Answered step by step

Verified Expert Solution

Question

1 Approved Answer

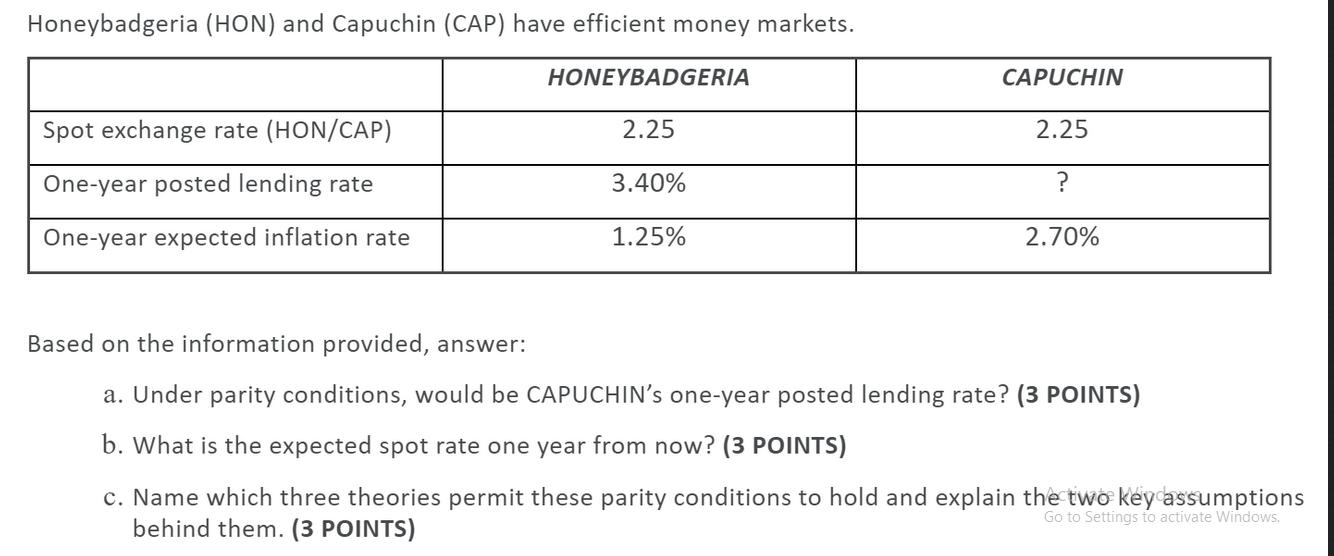

Honeybadgeria (HON) and Capuchin (CAP) have efficient money markets. HONEYBADGERIA Spot exchange rate (HON/CAP) 2.25 One-year posted lending rate One-year expected inflation rate 3.40%

Honeybadgeria (HON) and Capuchin (CAP) have efficient money markets. HONEYBADGERIA Spot exchange rate (HON/CAP) 2.25 One-year posted lending rate One-year expected inflation rate 3.40% 1.25% Based on the information provided, answer: CAPUCHIN 2.25 ? 2.70% a. Under parity conditions, would be CAPUCHIN's one-year posted lending rate? (3 POINTS) b. What is the expected spot rate one year from now? (3 POINTS) c. Name which three theories permit these parity conditions to hold and explain the two key assumptions behind them. (3 POINTS) Go to Settings to activate Windows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you analyze the image you sent which is a currency exchange rate comparison between Honeybadgeria HON and Capuchin CAP a Under parity conditions what would be Capuchins oneyear posted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started