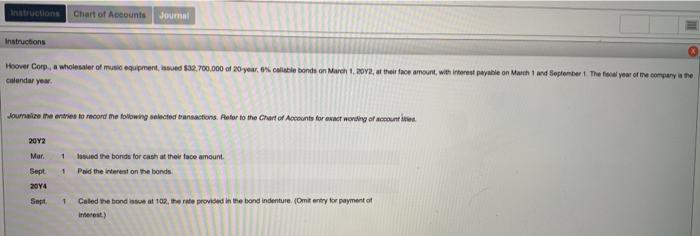

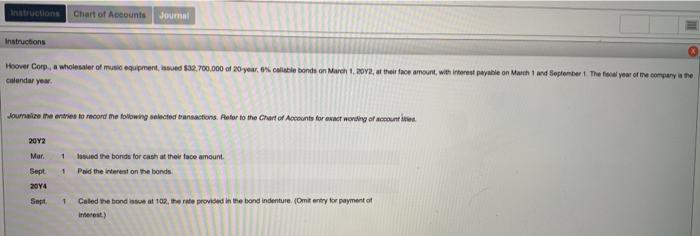

Hoover Corp., a wholesaler of music equipment, issued $32,700,000 of 20-year, 6% callable bonds on March 1, 20Y2, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year.

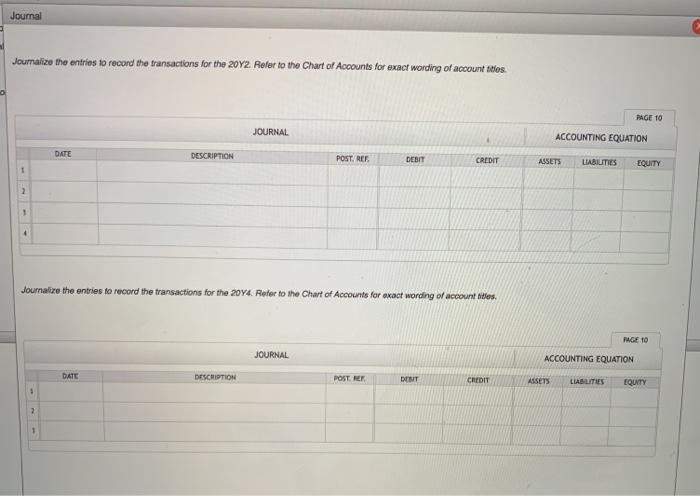

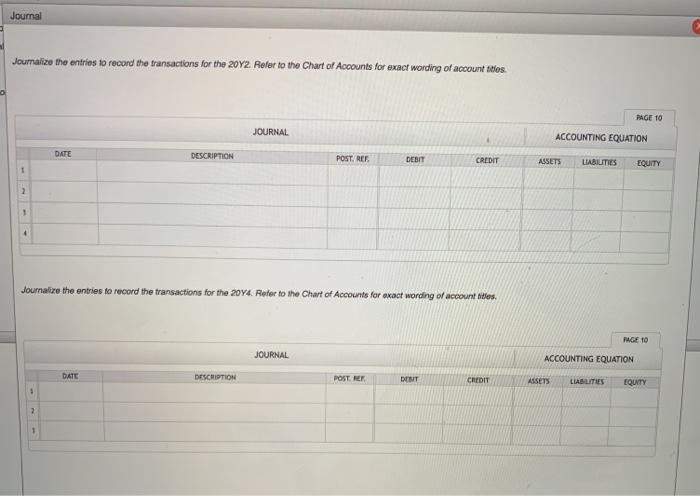

Journalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles.

