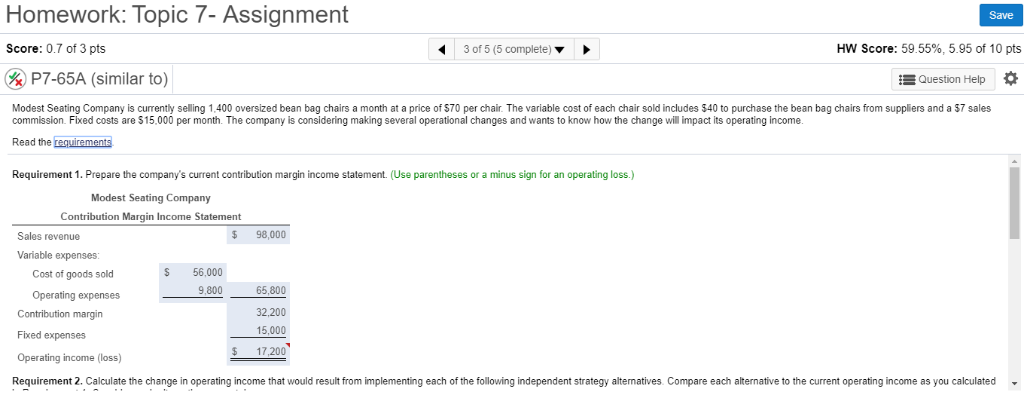

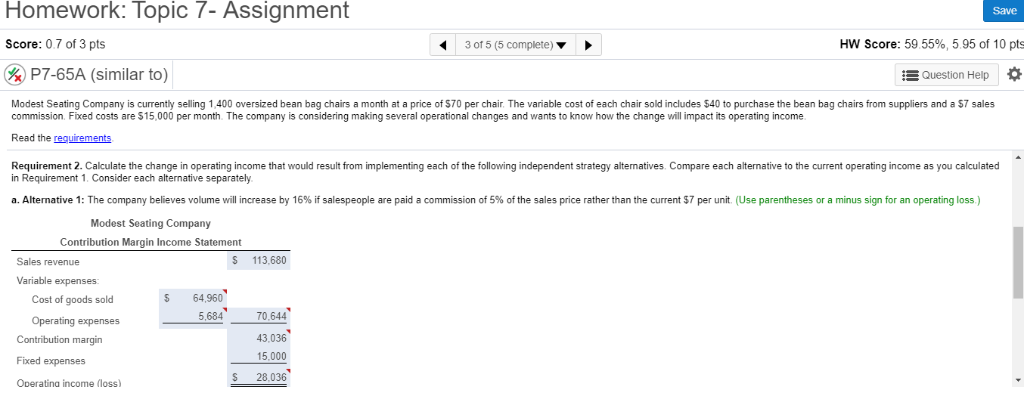

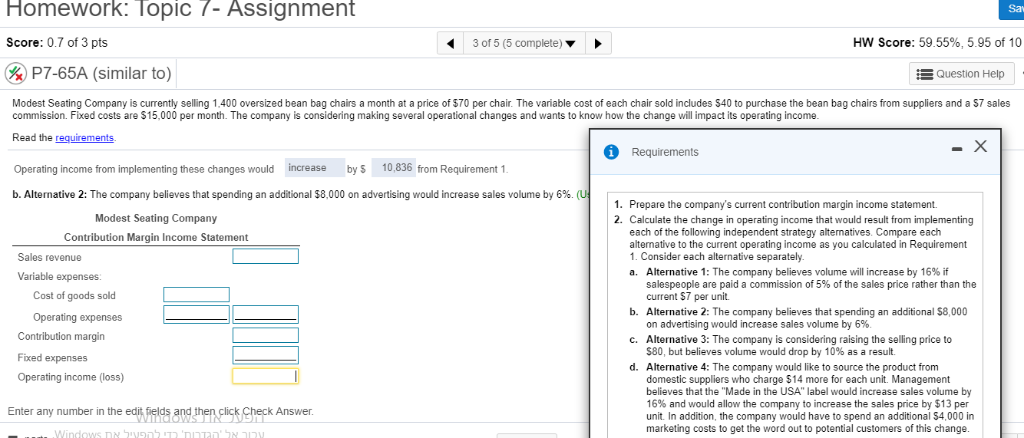

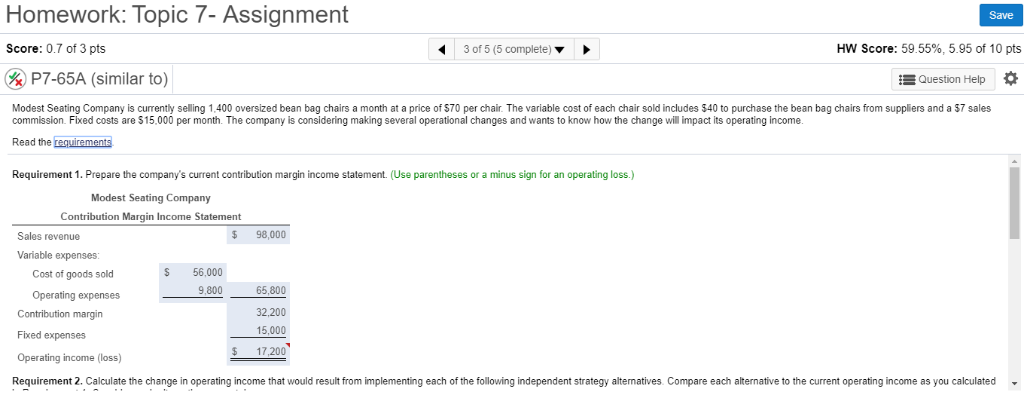

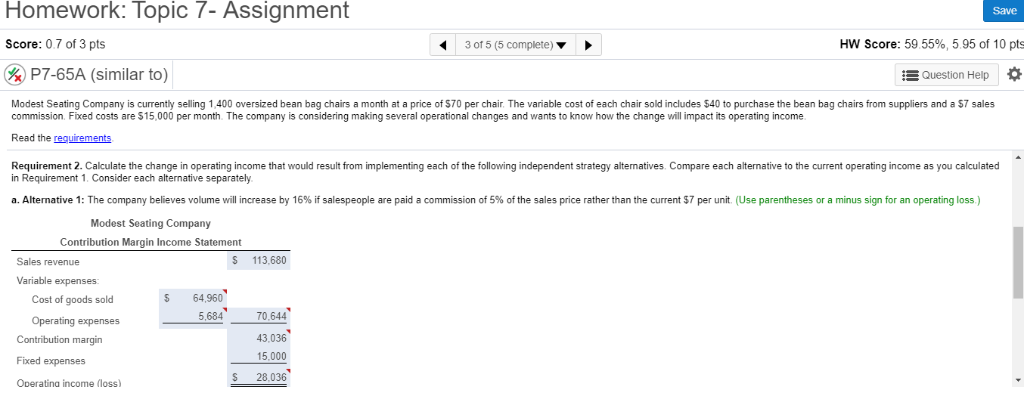

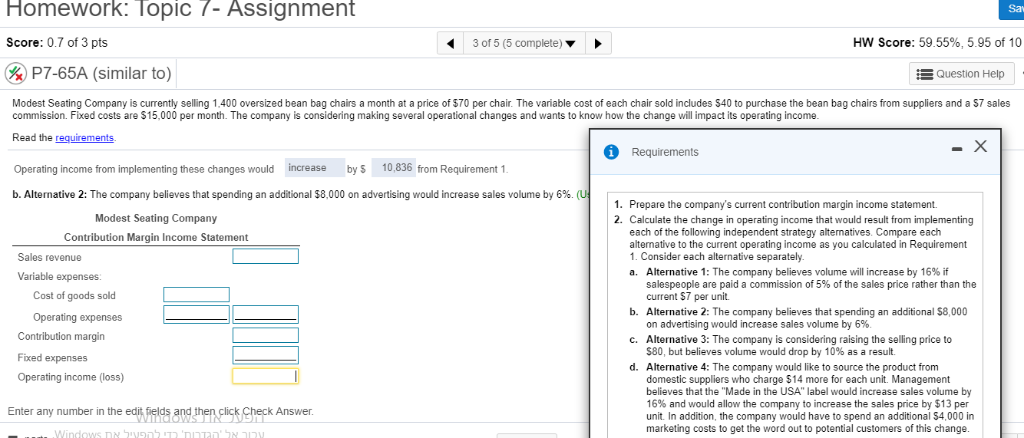

Homework: Topic - Assignment Save Score: 0.7 of 3 pts 43 of 5 (5 complete)> HW Score: 59.55%, 5.95 of 10 pts P7-65A (similar to) Question Help Modest Seating Company is currently selling 1,400 oversized bean bag chairs a month at a price of $70 per chair. The variable cost of each chair sold includes $40 to purchase the bean bag chairs from suppliers and a $7 sales commission. Fixed costs are $15,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income Read the requirements Requirement 1. Prepare the company's current contribution margin income statement. (Use parentheses or a minus sign for an operating loss.) Modest Seating Company Contribution Margin Income Statement Sales revenue $ 98,000 Variable expenses S 56,000 9,800 Cost of goods sold Operating expenses Contribution margin Fixed expenses Operating income (loss) Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated- 65,800 32,200 15,000 17.200 Homework: Topic 7- Assignment Score: 0.7 of 3 pts Save 3 of5 (5 complete) HW Score: 59 5596, 5 95 of 10 pts P7-65A (similar to) E Question Help Modest Seating