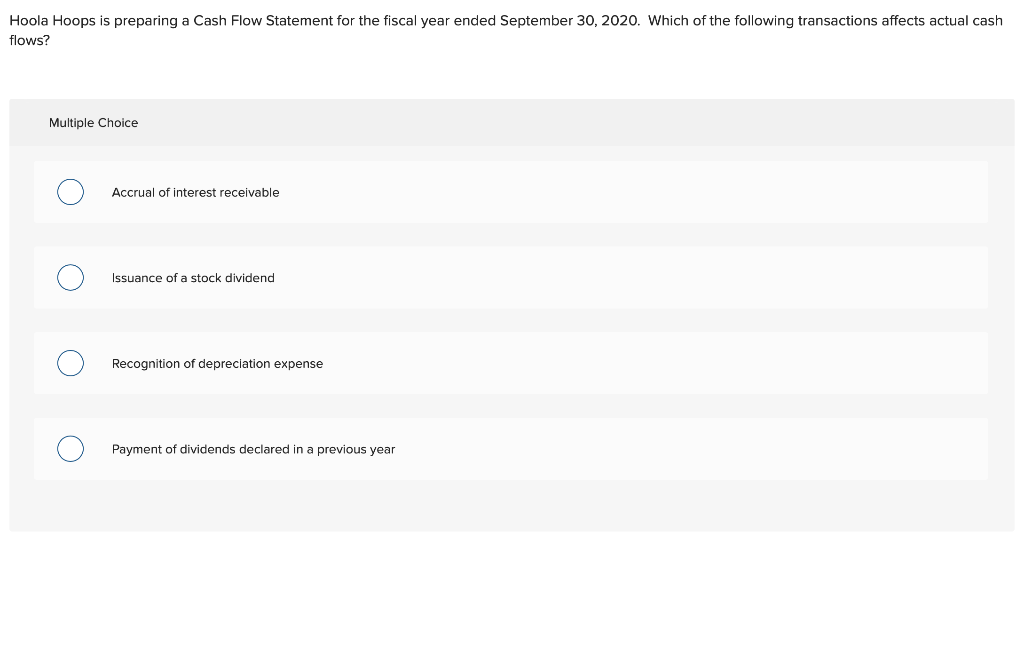

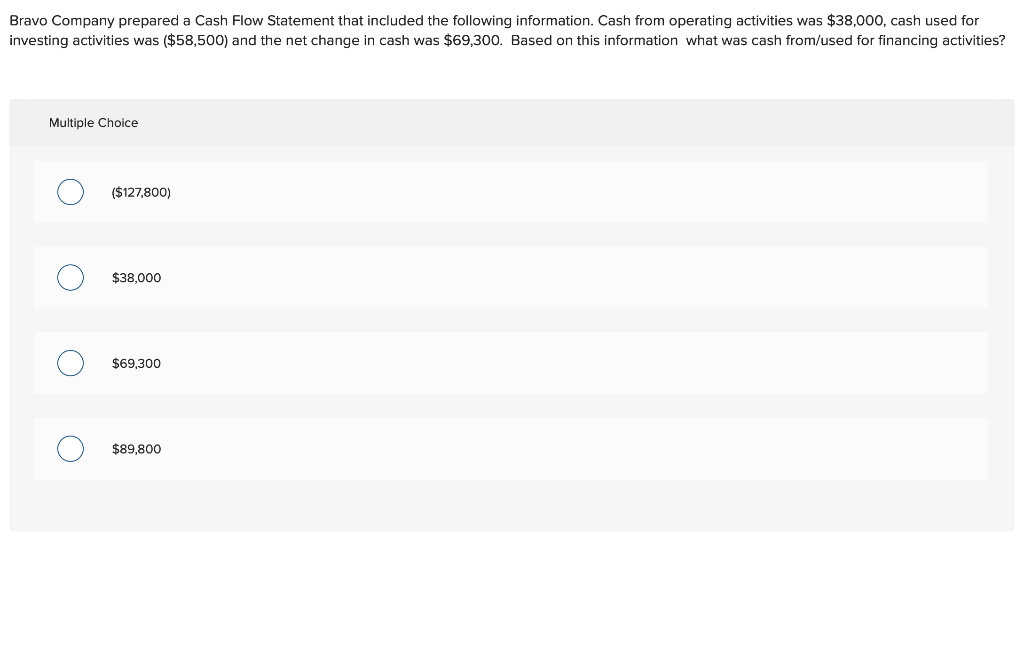

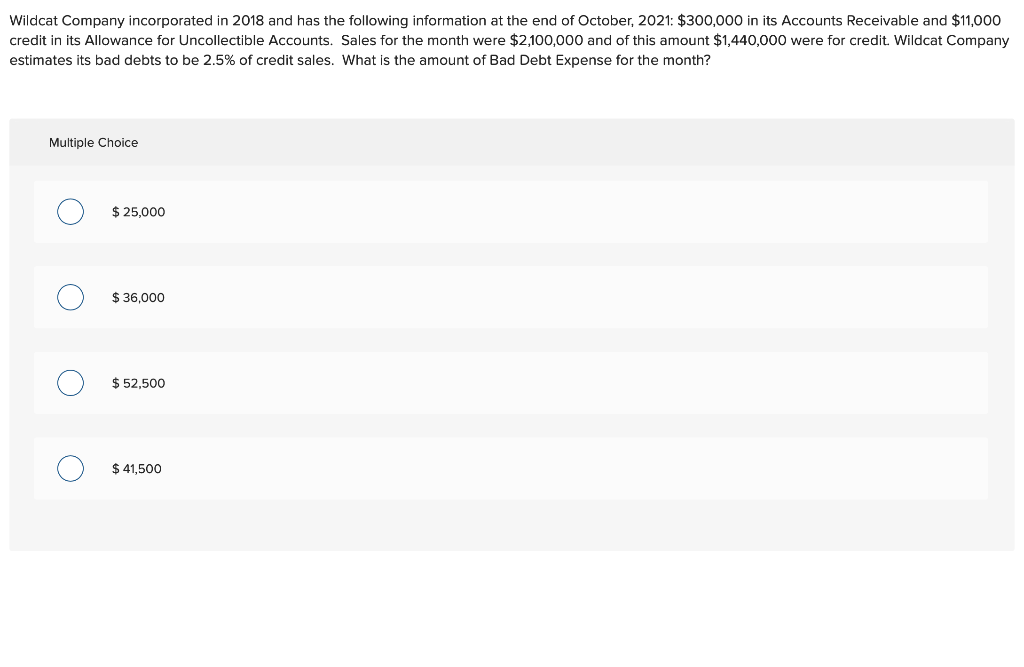

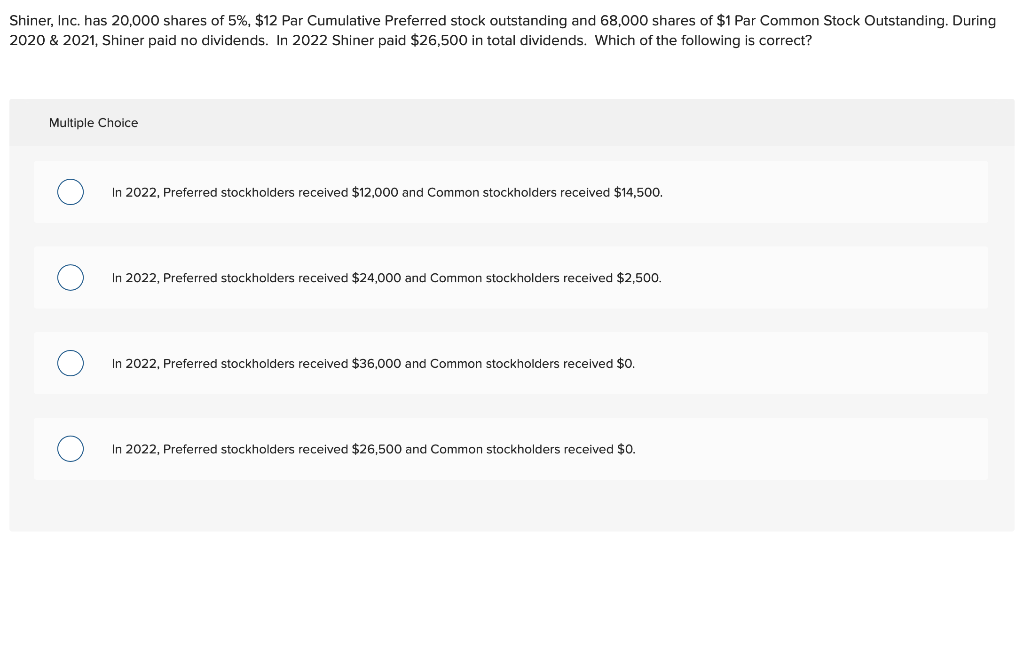

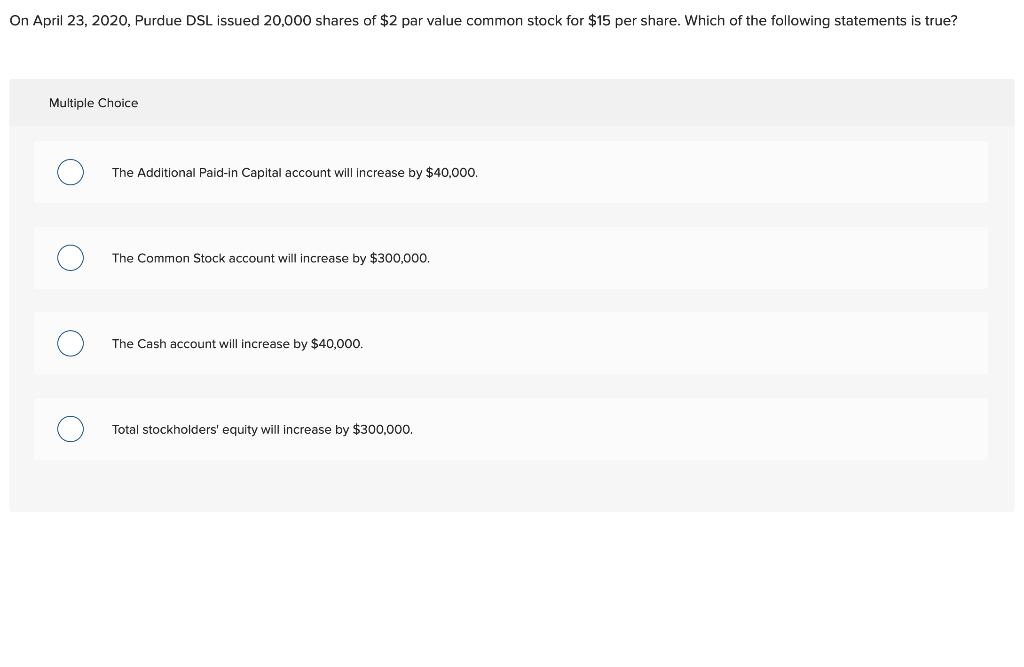

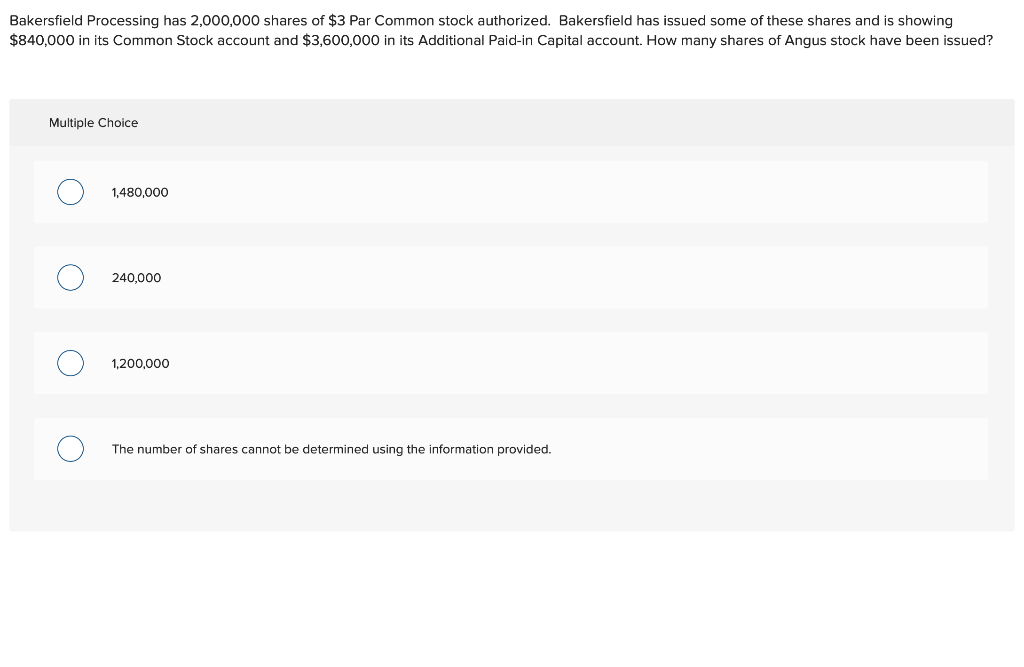

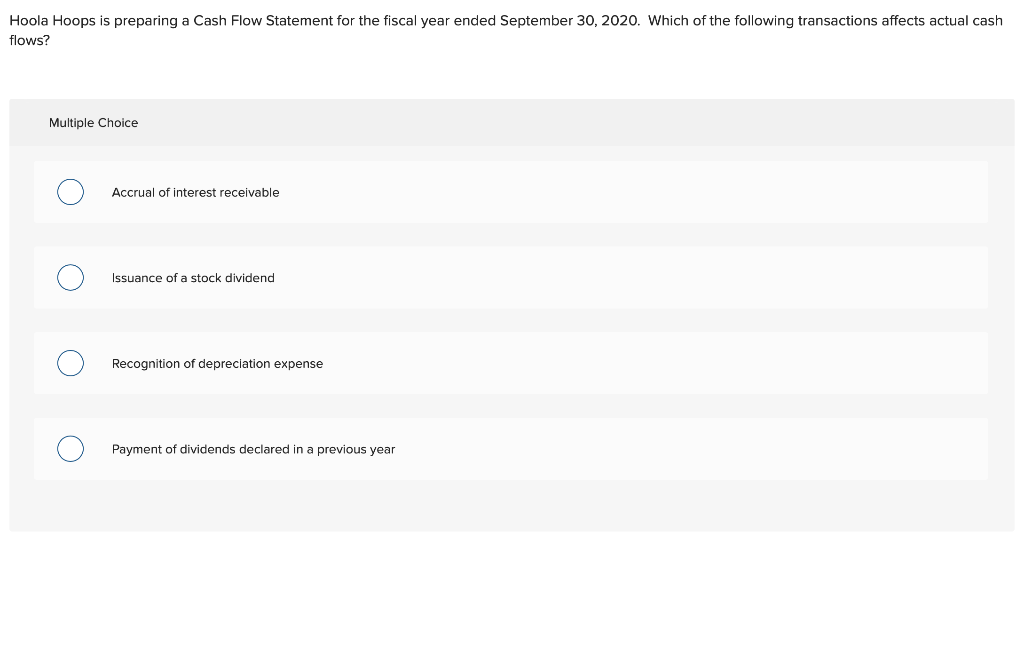

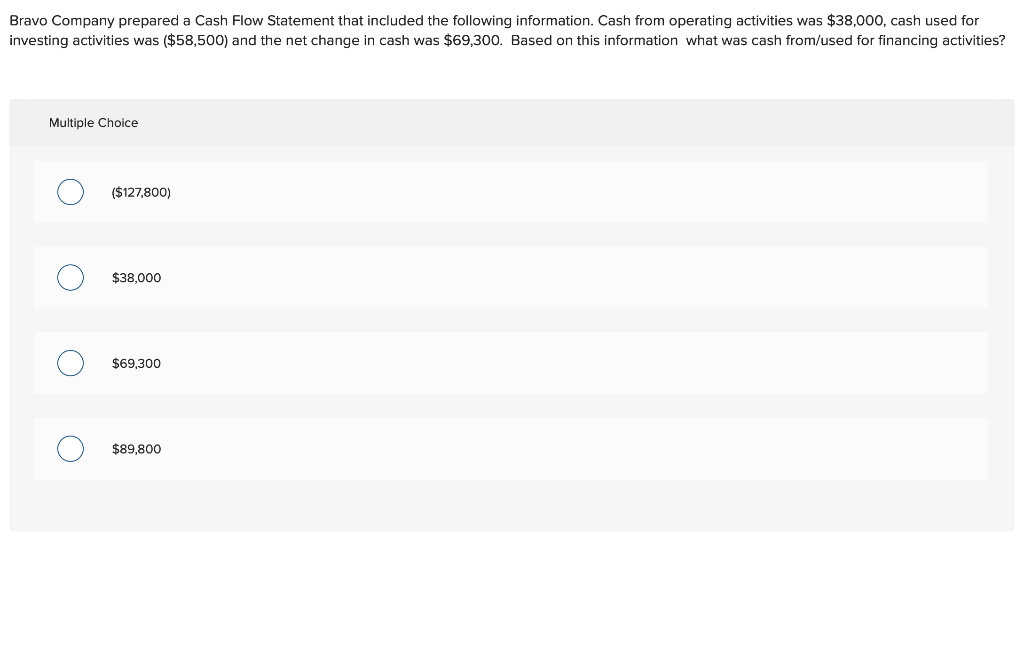

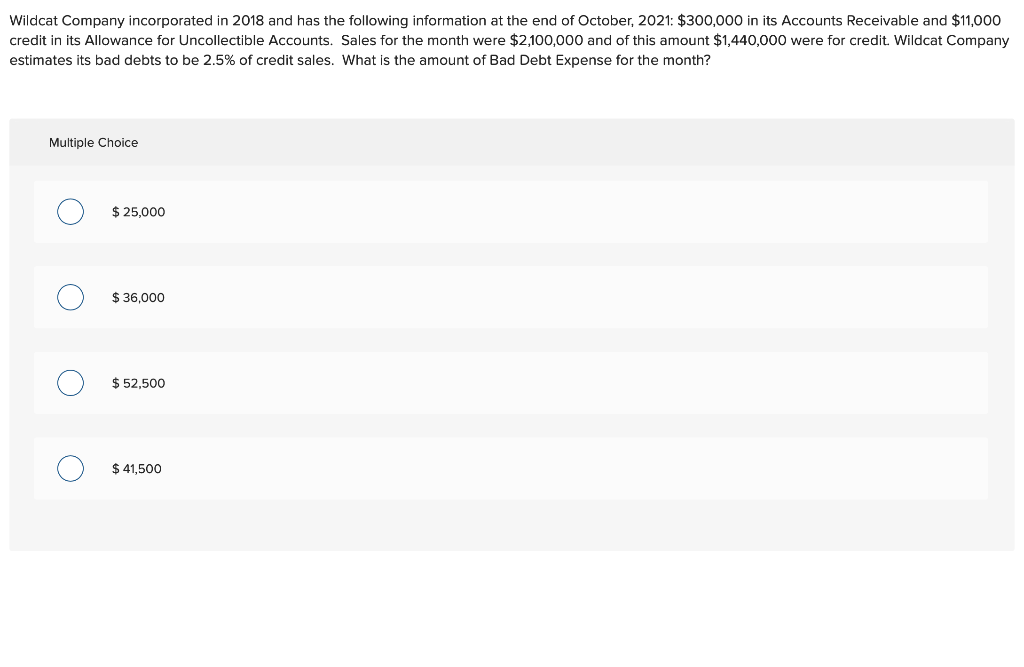

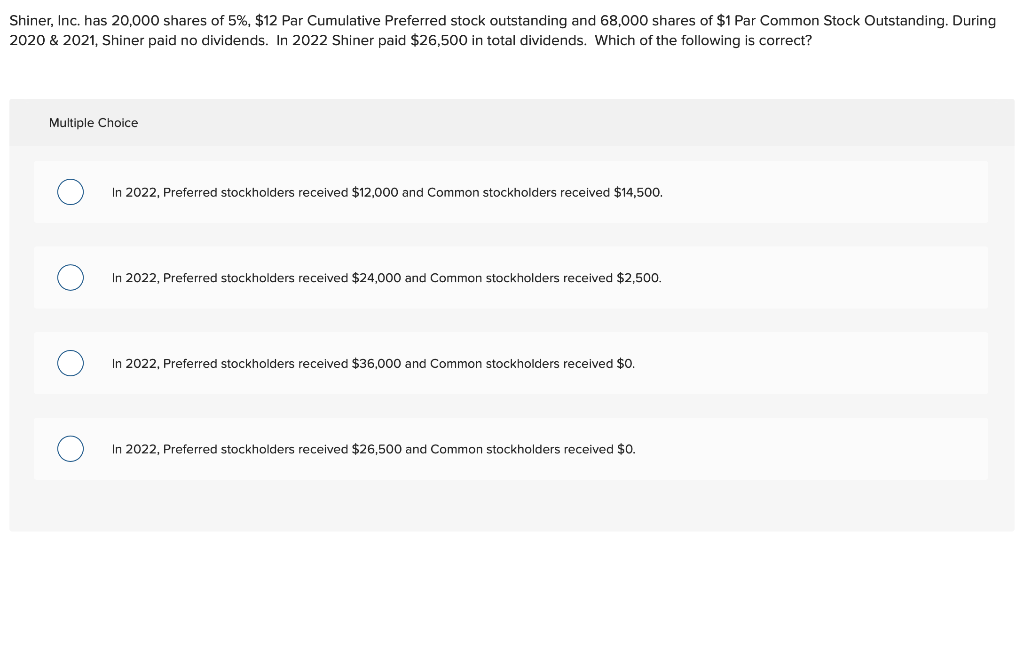