| 20Y2 | | |

| Mar. | 1 | Issued the bonds for cash at their face amount. |

| Sept. | 1 | Paid the interest on the bonds. |

| 20Y4 | | |

| Sept. | 1 | Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) |

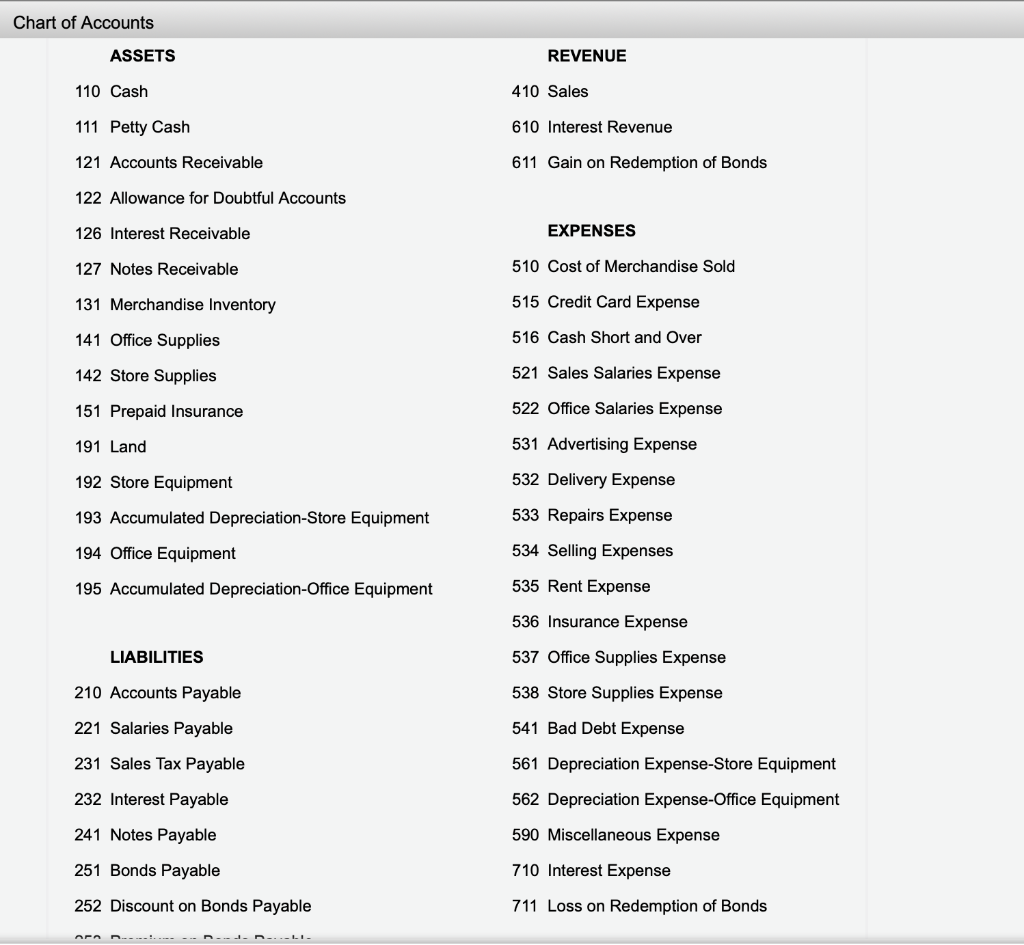

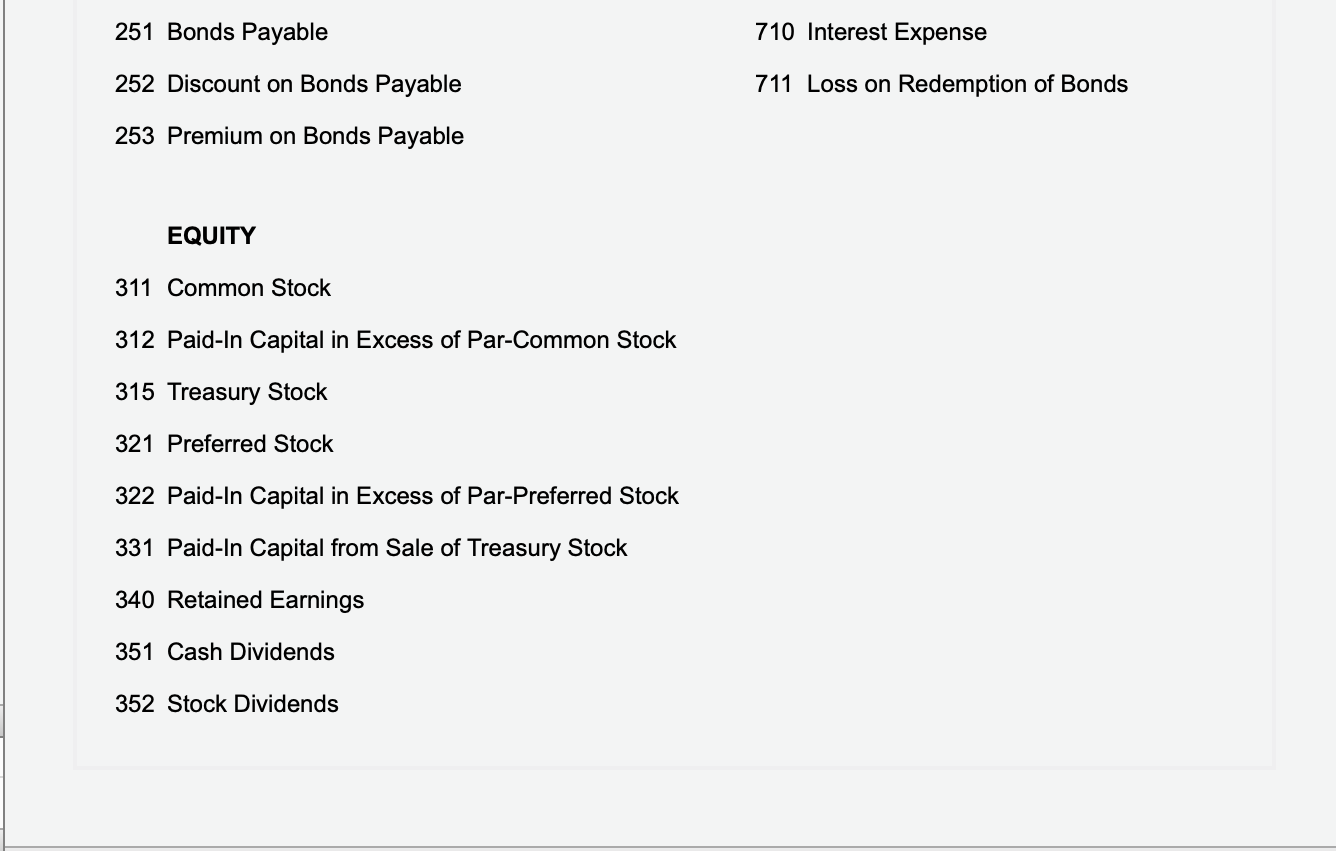

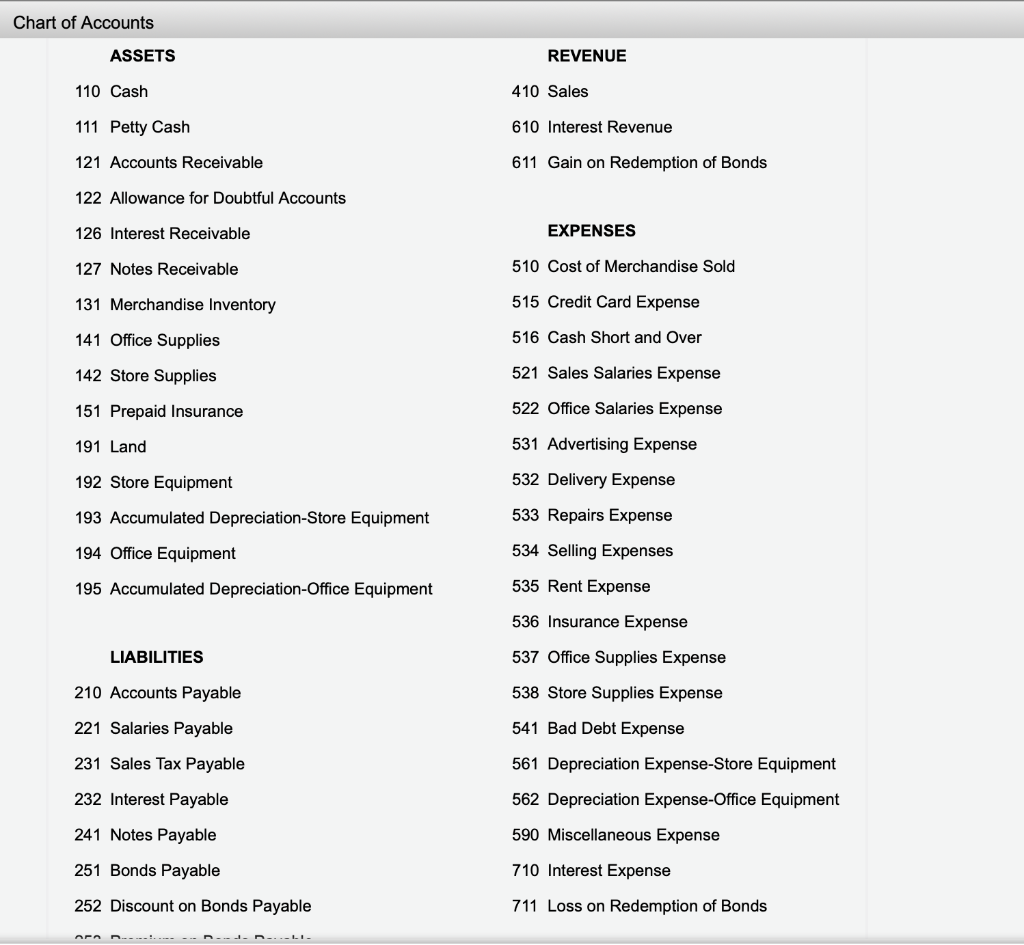

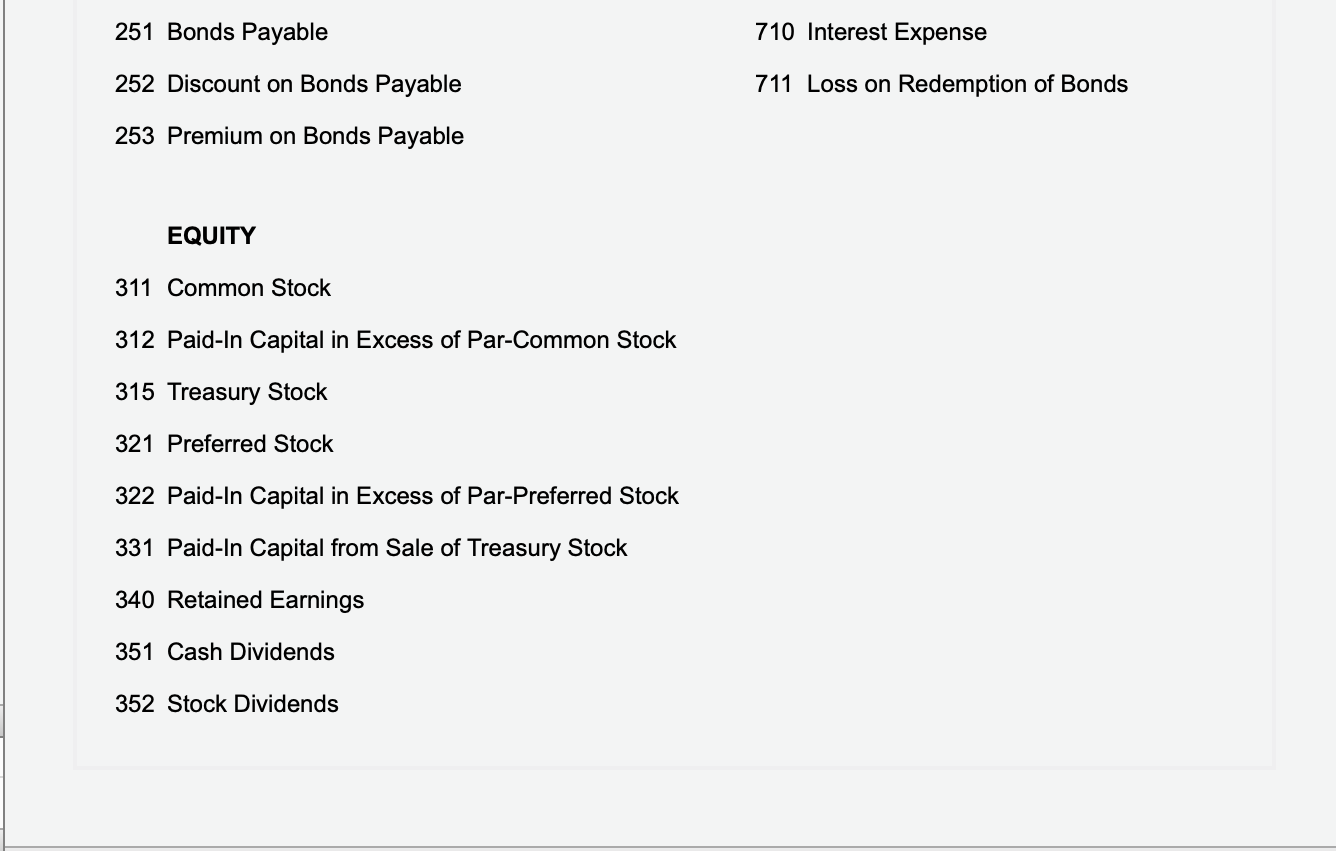

Chart of Accounts ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable 611 Gain on Redemption of Bonds 122 Allowance for Doubtful Accounts 126 Interest Receivable EXPENSES 127 Notes Receivable 510 Cost of Merchandise Sold 131 Merchandise Inventory 515 Credit Card Expense 141 Office Supplies 516 Cash Short and Over 142 Store Supplies 521 Sales Salaries Expense 151 Prepaid Insurance 522 Office Salaries Expense 191 Land 531 Advertising Expense 192 Store Equipment 532 Delivery Expense 193 Accumulated Depreciation Store Equipment 533 Repairs Expense 194 Office Equipment 534 Selling Expenses 195 Accumulated Depreciation Office Equipment 535 Rent Expense 536 Insurance Expense LIABILITIES 537 Office Supplies Expense 210 Accounts Payable 538 Store Supplies Expense 221 Salaries Payable 541 Bad Debt Expense 231 Sales Tax Payable 561 Depreciation