Company is currently selling 1,400 oversized bean bag chairs a month at a price of $70 per chair. The variable cost of each chair sold includes $40 to purchase the bean bag chairs from suppliers and a $7 sales commission. Fixed costs are $15,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income Read the requirements Requirement 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately a. Alternative 1: The company believes volume will increase by 16% lf salespeople are paid a commission of 5% of the sales price rather than the current $7 per unit Use parentheses or a minus sign for an operating loss Modest Seating Company Contribution Margin Income Statement Sales revenue S 113,680 Variable expenses S 64.960 5,684 Cost of goods sold Operating expenses Contribution margin Fixed expenses Operatina income (loss) 70,644 43,036 15,000 s 28,036 Homework: lopIC /- ASsignment Sav Score: 0.7 of 3 pts 3 of 5 (5 complete) HW Score: 59.55%, 5.95 of 10 P7-65A (similar to) Question Help Modest Seating Company is curently selling 1,400 oversized bean bag chairs a month at a price of $70 per chair. The variable cost of each chair sold includes $40 to purchase the bean bag chairs from suppliers and a $7 sales commission. Fixed costs are $15,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income. Read the requirements Operating income from implementing these changes would increase by $ 10,836 from Requirement 1 b. Alternative 2: The company believes that spending an additional $8,000 on advertising would increase sales volume by 6% Requirements 1. Prepare the company's current contribution margin income statement. 2. Calculate the change in operating income that would result from implementing Modest Seating Company Contribution Margin Income Statement each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 16% if Variablee salespeople are paid a commission of 5% of the sales price rather than the current $7 per unit. Cost of goods sold b. Alternative 2: The company believes that spending an additional $8,000 c. Alternative 3: The company is considering raising the selling price to d. Alternative 4: The company would like to source the product from Operating expenses on advertising would increase sales volume by 6% $80, but believes volume would drop by 10% as a result. Operating income (loss) domestic suppliers who charge $14 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 16% and would allow the company to increase the sales price by $13 per unit. In addition, the company would have to spend an additional $4,000 in marketing costs to get the word out to potential customers of this change Enter any number in the edit s and f k