Hong Kong tax is applicable.

Hong Kong tax is applicable.

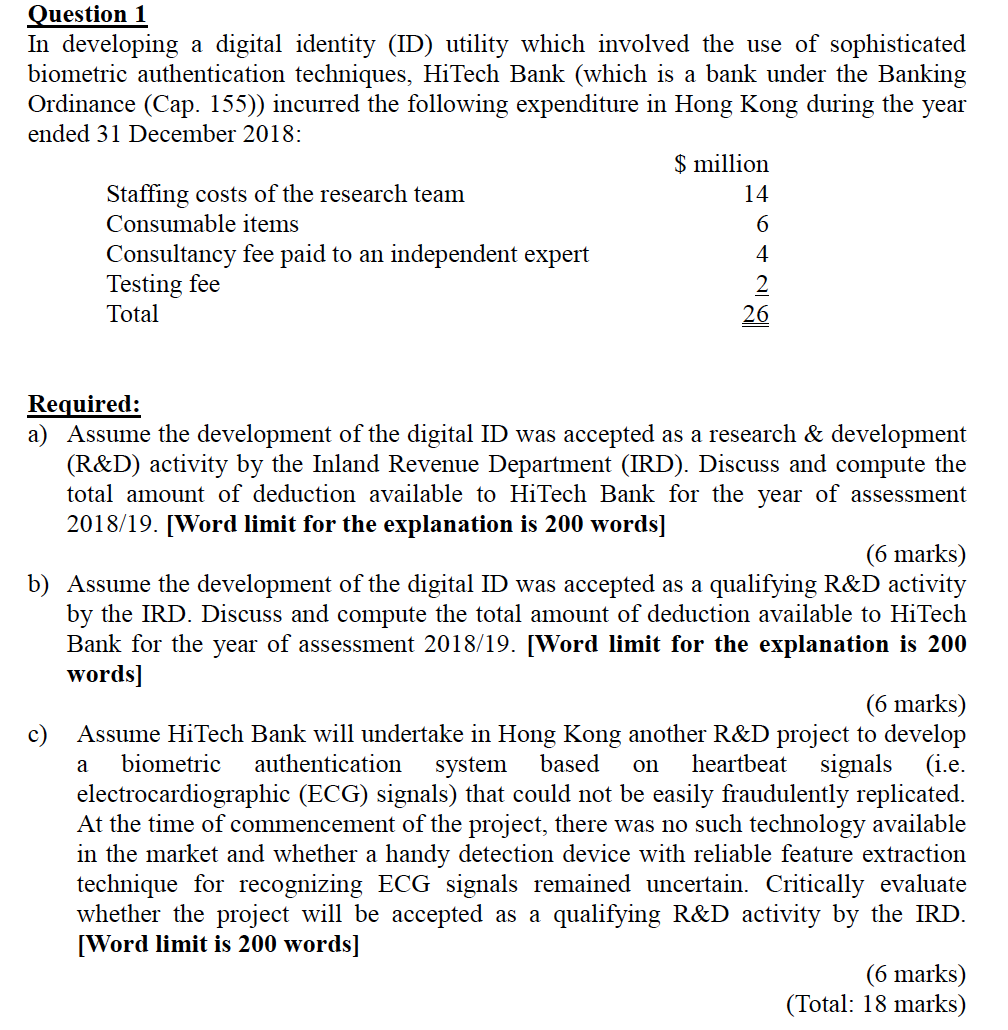

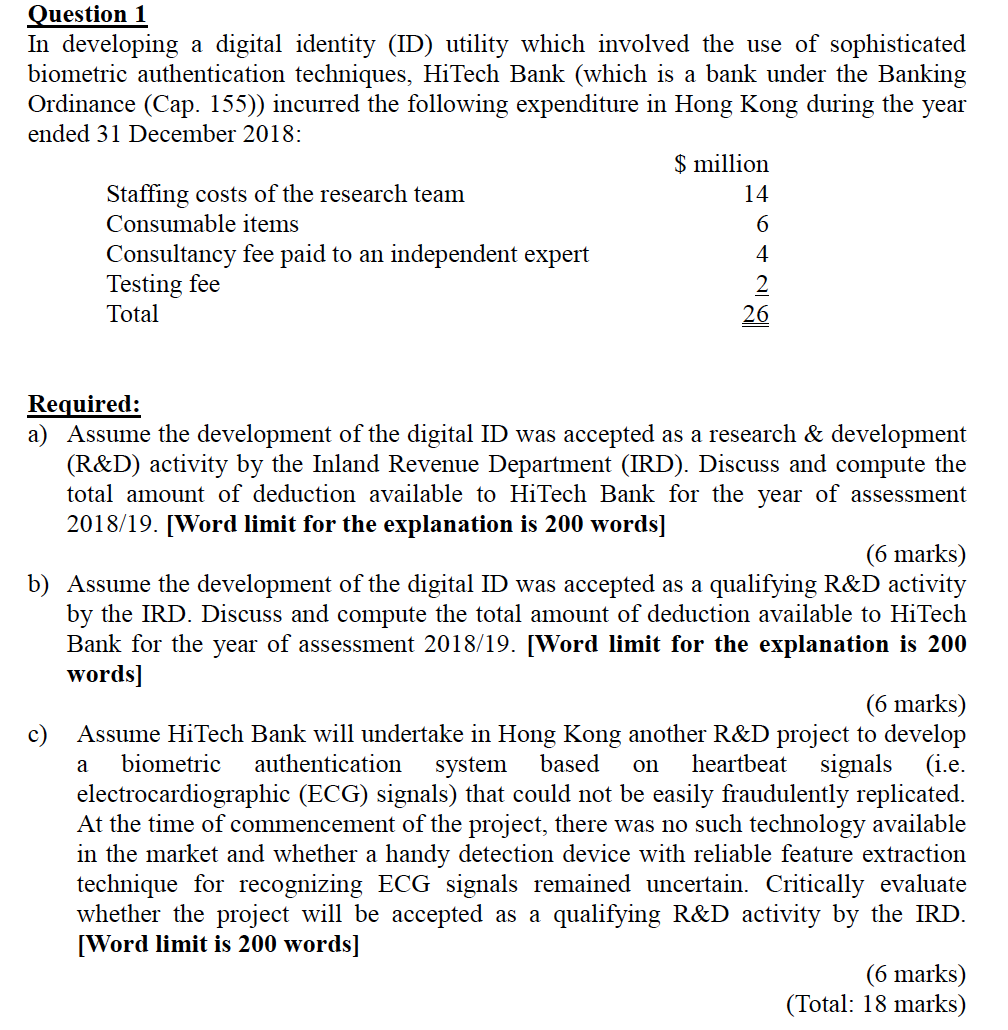

Question 1 In developing a digital identity (ID) utility which involved the use of sophisticated biometric authentication techniques, HiTech Bank (which is a bank under the Banking Ordinance (Cap. 155)) incurred the following expenditure in Hong Kong during the year ended 31 December 2018: $ million Staffing costs of the research team 14 Consumable items 6 Consultancy fee paid to an independent expert 4 Testing fee 2 Total 26 Required: a) Assume the development of the digital ID was accepted as a research & development (R&D) activity by the Inland Revenue Department (IRD). Discuss and compute the total amount of deduction available to HiTech Bank for the year of assessment 2018/19. [Word limit for the explanation is 200 words] (6 marks) b) Assume the development of the digital ID was accepted as a qualifying R&D activity by the IRD. Discuss and compute the total amount of deduction available to HiTech Bank for the year of assessment 2018/19. [Word limit for the explanation is 200 words] (6 marks) c) Assume HiTech Bank will undertake in Hong Kong another R&D project to develop a biometric authentication system based heartbeat signals (i.e. electrocardiographic (ECG) signals) that could not be easily fraudulently replicated. At the time of commencement of the project, there was no such technology available in the market and whether a handy detection device with reliable feature extraction technique for recognizing ECG signals remained uncertain. Critically evaluate whether the project will be accepted as a qualifying R&D activity by the IRD. [Word limit is 