Question

Honey-dukes Trent Shop is considering the desirability of producing a new chocolate candy called Pleasure Bombs. Before purchasing the new equipment required to manufacture Pleasure

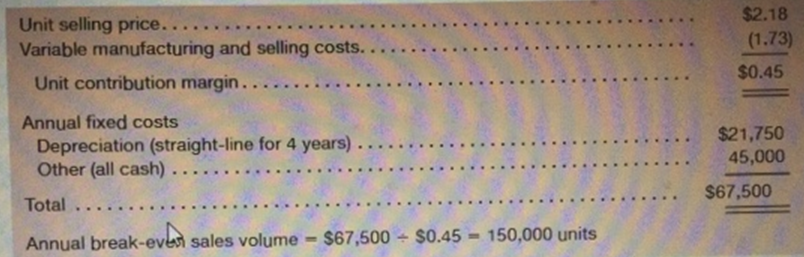

Honey-dukes Trent Shop is considering the desirability of producing a new chocolate candy called Pleasure Bombs. Before purchasing the new equipment required to manufacture Pleasure Bombs, Neville long, the shop?s proprietor performed the following analysis:

Because the expected annual sales volume is 160,000 units, long decided to undertake the production of Pleasure Bombs. This required and immediate investment of $87,000 in equipment that has a life of four year and no salvage value. After four years, the production of Pleasure Bombs will be discontinued.

Required

a. Evaluate the analysis performed by long.

b. If Honey-dukes Treat Shop has a time value of money of 8 percent, should it make the investment with projected annual sales of 160,000 units?

c. Considering the time value of money, what annual unit sales volume is required to break even?

Unit selling price...... Variable manufacturing and selling costs.. Unit contribution margin.. Annual fixed costs Depreciation (straight-line for 4 years) Other (all cash).. Total... Annual break-even sales volume - $67,500 $0.45 - 150,000 units .... .... ... $2.18 (1.73) $0.45 $21,750 45,000 $67,500

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Since the annual break even point is 150000 units Production of 160000 units wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started