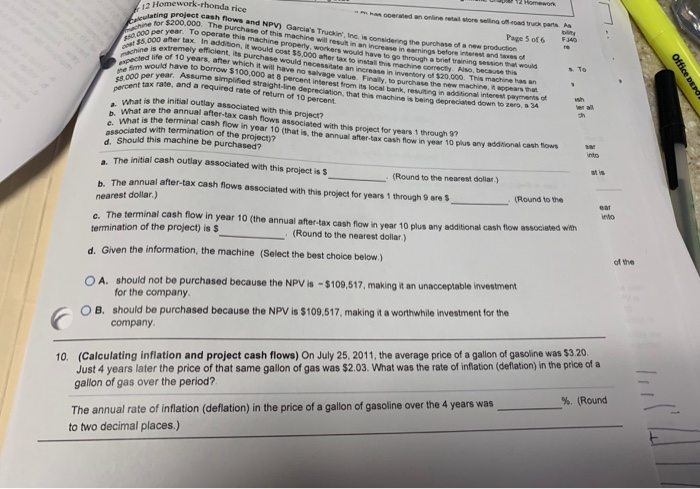

Homework-rhonda rice 2 Home hered an online online pas Page 5 of 6 ring project cash flows and NPV) Garcia's Truckin' ing is considering the purchase of a new for $200.000. The purchase of this machine will resin an incred i ngs before and are per year. To operate this machine property, workers wou have to go through a brit 0.000 after tax. In addition, it would cost 15.000 a ning $5.00 r tax to install the machine con Also, beca as extreme you purchase would nec e nincrease in invertory of $20.000. This man We of ye a r which will have no savage valve Fingly to purchase the new Ch . wuld have to TON 100.000 a B percent pres e g ona more en per year. Assume simplified straight-line depreciation that the machine is being depreciated down to zero tax rate, and a required rate of return of 10 percent Office DEPO percent is the initial outlay associated with this prolact What are the annual after-tax cash flows associated with this project for years I though What is the terminal cash flow in year 10 (that is the annual after tax cash flow in year 10 plus any additional cash flows ociated with termination of the prolon2 Should this machine be purchased s The initial cash outlay associated with this projects (Round to the nearest dollar) The annual after-tax cash flows associated with this project for years 1 through 9 are s (Round to the nearest dollar.) The terminal cash flow in year 10 (the annual after-tax cash wine 10 plus disonal cash flow associated with termination of the project) is $ (Round to the nearest dollar) d. Given the information, the machine (Select the best choice below) of the OA should not be purchased because the NPV is - $109.517 making it an unacceptable investment for the company OB should be purchased because the NPV is $109,517making it a worthwhile investment for the company. 10. (Calculating inflation and project cash flows) On July 25, 2011, the average price of a gallon of gasoline was $3.20 Just 4 years later the price of that same gallon of gas was $2.03. What was the rate of inflation (deflation in the price of a gallon of gas over the period? %. (Round The annual rate of inflation (deflation) in the price of a gallon of gasoline over the 4 years was to two decimal places.)