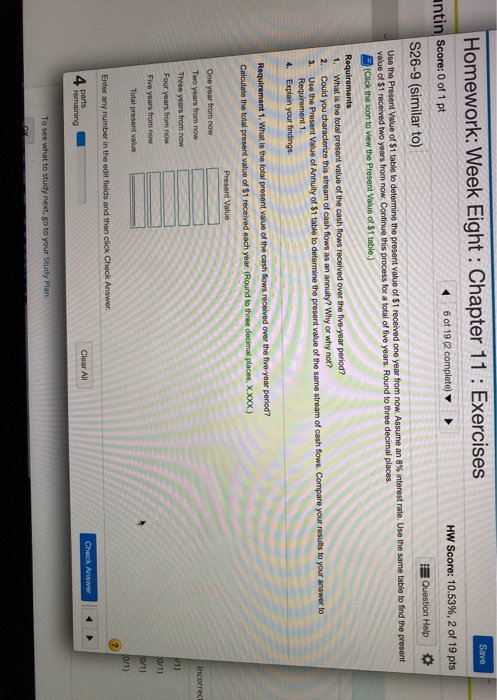

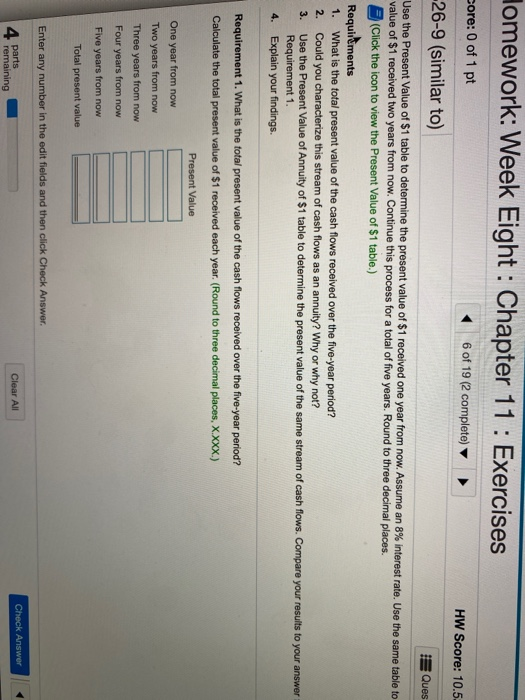

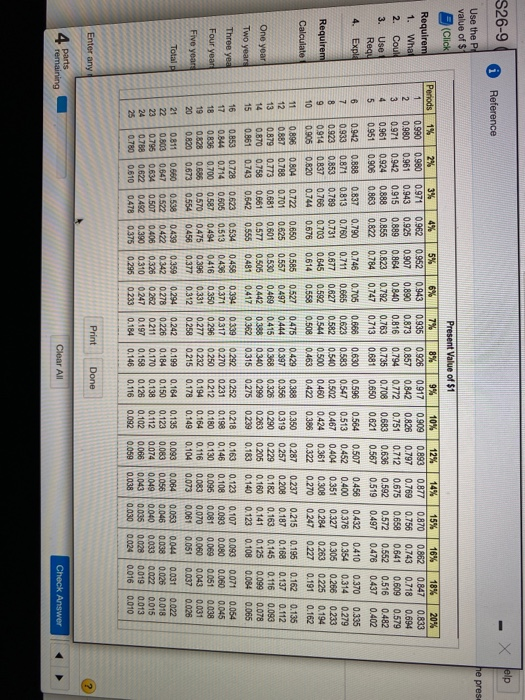

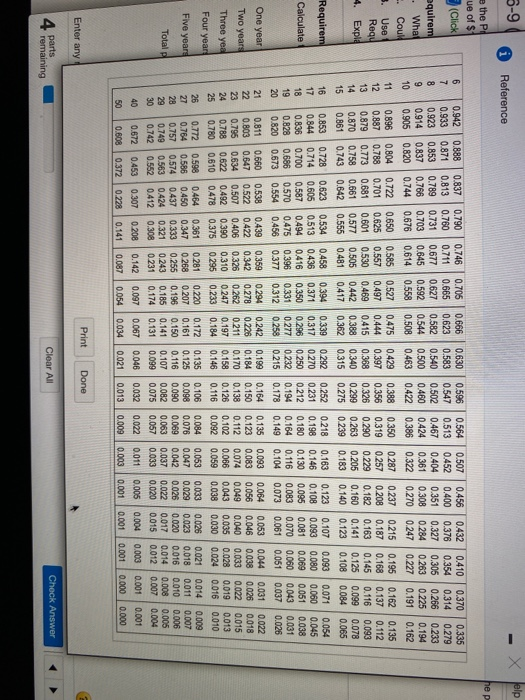

Homework: Week Eight : Chapter 11: Exercises Save antin Score: 0 of 1 pt 6 of 19 (2 complete) HW Score: 10.53%, 2 of 19 pts S26-9 (similar to) Question Help Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume an 8% interest rate. Use the same table to find the present value of $1 received two years from now. Continue this process for a total of five years. Round to three decimal places. (Click the icon to view the Present Value of $1 table.) Requirements 1. What is the total present value of the cash flows received over the five-year period? 2. Could you characterize this stream of cash flows as an annuity? Why or why not? 3. Use the Present Value of Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer to Requirement 1. 4. Explain your findings. Requirement 1. What is the total present value of the cash flows received over the five-year period? Calculate the total present value of $1 received each year, (Round to three decimal places, X.XXX.) Present Value One year from now Two years from now Three years from now Four years from now Five years from now Total present value Incorrect V1) 10/1) 0/1) 0/1) ? Enter any number in the edit fields and then click Check Answer. parts remaining Clear All Clear All Check Answer To see what to study next. go to your Study Plan Homework: Week Eight: : Chapter 11 : Exercises 6 of 19 (2 complete) core: 0 of 1 pt -26-9 (similar to) HW Score: 10.5. Ques Use the Present Value of $1 table to determine the present value of $1 received one year from now. Assume an 8% interest rate. Use the same table to value of $1 received two years from now. Continue this process for a total of five years. Round to three decimal places. (Click the icon to view the Present Value of $1 table.) Requirements 1. What is the total present value of the cash flows received over the five-year period? 