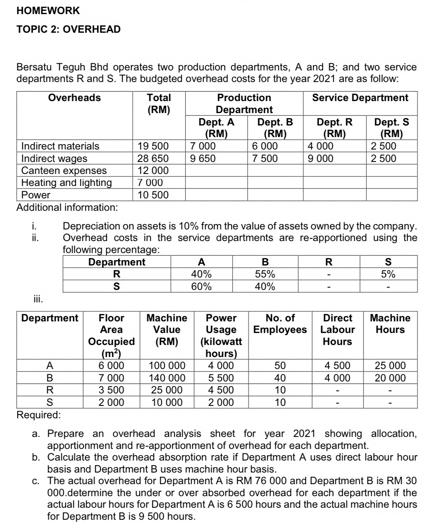

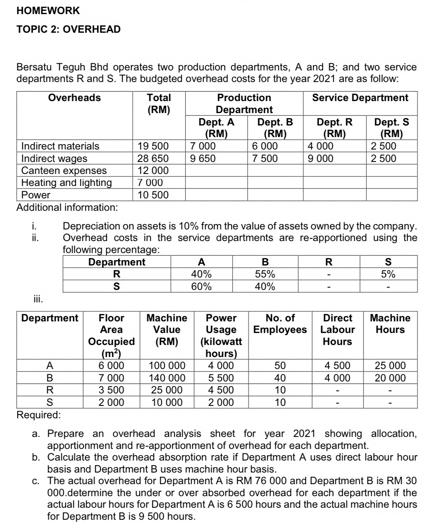

HOMEWORK TOPIC 2: OVERHEAD Bersatu Teguh Bhd operates two production departments, A and B; and two service departments R and S. The budgeted overhead costs for the year 2021 are as follow: Overheads Total Production Service Department (RM) Department Dept. A Dept. B Dept. R Dept. S (RM) (RM) (RM) (RM) Indirect materials 19 500 7 000 6 000 4 000 2 500 Indirect wages 28 650 9 650 7 500 9 000 2 500 Canteen expenses 12 000 Heating and lighting 7 000 Power 10 500 Additional information: i. Depreciation on assets is 10% from the value of assets owned by the company. ii. Overhead costs in the service departments are re-apportioned using the following percentage: Department A B R S R 40% 55% 5% S 60% 40% 5 500 Department Floor Machine Power No. of Direct Machine Area Value Usage Employees Labour Hours Occupied (RM) (kilowatt Hours (m) hours) A 6 000 100 000 4 000 50 4 500 25 000 B 7 000 140 000 40 4 000 20 000 R 3 500 25 000 4 500 10 S 2 000 10 000 2 000 10 Required: a. Prepare an overhead analysis sheet for year 2021 showing allocation apportionment and re-apportionment of overhead for each department. b. Calculate the overhead absorption rate if Department A uses direct labour hour basis and Department Buses machine hour basis. c. The actual overhead for Department A is RM 76 000 and Department B is RM 30 000 determine the under or over absorbed overhead for each department if the actual labour hours for Department Ais 6 500 hours and the actual machine hours for Department B is 9 500 hours HOMEWORK TOPIC 2: OVERHEAD Bersatu Teguh Bhd operates two production departments, A and B; and two service departments R and S. The budgeted overhead costs for the year 2021 are as follow: Overheads Total Production Service Department (RM) Department Dept. A Dept. B Dept. R Dept. S (RM) (RM) (RM) (RM) Indirect materials 19 500 7 000 6 000 4 000 2 500 Indirect wages 28 650 9 650 7 500 9 000 2 500 Canteen expenses 12 000 Heating and lighting 7 000 Power 10 500 Additional information: i. Depreciation on assets is 10% from the value of assets owned by the company. ii. Overhead costs in the service departments are re-apportioned using the following percentage: Department A B R S R 40% 55% 5% S 60% 40% 5 500 Department Floor Machine Power No. of Direct Machine Area Value Usage Employees Labour Hours Occupied (RM) (kilowatt Hours (m) hours) A 6 000 100 000 4 000 50 4 500 25 000 B 7 000 140 000 40 4 000 20 000 R 3 500 25 000 4 500 10 S 2 000 10 000 2 000 10 Required: a. Prepare an overhead analysis sheet for year 2021 showing allocation apportionment and re-apportionment of overhead for each department. b. Calculate the overhead absorption rate if Department A uses direct labour hour basis and Department Buses machine hour basis. c. The actual overhead for Department A is RM 76 000 and Department B is RM 30 000 determine the under or over absorbed overhead for each department if the actual labour hours for Department Ais 6 500 hours and the actual machine hours for Department B is 9 500 hours