Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hopefully this is more clear. needing some help with my acct. project please. thanks.. Acet 300, Case Project, Summer 2017 nuary Inc. (NMR) entered into

hopefully this is more clear. needing some help with my acct. project please. thanks..

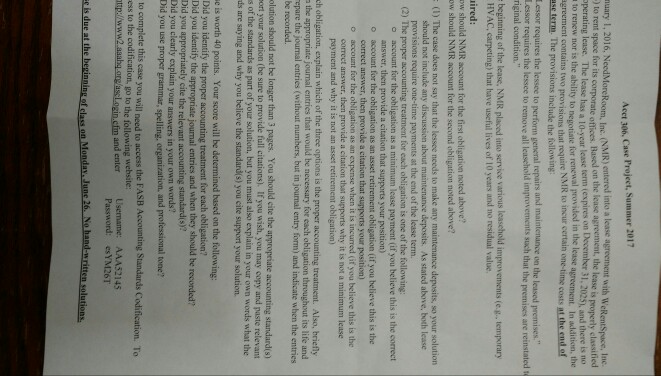

Acet 300, Case Project, Summer 2017 nuary Inc. (NMR) entered into a lease agreement with WeRentspace, Inc. to rent space for its corporate offices. Based on the lease agreement the lease is properly classified operating lease. The lease has a 10-year lease tem (expires on December 31, 2025, and there is n to renew nor is the ability to negotiate for renewal provided in the lease agreement. In addition, the agreement contains two provisions that require NMR to incur certain one-time costs at the end of ase term. The provisions include the following: Lessor requires the lessee to perform general repairs and maintenance on the leased premises Lessor requires the le ssee to remove all leasehold improvements such that the premises are reinstated riginal condition." beginning of the lease, NMR placed into service various leasehold improvements (e.g..temporary HVAC, carpeting) that have useful lives of 10 years and no residual value, uired: ow should NMR account for the first obligation noted above? ow should NMR account for the second obligation noted above? (i) The case does not say that the lessee needs to make any maintenance deposits, so your solution should not include any discussion abaut maintenance deposits, As stated above, both lease provisions require one-time payments at the end of the lease term. 02) The proper o account for the obligation as a minimum lease payment (if you believe this is the correct answer, then provide a citation that supports your position) o account for the obligation as an asset retirement obligation (if you believe this is the correct answer, then provide a citation that supports your position) o account for the obligation as an expense when it is incurred of you believe this is the correct then provide a citation that supports it is not a minimum lease payment and why is an asset retirement obligation) ch obligation, explain which of the three options is the proper accounting treatment. Also, briefly n the appropriate joumal entries that would be necessary for each obligation throughout its life and epare the journal entries (without numbers, but in joumal entry form) and indicate when the entries olution should not be longer than 3 pages. You should cite the appropriate accounting ort your solution (be sure to provide full citations). If you wish, you may copy and paste relevant s of the standards as part of your solution, but you must also explain in your own words what the ds are saying and why you believe the s you cite support your solution. e is worth 40 points. Your score will be determined based on the following: Did you identify the proper accounting treatment for each obligation? Did you identify the appropriate jourmal entries and when they should be recorded? Did you appropriately cite the relevant accounting standard(s) Did you clearly explain your answers in your own words? Did you use proper grammar, spelling, organization and professional tone? to complete this case you will need to access the FASB Accounting Standards Codification, To ess to the codification, go to the following website: Username: AAA52145 and enter Password: esYM26T is due at he be erslass an Mondavaslune Nehandritten solutions, Acet 300, Case Project, Summer 2017 nuary Inc. (NMR) entered into a lease agreement with WeRentspace, Inc. to rent space for its corporate offices. Based on the lease agreement the lease is properly classified operating lease. The lease has a 10-year lease tem (expires on December 31, 2025, and there is n to renew nor is the ability to negotiate for renewal provided in the lease agreement. In addition, the agreement contains two provisions that require NMR to incur certain one-time costs at the end of ase term. The provisions include the following: Lessor requires the lessee to perform general repairs and maintenance on the leased premises Lessor requires the le ssee to remove all leasehold improvements such that the premises are reinstated riginal condition." beginning of the lease, NMR placed into service various leasehold improvements (e.g..temporary HVAC, carpeting) that have useful lives of 10 years and no residual value, uired: ow should NMR account for the first obligation noted above? ow should NMR account for the second obligation noted above? (i) The case does not say that the lessee needs to make any maintenance deposits, so your solution should not include any discussion abaut maintenance deposits, As stated above, both lease provisions require one-time payments at the end of the lease term. 02) The proper o account for the obligation as a minimum lease payment (if you believe this is the correct answer, then provide a citation that supports your position) o account for the obligation as an asset retirement obligation (if you believe this is the correct answer, then provide a citation that supports your position) o account for the obligation as an expense when it is incurred of you believe this is the correct then provide a citation that supports it is not a minimum lease payment and why is an asset retirement obligation) ch obligation, explain which of the three options is the proper accounting treatment. Also, briefly n the appropriate joumal entries that would be necessary for each obligation throughout its life and epare the journal entries (without numbers, but in joumal entry form) and indicate when the entries olution should not be longer than 3 pages. You should cite the appropriate accounting ort your solution (be sure to provide full citations). If you wish, you may copy and paste relevant s of the standards as part of your solution, but you must also explain in your own words what the ds are saying and why you believe the s you cite support your solution. e is worth 40 points. Your score will be determined based on the following: Did you identify the proper accounting treatment for each obligation? Did you identify the appropriate jourmal entries and when they should be recorded? Did you appropriately cite the relevant accounting standard(s) Did you clearly explain your answers in your own words? Did you use proper grammar, spelling, organization and professional tone? to complete this case you will need to access the FASB Accounting Standards Codification, To ess to the codification, go to the following website: Username: AAA52145 and enter Password: esYM26T is due at he be erslass an Mondavaslune Nehandritten solutionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started