2. Could you characterize this stream of cash flows as an annuity? Why or why not? Use the Present Value of Annuity of $1 table to determine the present value of the same stream of cash flows. Compare your results to your answer Requirement 1. Explain your findings. 3. 4. Requirement 1. What is the total present value of the cash flows received over the five-year period? Calculate the total present value of $1 received each year. (Round to three decimal places, X.XXX.) Present Value One year from now Two years from now Three years from now Four years from now Five years from now Total present value Enter any number in the edit fields and then click Check Answer. 4 Check Answer Clear All parts remaining S26-9 xelp Reference he pres Use the P: value of $ (Click Present Value of $1 Periods 15% 16% 1 Requirem 1. Whal 2. Coul 3. Use Requ 4. Expl 2 3 4 5 6 7 8 9 10 Requirem Calculate 11 12 13 14 15 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 18% 20% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.942 0.888 0.837 0.790 0.746 0.705 0.686 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.923 0.853 0.789 0.731 0.877 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.828 0.038 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.820 0.031 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.811 0.650 0.538 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 0.800 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 0.796 0.634 0.507 0.406 0.326 0.262 0211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 0.788 0.622 0.492 0.390 0.310 0 247 0.197 0.158 0.126 0.102 0.066 0.043 0.035 0.028 0.019 0.780 0.013 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.059 0.038 0.030 0.024 0.016 0.010 One year Two year Three ye Four year 16 17 18 19 20 Five year Total 21 22 23 24 Enter any Print Done 4 parts remaining Clear All Check