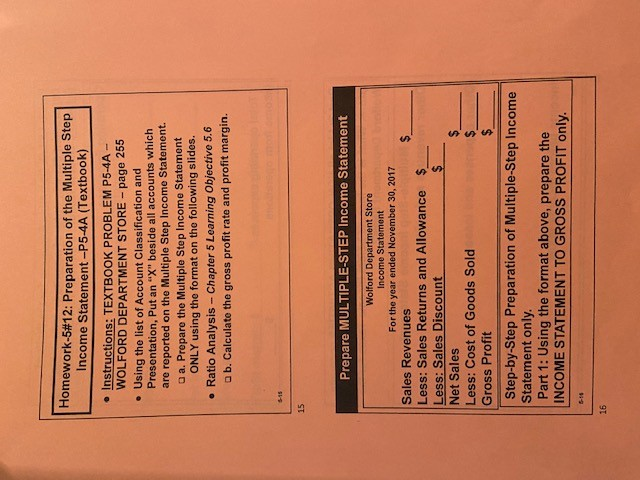

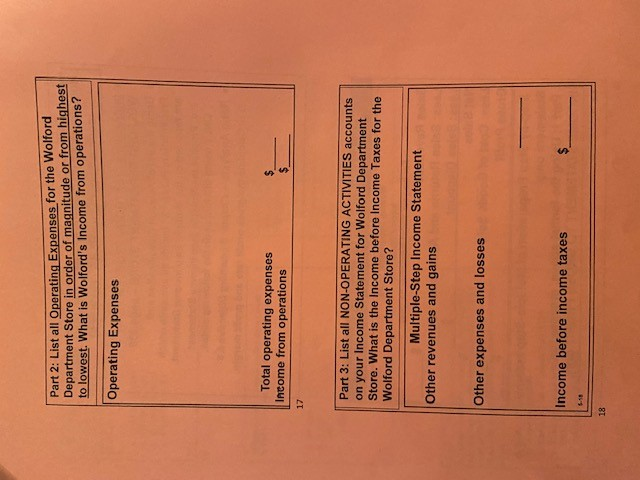

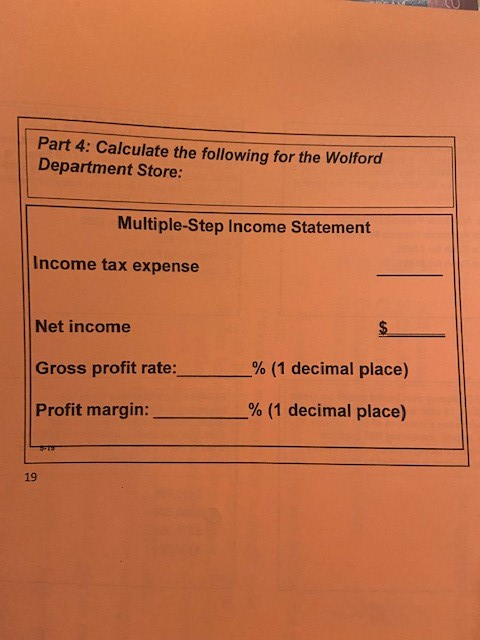

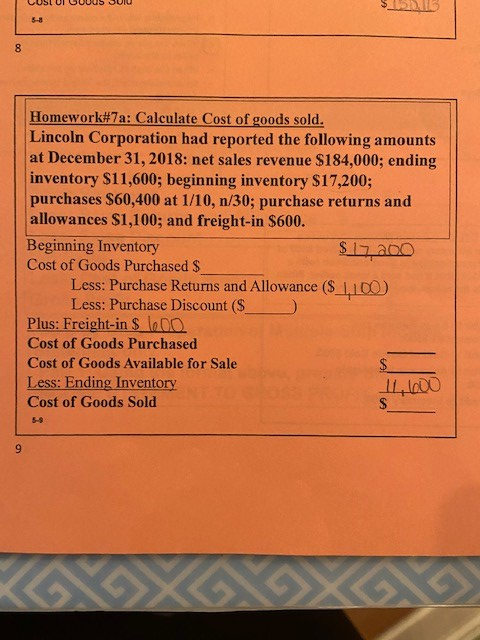

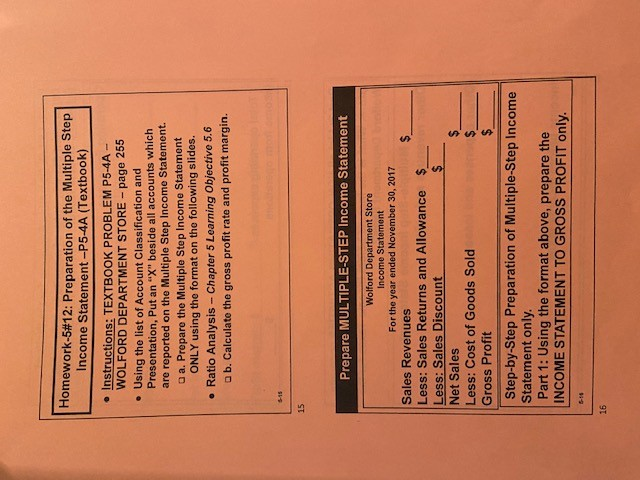

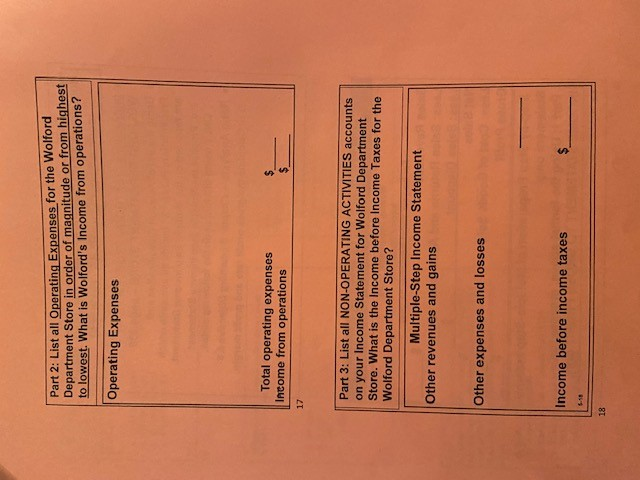

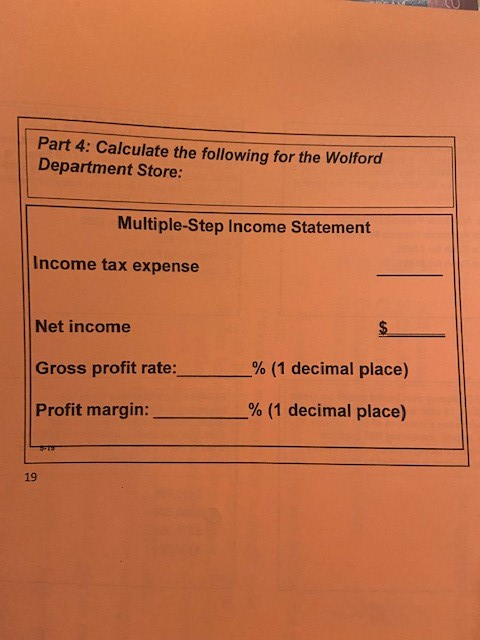

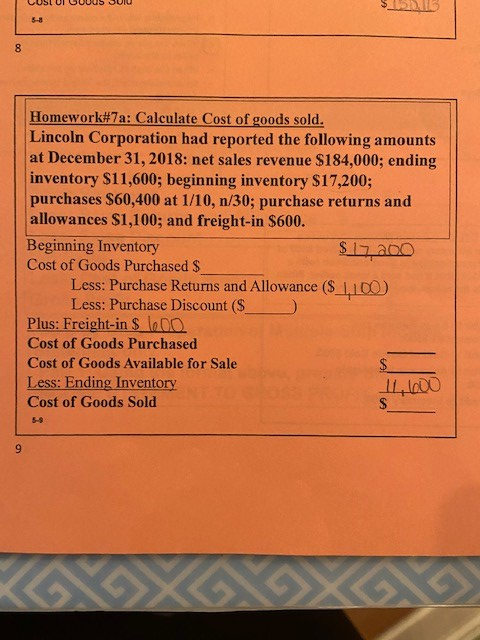

Homework-5#12: Preparation of the Multiple Step Income Statement -P5-4A (Textbook) Instructions: TEXTBOOK PROBLEM P5-4A - WOLFORD DEPARTMENT STORE - page 255 . Using the list of Account Classification and Presentation, Put an "X" besido all accounts which are reported on the Multiple Step Income Statement. a. Prepare the Multiple Step Income Statement ONLY using the format on the following slides. . Ratio Analysis - Chapter 5 Learning Objective 5.6 ab. Calculate the gross profit rate and profit margin. Prepare MULTIPLE-STEP Income Statement Wolford Department Store Income Statement For the year ended November 30, 2017 Sales Revenues Less: Sales Returns and Allowance $ Less: Sales Discount Net Sales Less: Cost of Goods Sold Gross Profit Step-by-Step Preparation of Multiple-Step Income Statement only. Part 1: Using the format above, prepare the INCOME STATEMENT TO GROSS PROFIT only. Part 2: List all Operating Expenses for the Wolford Department Store in order of magnitude or from highest to lowest. What is Wolford's Income from operations? Operating Expenses Total operating expenses Income from operations Part 3: List all NON-OPERATING ACTIVITIES accounts on your Income Statement for Wolford Department Store. What