Expense-Store Equipment 232 Interest Payable 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 241 Notes Payable 251 Bonds Payable 710 Interest Expense 252 Discount on Bonds Payable 711 Loss on Redemption of Bonds APA ------ 251 Bonds Payable 710 Interest Expense 252 Discount on Bonds Payable 711 Loss on Redemption of Bonds 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Intos Chart of Accounts Journal Instructions Hoover Corp, a wholesaler of music equipment, sed $82,700,000 at 20 your scalable bonds on Mwen 1, 2012, at that the amount, win interesi payable on Matt and Soptunter i Tre for yow of the company Calendar ye Journize the entries to record me to owng selected transactions. Pater to the Chart of Accounts for exact month of account obos 2092 Mar Sept 1 Wed the bonds for cash at the face amount 1 Paid the interest on the bonds 2014 Seit 1 Caled the bond now at 102, the rate provided in the bond indenture. Omt entry for payment of interest) Journal Journalize the entries to record the transactions for the 2072. Refer to the Chart of Accounts for exact wording of account titles PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 Journalize the entries to record the transactions for the 20Y4. Refer to the Chart of Accounts for exact wording of account titles. INGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST REE DIRIT CREDIT ASSETS LIABILITIES EQUITY 1 2 1 Chart of Accounts ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 121 Accounts Receivable 611 Gain on Redemption of Bonds 122 Allowance for Doubtful Accounts 126 Interest Receivable EXPENSES 127 Notes Receivable 510 Cost of Merchandise Sold 131 Merchandise Inventory 515 Credit Card Expense 141 Office Supplies 516 Cash Short and Over 142 Store Supplies 521 Sales Salaries Expense 151 Prepaid Insurance 522 Office Salaries Expense 191 Land 531 Advertising Expense 192 Store Equipment 532 Delivery Expense 193 Accumulated Depreciation Store Equipment 533 Repairs Expense 194 Office Equipment 534 Selling Expenses 195 Accumulated Depreciation Office Equipment 535 Rent Expense 536 Insurance Expense LIABILITIES 537 Office Supplies Expense 210 Accounts Payable 538 Store Supplies Expense 221 Salaries Payable 541 Bad Debt Expense 231 Sales Tax Payable 561 Depreciation Expense-Store Equipment 232 Interest Payable 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 241 Notes Payable 251 Bonds Payable 710 Interest Expense 252 Discount on Bonds Payable 711 Loss on Redemption of Bonds APA ------ 251 Bonds Payable 710 Interest Expense 252 Discount on Bonds Payable 711 Loss on Redemption of Bonds 253 Premium on Bonds Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends Intos Chart of Accounts Journal Instructions Hoover Corp, a wholesaler of music equipment, sed $82,700,000 at 20 your scalable bonds on Mwen 1, 2012, at that the amount, win interesi payable on Matt and Soptunter i Tre for yow of the company Calendar ye Journize the entries to record me to owng selected transactions. Pater to the Chart of Accounts for exact month of account obos 2092 Mar Sept 1 Wed the bonds for cash at the face amount 1 Paid the interest on the bonds 2014 Seit 1 Caled the bond now at 102, the rate provided in the bond indenture. Omt entry for payment of interest) Journal Journalize the entries to record the transactions for the 2072. Refer to the Chart of Accounts for exact wording of account titles PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 Journalize the entries to record the transactions for the 20Y4. Refer to the Chart of Accounts for exact wording of account titles. INGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST REE DIRIT CREDIT ASSETS LIABILITIES EQUITY 1 2 1