Hope it is readable now... please help fix the errors asap

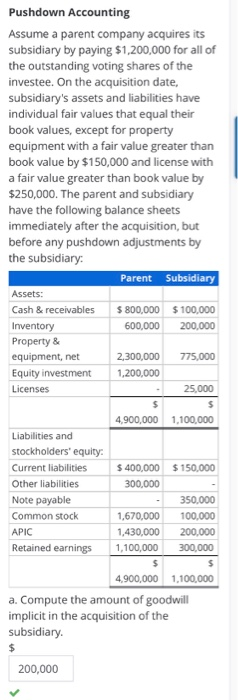

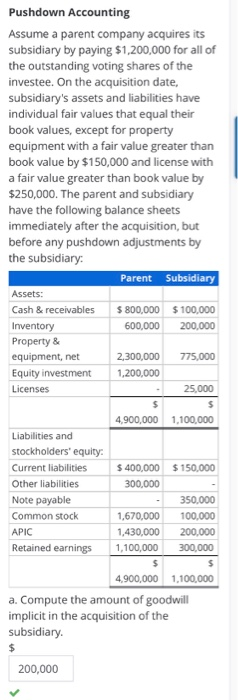

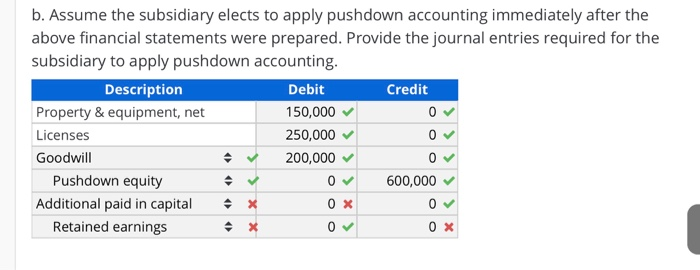

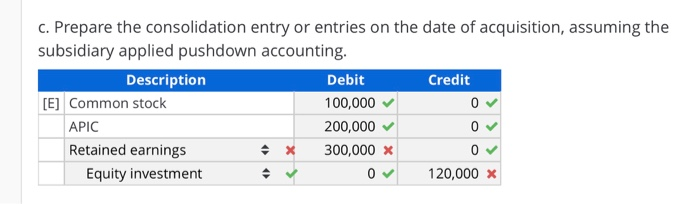

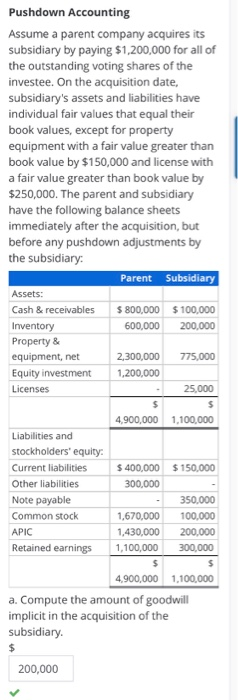

Pushdown Accounting Assume a parent company acquires its subsidiary by paying $1,200,000 for all of the outstanding voting shares of the investee. On the acquisition date, subsidiary's assets and liabilities have individual fair values that equal their book values, except for property equipment with a fair value greater than book value by $150,000 and license with a fair value greater than book value by $250,000. The parent and subsidiary have the following balance sheets immediately after the acquisition, but before any pushdown adjustments by the subsidiary: Parent Subsidiary Assets: Cash & receivables $ 800,000 $100,000 Inventory 600,000 200,000 Property & equipment, net 2,300,000 775,000 Equity investment 1,200,000 Licenses 25,000 $ 4,900,000 1,100.000 Liabilities and stockholders' equity: Current liabilities $ 400,000 $150,000 Other liabilities 300,000 Note payable 350.000 Common stock 1,670,000 100,000 APIC 1,430,000 200,000 Retained earnings 1,100,000 300,000 $ $ 4,900,000 1,100,000 a. Compute the amount of goodwill implicit in the acquisition of the subsidiary. $ 200,000 b. Assume the subsidiary elects to apply pushdown accounting immediately after the above financial statements were prepared. Provide the journal entries required for the subsidiary to apply pushdown accounting. Description Debit Credit Property & equipment, net 150,000 0 Licenses 250,000 0 Goodwill 200,000 Pushdown equity 0 600,000 Additional paid in capital 0 x Retained earnings 0 > X IN X 0 c. Prepare the consolidation entry or entries on the date of acquisition, assuming the subsidiary applied pushdown accounting. Description Debit Credit [E] Common stock 100,000 0 APIC 200,000 0 Retained earnings 300,000 X 0 Equity investment 0 120,000 x Pushdown Accounting Assume a parent company acquires its subsidiary by paying $1,200,000 for all of the outstanding voting shares of the investee. On the acquisition date, subsidiary's assets and liabilities have individual fair values that equal their book values, except for property equipment with a fair value greater than book value by $150,000 and license with a fair value greater than book value by $250,000. The parent and subsidiary have the following balance sheets immediately after the acquisition, but before any pushdown adjustments by the subsidiary: Parent Subsidiary Assets: Cash & receivables $ 800,000 $100,000 Inventory 600,000 200,000 Property & equipment, net 2,300,000 775,000 Equity investment 1,200,000 Licenses 25,000 $ 4,900,000 1,100.000 Liabilities and stockholders' equity: Current liabilities $ 400,000 $150,000 Other liabilities 300,000 Note payable 350.000 Common stock 1,670,000 100,000 APIC 1,430,000 200,000 Retained earnings 1,100,000 300,000 $ $ 4,900,000 1,100,000 a. Compute the amount of goodwill implicit in the acquisition of the subsidiary. $ 200,000 b. Assume the subsidiary elects to apply pushdown accounting immediately after the above financial statements were prepared. Provide the journal entries required for the subsidiary to apply pushdown accounting. Description Debit Credit Property & equipment, net 150,000 0 Licenses 250,000 0 Goodwill 200,000 Pushdown equity 0 600,000 Additional paid in capital 0 x Retained earnings 0 > X IN X 0 c. Prepare the consolidation entry or entries on the date of acquisition, assuming the subsidiary applied pushdown accounting. Description Debit Credit [E] Common stock 100,000 0 APIC 200,000 0 Retained earnings 300,000 X 0 Equity investment 0 120,000 x