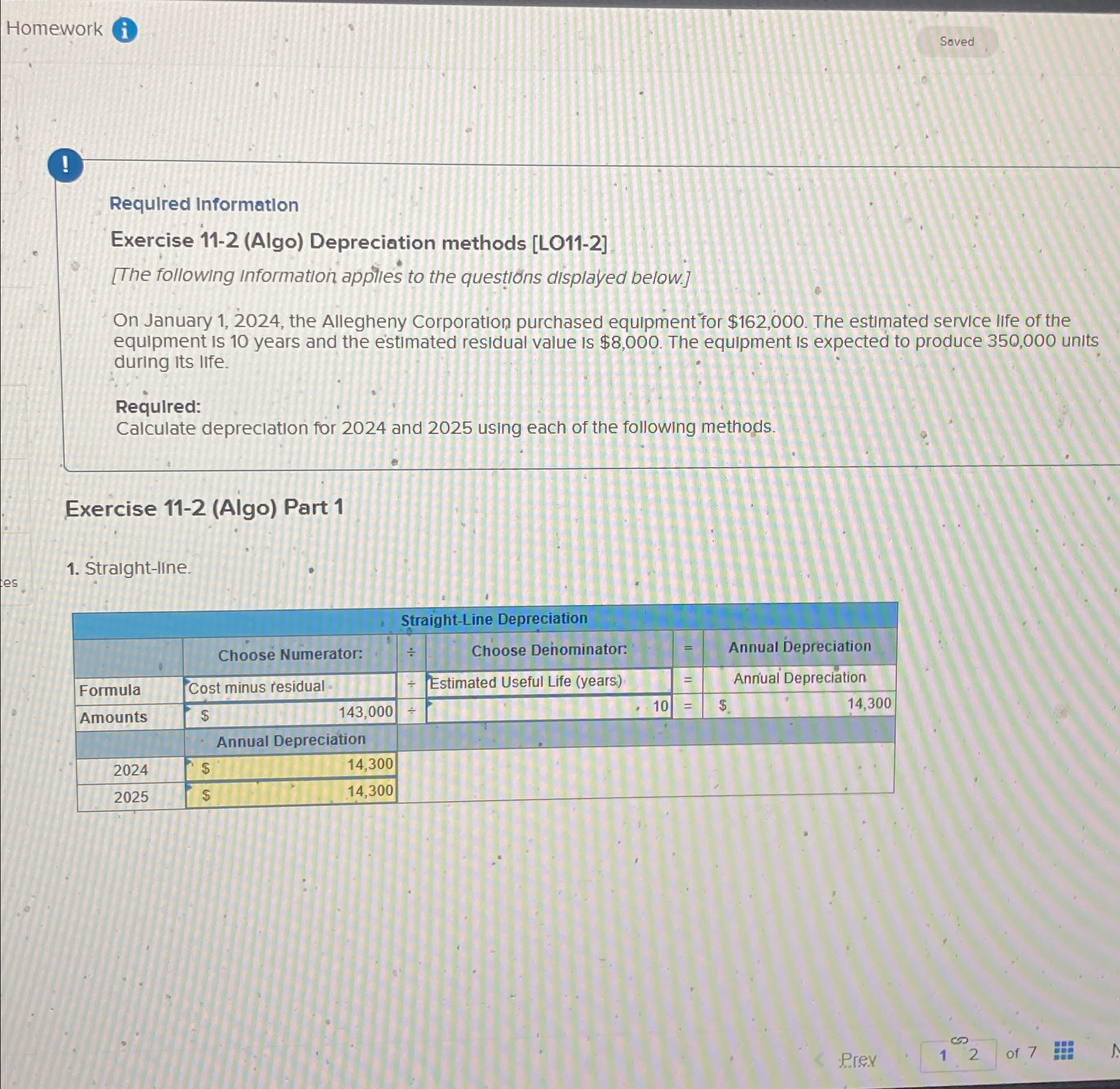

Homework Soved ! Requlred Information Exercise 1 1 - 2 ( Algo ) Depreciation methods [ LO 1 1 - 2 ] [ The following

Homework

Soved

Requlred Information

Exercise Algo Depreciation methods LO

The following information applies to the questions displayed below.

On January the Allegheny Corporation purchased equipment for $ The estimated service life of the equipment is years and the estimated residual value is $ The equipment is expected to produce units during its life.

Required:

Calculate depreciation for and using each of the following methods.

Exercise Algo Part

Straightline.

tableStraightLine DepreciationChoose Numera,tor:,Choose Dehominator:,,Annual DepreciationFormulaCost minus residual,Estimated Useful Life yearsAnnual DepreciationAmounts$$Annual Depreci,ation,,,,,,$$

Prev

of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started