hope someone could solve this question with steps so i can understand and i will be so thankful

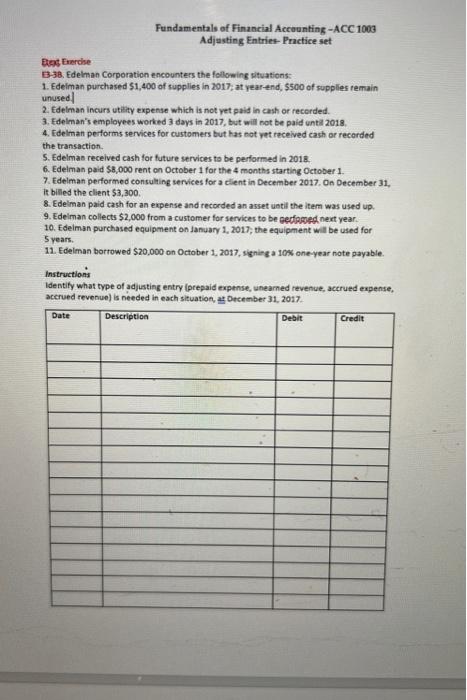

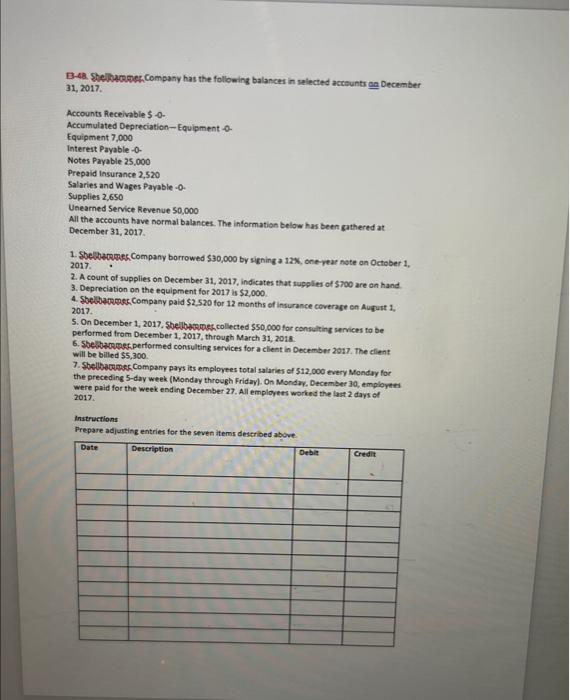

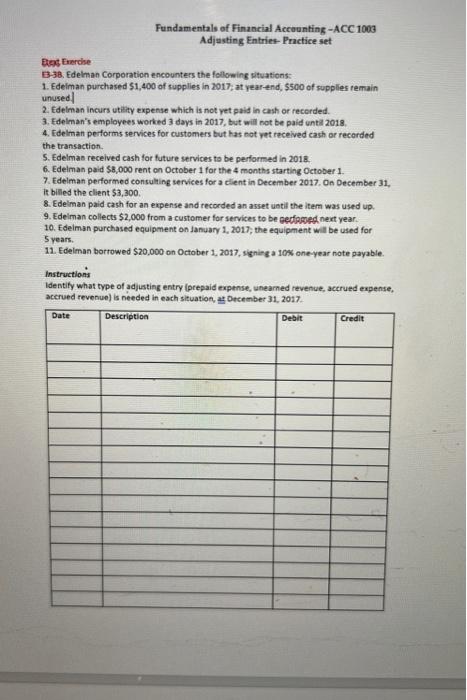

Adjusting Entries-Practice set Elect Frerche B3-38. Edelman Corporation encounters the following vituations: 1. Edeiman purchased $1,400 of supplles in 2017 ; at year-end, $500 of supplies remain unused. 2. Edelman incurs utiety expense which is not yet paid in cash or recorded. 3. Fdelman's employees worked 3 days in 2017, but will not be paid until 2018, 4. Idelman performs services for customers but has not vet received cash or recorded the transaction. 5. Edelmas received cash for future services to be performed in 2018 . 6. Edelman paid \$8,000 rent on October 1 for the 4 months starting Oetober 1. 7. Edelman performed consulting services for a client in December 2017. On December 31, it billed the client 53,300 . 8. Edelman paid cash for an expense and recorded an asset until the item was used up. 9. Edeiman collects $2,000 from a customer for services to be geffored next year. 10. Fdeiman purchased equipment on January 1, 2017, the equipment will be used for 5 years. 11. Edelman borrowed $20,000 on October 1, 2017, signieg a 10\% one-year note payable. Instructions Identify what type of adjusting entry (prepaid expense, uneamed revenue, accrued expense, accrued revenue) is needed in each situation, at December 31,2017 . 31,2017. Accounts Receivable 50 - Accumulated Depreciation-Equipment 0 - Equipment 7,000 Interest Payable 0 - Notes Payable 25,000 Prepaid insurance 2,520 Salaries and Wages Payable - 0 . Supplies 2,650 Unearned Service Revenue 50,000 All the accounts have normal balances. The information below has been gathered at, December 31, 2017. 1. She Whanere Company borrowed $30,000 by signing a 12%, one-year note an October 1 , 2017. 2. A count of supplies on December 31, 2017, indicates that supplies of $700 are on hand. 3. Depreciation on the equipment for 2017 is $2,000. 4. Stoelbamecc Company paid $2,520 for 12 months of insurance coverage on Augurt 1 , 2017. 5. On December 1, 2017, stveltherpesh collected $50,000 for consulting services to be performed from December 1,2017, through March 31, 2018. 6. 5beltapopecperformed consulting services for a client in December 2017. The client will be billed 55,300 . 7. Shelbecimec Company pays its employees total salaries ef 512,000 every Mondoy for the preceding 5-day week (Mondwy through Friday). On Monday. December 30 , employees were paid for the week ending December 27 . All employess worked the last 2 days of 2017. Instructions Prepare adjusting entries for the seven items described above