is the Income before Income Taxes for the Wolford Department Store? Multiple-Step Income Statement Other revenues and gains Other expenses and losses Income before income taxes Part 4: Calculate the following for the Wolford Department Store: Multiple-Step Income Statement Income tax expense Net income Gross profit rate: % (1 decimal place) Profit margin: % (1 decimal place) USLUGUUUS QUI Homework#7a: Calculate Cost of goods sold. Lincoln Corporation had reported the following amounts at December 31, 2018: net sales revenue $184,000; ending inventory $11,600; beginning inventory $17,200; purchases $60,400 at 1/10,n/30; purchase returns and allowances $1,100; and freight-in $600. Beginning Inventory $ 1700 Cost of Goods Purchased $ Less: Purchase Returns and Allowance ($ 1,100 Less: Purchase Discount (S ) Plus: Freight-in $ 0.00 Cost of Goods Purchased Cost of Goods Available for Sale Less: Ending Inventory 1.000 Cost of Goods Sold Homework-5#12: Preparation of the Multiple Step Income Statement -P5-4A (Textbook) Instructions: TEXTBOOK PROBLEM P5-4A - WOLFORD DEPARTMENT STORE - page 255 . Using the list of Account Classification and Presentation, Put an "X" besido all accounts which are reported on the Multiple Step Income Statement. a. Prepare the Multiple Step Income Statement ONLY using the format on the following slides. . Ratio Analysis - Chapter 5 Learning Objective 5.6 ab. Calculate the gross profit rate and profit margin. Prepare MULTIPLE-STEP Income Statement Wolford Department Store Income Statement For the year ended November 