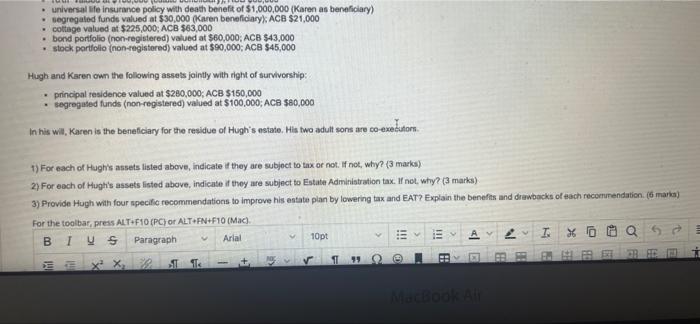

Hopes and Dreams HUN 70 and wing for det hun RSP valued at 100.000 Karen by ACS 4.000 . RRP 3.000 on dhan ACB.000 RRIF ved at $100.000 by AC S80.000 universale nung by with death benar 31.000.000 Kms by - segregated funds ved at 0000 Kanary ACA $21.000 - Core valued $225,000 ACS S03.000 bond portfolio forgated and a $60,000: ACB S3.000 portfolio (non registered) valued at $10,000 ACR 545.000 Hugh and Karen own the following sely with tht of survivorship principal residence valued at $280,000, ACS $150.000 segregated Runds (non-registered) valued at $100,000: ACB 50,000 In he wil, Karen is the beneficiary for the residue of Hugh's estate. His two adult sore are common 1) For each of us assets listed above, indicate if they are subject to tax or not. not, why? (3 marks) 2) For each of Hugh's assets listed above, indicate they are subject to Estate Administration tax not, why? (mark) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks of each recommendation 1 mark) or the toolbar, press ALT F10 (PC) or ALTOFN+F10 (Mac). 3 I us Paragraph Arial 10pt A LIXOUQ6 T 1992 BE 22 BBB. E, it 9 !!! r E On ering from teaching age, Hupported business LLLLL trende who renovate chans and boom From the start Hughed her target From 10.00 Cheetah over 10 years! trends for the Hopes and Dreams Hugh is now 70 and retiring for good. He owns 100% of his business. Ha children have their owners and have no were in the business so hapa huiness, Hugh owns the following RRSP1 valued at $100,000 (Karen beneficiwy ACE $54.000 RRSP 2 valued at $43.000 (son Todd beneficiary ACB $21,000 RAIF valued at $100,000 (estate beneficiary : ACB 580.000 Universal life insurance policy with death benefit of $1,000,000 (karena beneficiary) - segregated funds valued at $30.000 (Karen beneficiary ACB $21,000 cottage valued at $225.000, ACB 563,000 bond portfolio (non registered) valued at $60,000; ACB 343.000 stock portfolio (nonregistered valued at $90,000, ACB 545,000 Hugh and Karen own the following assets jointly with right of survivorship: principal residence valued at $280,000: ACB $150,000 segregated funds (non-registered) valued at $100.000, ACB 580,000 his wa, Karen is the beneficiary for the residue of Hugh's estate. His two adut one we co-edston 1 Ni 1) For each of Hugh's assets listed above, indicate if they are subject to tax or not. If not, why? (3 mars 2) For each of Hugh's assets listed above, indicate they are subject to Estate Administration the net, why? martes) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks et each recommandation 15 marta For the toolbar, press ALT F10 [PO) O ALTFN+F10 Mac Paragraph Arial 10pt T: 6 !!! FF universal life insurance policy with death benefit of $1,000,000 (Karen as beneficiary) segregated funds valued at $30,000 (Karen beneficiaryX ACB $21,000 . cottage valued at $225,000; ACB $63,000 bond portfolio (non-registered) valued at $60,000; ACB $43,000 stock portfolio (non-registered) valued at $90,000; ACB $45,000 Hugh and Karen can the following assets jointly with right of survivorship: principal residence valued at 280,000, ACB $150,000 . segregated funds (non-registered) valued at $100,000; ACA $80,000 In his will, Karen is the beneficiary for the residue of Hugh's estate. His two adult sons are co-exek co-executors 1) For each of Hugh's assets listed above, indicate if they are subject to tax or not. If not, why? (3 marks) 2) For each of Hugh's assets listed above, indicate if they are subject to Estate Administration tax. If not, why? (3 marks) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks of each recommendation (6 marka) For the toolbar, press ALT F10 (PC) or ALTOFN+F10(Mac) B1 VS Paragraph Arial 10pt LI a GP X XT OREC 79 MATTOO AT Question 18 Glen and Megan will both turn 71 this year and will be required to convert their existing RRSP balances into an income