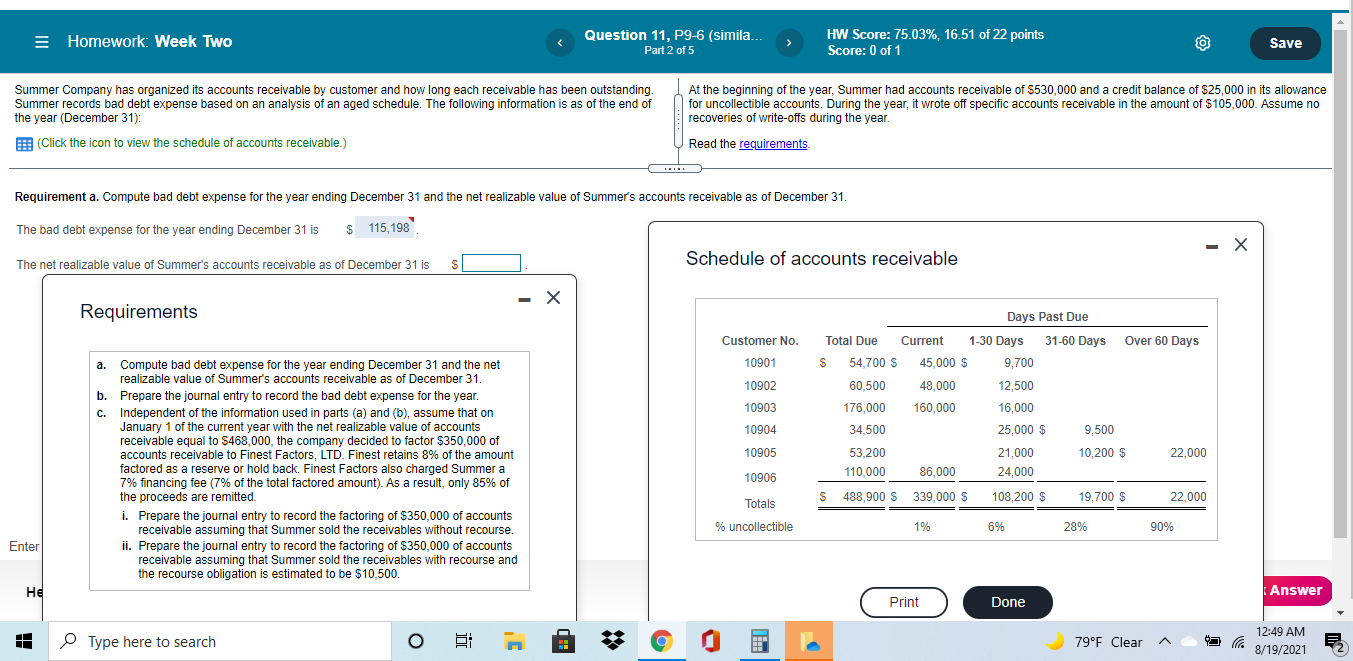

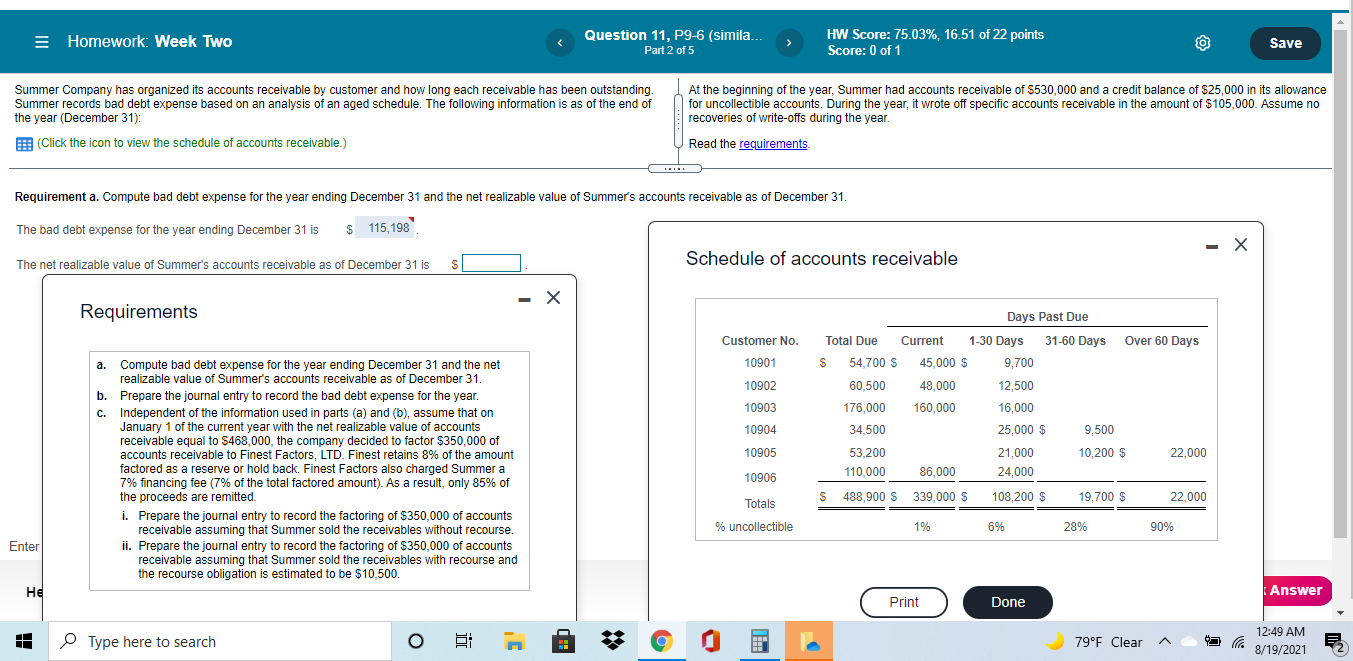

= Homework: Week Two Question 11, P9-6 (simila... Part 2 of 5 HW Score: 75.03%, 16.51 of 22 points Score: 0 of 1 Save Summer Company has organized its accounts receivable by customer and how long each receivable has been outstanding Summer records bad debt expense based on an analysis of an aged schedule. The following information is as of the end of the year (December 31): At the beginning of the year, Summer had accounts receivable of $530,000 and a credit balance of $25,000 in its allowance for uncollectible accounts. During the year, it wrote off specific accounts receivable in the amount of $105,000. Assume no recoveries of write-offs during the year. B (Click the icon to view the schedule of accounts receivable.) Read the requirements Requirement a. Compute bad debt expense for the year ending December 31 and the net realizable value of Summer's accounts receivable as of December 31. The bad debt expense for the year ending December 31 is $ 115,198 - X The net realizable value of Summer's accounts receivable as of December 31 is $ Schedule of accounts receivable Requirements Customer No. 10901 10902 Days Past Due Total Due Current 1-30 Days 31-60 Days Over 60 Days S 54,700 S 45,000 $ 9,700 60,500 48,000 12,500 160,000 16,000 34,500 25,000 $ 9.500 53,200 21,000 10,200 $ 22,000 110,000 86,000 24,000 176,000 10903 10904 a. Compute bad debt expense for the year ending December 31 and the net realizable value of Summer's accounts receivable as of December 31. b. Prepare the journal entry to record the bad debt expense for the year. c. Independent of the information used in parts (a) and (b), assume that on January 1 of the current year with the net realizable value of accounts receivable equal to 5468,000, the company decided to factor $350,000 of accounts receivable to Finest Factors, LTD. Finest retains 8% of the amount factored as a reserve or hold back. Finest Factors also charged Summer a 7% financing fee (7% of the total factored amount). As a result, only 85% of the proceeds are remitted. i. Prepare the journal entry to record the factoring of $350,000 of accounts receivable assuming that Summer sold the receivables without recourse. ii. Prepare the journal entry to record the factoring of $350,000 of accounts receivable assuming that Summer sold the receivables with recourse and the recourse obligation estimated to be $10.500 10905 10906 488,900 S Totals 108,200 $ 339,000 $ 19,700 $ 22,000 % uncollectible 1% 6% 28% 90% Enter Answer Print Done | IH Type here to search O J' 79F Clear la 12:49 AM 8/19/2021