30, 2017 Sales Revenues Less: Sales Returns and Allowance $ Less: Sales Discount Net Sales Less: Cost of Goods Sold Gross Profit Step-by-Step Preparation of Multiple-Step Income Statement only. Part 1: Using the format above, prepare the INCOME STATEMENT TO GROSS PROFIT only. Part 2: List all Operating Expenses for the Wolford Department Store in order of magnitude or from highest to lowest. What is Wolford's Income from operations? Operating Expenses Total operating expenses Income from operations Part 3: List all NON-OPERATING ACTIVITIES accounts on your Income Statement for Wolford Department Store. What is the Income before Income Taxes for the Wolford Department Store? Multiple-Step Income Statement Other revenues and gains Other expenses and losses Income before income taxes Part 4: Calculate the following for the Wolford Department Store: Multiple-Step Income Statement Income tax expense Net income Gross profit rate: % (1 decimal place) Profit margin: % (1 decimal place) USLUGUUUS QUI Homework#7a: Calculate Cost of goods sold. Lincoln Corporation had reported the following amounts at December 31, 2018: net sales revenue $184,000; ending inventory $11,600; beginning inventory $17,200; purchases $60,400 at 1/10,n/30; purchase returns and allowances $1,100; and freight-in $600. Beginning Inventory $ 1700 Cost of Goods Purchased $ Less: Purchase Returns and Allowance ($ 1,100 Less: Purchase Discount (S ) Plus: Freight-in $ 0.00 Cost of Goods Purchased Cost of Goods Available for Sale Less: Ending Inventory 1.000 Cost of Goods Sold