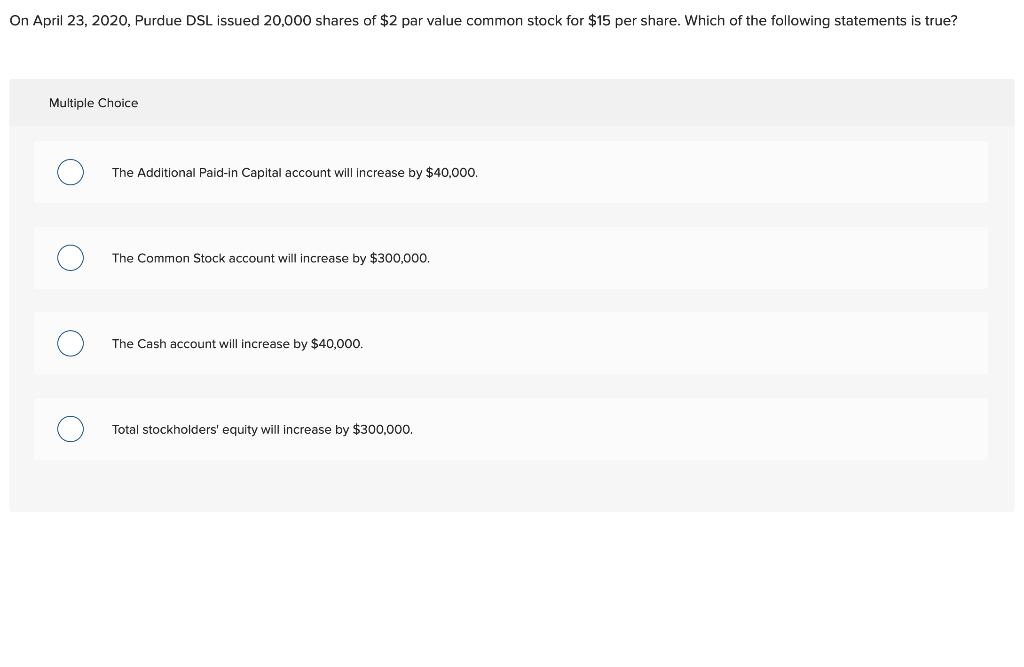

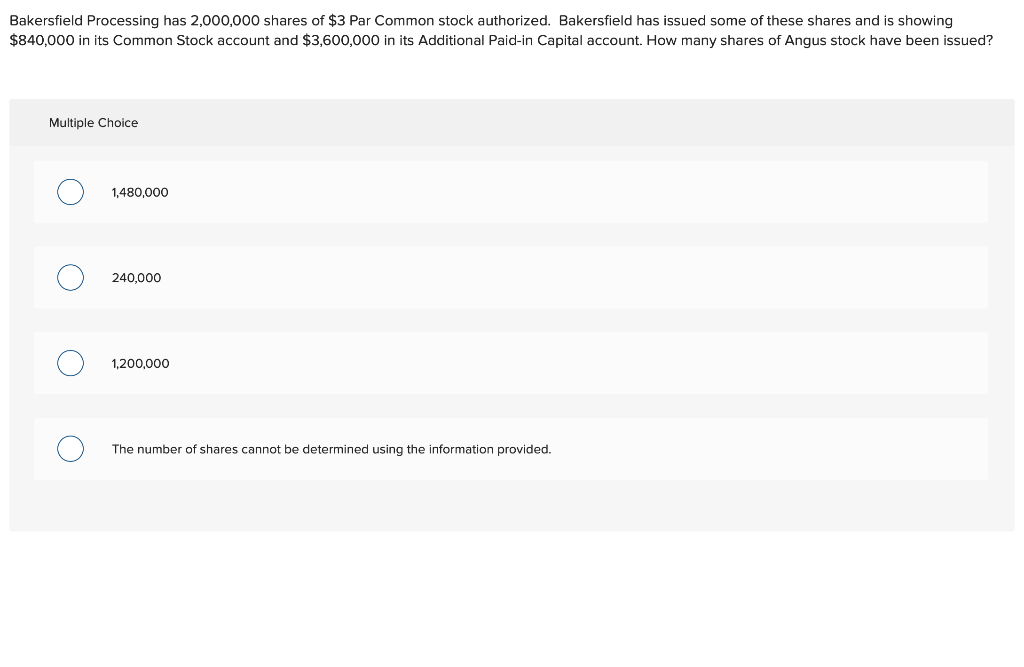

Hoola Hoops is preparing a Cash Flow Statement for the fiscal year ended September 30, 2020. Which of the following transactions affects actual cash flows? Multiple Choice Accrual of interest receivable O Issuance of a stock dividend O Recognition of depreciation expense Payment of dividends declared in a previous year Bravo Company prepared a Cash Flow Statement that