200 words] (6 marks) (Total: 18 marks) on Question 1 In developing a digital identity (ID) utility which involved the use of sophisticated biometric authentication techniques, HiTech Bank (which is a bank under the Banking Ordinance (Cap. 155)) incurred the following expenditure in Hong Kong during the year ended 31 December 2018: $ million Staffing costs of the research team 14 Consumable items 6 Consultancy fee paid to an independent expert 4 Testing fee 2 Total 26 Required: a) Assume the development of the digital ID was accepted as a research & development (R&D) activity by the Inland Revenue Department (IRD). Discuss and compute the total amount of deduction available to HiTech Bank for the year of assessment 2018/19. [Word limit for the explanation is 200 words] (6 marks) b) Assume the development of the digital ID was accepted as a qualifying R&D activity by the IRD. Discuss and compute the total amount of deduction available to HiTech Bank for the year of assessment 2018/19. [Word limit for the explanation is 200 words] (6 marks) c) Assume HiTech Bank will undertake in Hong Kong another R&D project to develop a biometric authentication system based heartbeat signals (i.e. electrocardiographic (ECG) signals) that could not be easily fraudulently replicated. At the time of commencement of the project, there was no such technology available in the market and whether a handy detection device with reliable feature extraction technique for recognizing ECG signals remained uncertain. Critically evaluate whether the project will be accepted as a qualifying R&D activity by the IRD. [Word limit is 200 words] (6 marks) (Total: 18 marks) on

Hong Kong tax is applicable.

Hong Kong tax is applicable.