Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hopefully, someone can help please. Also, I would like explanation with it too, not just the answer, please and thank you! Eire Products is a

Hopefully, someone can help please. Also, I would like explanation with it too, not just the answer, please and thank you!

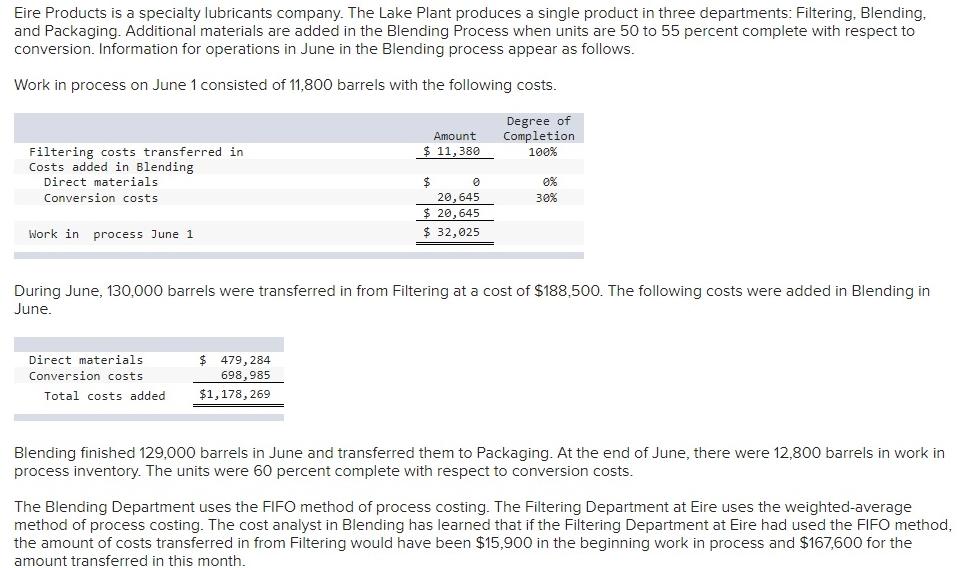

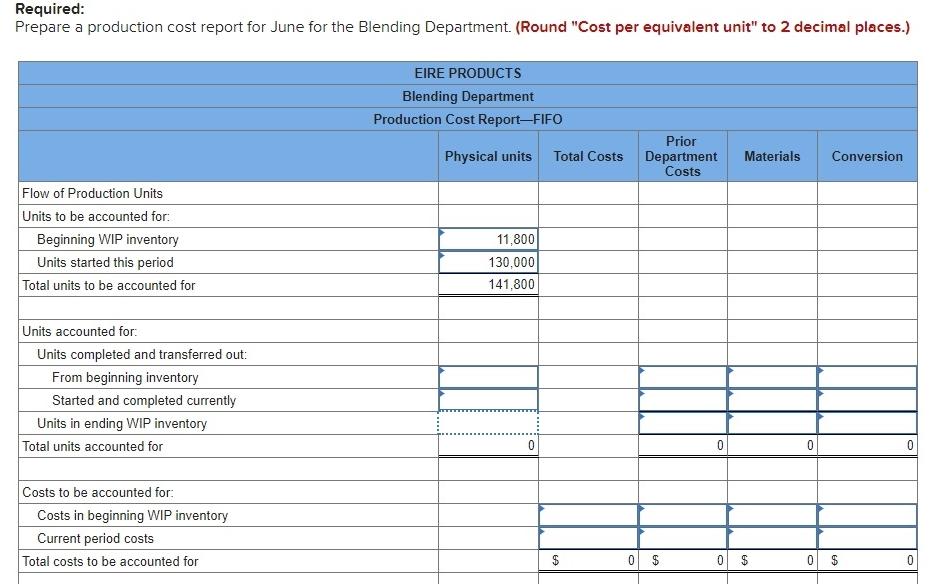

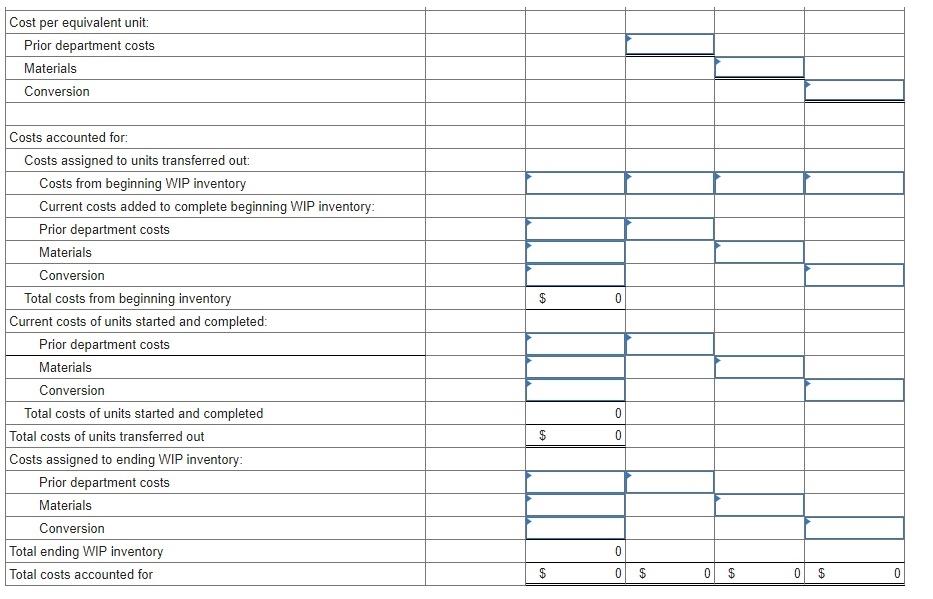

Eire Products is a specialty lubricants company. The Lake Plant produces a single product in three departments: Filtering, Blending, and Packaging. Additional materials are added in the Blending Process when units are 50 to 55 percent complete with respect to conversion. Information for operations in June in the Blending process appear as follows. Work in process on June 1 consisted of 11,800 barrels with the following costs. Amount $ 11,380 Degree of Completion 100% Filtering costs transferred in Costs added in Blending Direct materials Conversion costs 0% 30% $ 9 20,645 $ 20,645 $ 32,025 Work in process June 1 During June, 130,000 barrels were transferred in from Filtering at a cost of $188,500. The following costs were added in Blending in June Direct materials Conversion costs Total costs added $ 479, 284 698,985 $1,178, 269 Blending finished 129,000 barrels in June and transferred them to Packaging. At the end of June, there were 12,800 barrels in work in process inventory. The units were 60 percent complete with respect to conversion costs. The Blending Department uses the FIFO method of process costing. The Filtering Department at Eire uses the weighted average method of process costing. The cost analyst in Blending has learned that if the Filtering Department at Eire had used the FIFO method, the amount of costs transferred in from Filtering would have been $15,900 in the beginning work in process and $167,600 for the amount transferred in this month. Required: Prepare a production cost report for June for the Blending Department. (Round "Cost per equivalent unit" to 2 decimal places.) EIRE PRODUCTS Blending Department Production Cost Report-FIFO Physical units Total Costs Prior Department Costs Materials Conversion Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for 11,800 130,000 141,800 Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Units in ending WIP inventory Total units accounted for 0 0 0 0 Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for 0 $ 0 $ 0 $ Cost per equivalent unit: Prior department costs Materials Conversion $ 0 Costs accounted for: Costs assigned to units transferred out: Costs from beginning WIP inventory Current costs added to complete beginning WIP inventory Prior department costs Materials Conversion Total costs from beginning inventory Current costs of units started and completed: Prior department costs Materials Conversion Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WIP inventory: Prior department costs Materials Conversion Total ending WIP inventory Total costs accounted for 0 $ 0 OO $ $ 0 $ 0 $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started