included the following information. Cash from operating activities was $38,000, cash used for investing activities was ($58,500) and the net change in cash was $69,300. Based on this information what was cash from/used for financing activities? Multiple Choice ($127,800) $38,000 $69,300 $89,800 Wildcat Company incorporated in 2018 and has the following information at the end of October, 2021: $300,000 in its Accounts Receivable and $11,000 credit in its Allowance for Uncollectible Accounts. Sales for the month were $2,100,000 and of this amount $1,440,000 were for credit. Wildcat Company estimates its bad debts to be 2.5% of credit sales. What is the amount of Bad Debt Expense for the month? Multiple Choice 0 $ 25,000 0 $36,000 0 $ 52,500 0 $ 41,500 Shiner, Inc. has 20,000 shares of 5%, $12 Par Cumulative Preferred stock outstanding and 68,000 shares of $1 Par Common Stock Outstanding. During 2020 & 2021, Shiner paid no dividends. In 2022 Shiner paid $26,500 in total dividends. Which of the following is correct? Multiple Choice In 2022, Preferred stockholders received $12,000 and Common stockholders received $14,500. In 2022, Preferred stockholders received $24,000 and Common stockholders received $2,500. In 2022, Preferred stockholders received $36,000 and Common stockholders received $0. In 2022, Preferred stockholders received $26,500 and Common stockholders received $0. On April 23, 2020, Purdue DSL issued 20,000 shares of $2 par value common stock for $15 per share. Which of the following statements is true? Multiple Choice 0 O The Additional Paid-in Capital account will increase by $40,000. 0 The Common Stock account will increase by $300,000 0 The Cash account will increase by $40,000. 0 O Total stockholders' equity will increase by $300,000. Bakersfield Processing has 2,000,000 shares of $3 Par Common stock authorized. Bakersfield has issued some of these shares and is showing $840,000 in its Common Stock account and $3,600,000 in its Additional Paid-in Capital account. How many shares of Angus stock have been issued? Multiple Choice 0 1,480,000 240,000 1,200,000 The number of shares cannot be determined using the information provided