producing retirement product. Follow a. Glen and Megan hold RRSPs with a balance of $150,000 and $450,000 respectively, b. Glen was a member of a defined benefit pension plan (DBPP) for most of his career, so he di not have opportunity to contribute as much to a RRSP $50,000 per year. Megan has no pension income from her former employer. C. In general, Glen and Megan can sustain their current lifestyle based upon Glen's pension income and both of their government pension incomes). d. It is increasingly important to Glen and Megan that they leave some monies to their two children upon their death. e. Currently, Megan's health is deteriorating with minor issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life now; ta grandchildren before it is too late. She believes that she may need large sums of money when the time is right in order to meet this short-term objective . Megan also is relatively unsophisticated with money and would just like to have a steady income stream that she can rely upon in the event of Glen's du 9. The survivor benefit from Glen's pension would leave Megan 60% of his current benefits, if he should predecease her. h. Glen enjoys managing the money (and investments) that is held in their self-directed RRSPs. Required: a) Based upon these facts, comment on the suitability (including tax implications) of each of the following options for the conversion of Megan's RRSP.(Mark options to the objectives and facts stated above) (Use point form) (8 marks) Option: 1) Life Annuity with a 5 year guaranteed term 2) Registered Retirement Income Fund (RRIF) For the toolbar, press ALT F10 (PC) or ALT+FN.F10 (Mac). B I y s Paragraph 10pt Y Arial > A IN 4 I 8 points convert their existing RRSP balances into an income producing retirement product. Following information relates to their situation: od $450,000 respectively. P) for most of his career, so he dil not have opportunity to contribute as much to a RRSP, however, now receives a full pension from his employer of Former employer le based upon Glen's pension income and both of their government pension incomes). ave some monies to their two children upon their death. s; however, Glen is still in good health. Given her health, Megan wants to enjoy life now, take some trips with her husband and even her children and ay need large sums of money when the time is right in order to meet this short-term objective vould just like to have a steady income stream that she can rely upon in the event of Glen's death. egan 60% of his current benefits, if he should predeceasc her. as held in their self-directed RRSPs. tax implications) of each of the following options for the conversion of Megan's RRSP. (Marks are awarded by linking the characteristics of these m) (8 marks) T y @ Q 6 Hopes and Dreams HUN 70 and wing for det hun RSP valued at 100.000 Karen by ACS 4.000 . RRP 3.000 on dhan ACB.000 RRIF ved at $100.000 by AC S80.000 universale nung by with death benar 31.000.000 Kms by - segregated funds ved at 0000 Kanary ACA $21.000 - Core valued $225,000 ACS S03.000 bond portfolio forgated and a $60,000: ACB S3.000 portfolio (non registered) valued at $10,000 ACR 545.000 Hugh and Karen own the following sely with tht of survivorship principal residence valued at $280,000, ACS $150.000 segregated Runds (non-registered) valued at $100,000: ACB 50,000 In he wil, Karen is the beneficiary for the residue of Hugh's estate. His two adult sore are common 1) For each of us assets listed above, indicate if they are subject to tax or not. not, why? (3 marks) 2) For each of Hugh's assets listed above, indicate they are subject to Estate Administration tax not, why? (mark) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks of each recommendation 1 mark) or the toolbar, press ALT F10 (PC) or ALTOFN+F10 (Mac). 3 I us Paragraph Arial 10pt A LIXOUQ6 T 1992 BE 22 BBB. E, it 9 !!! r E On ering from teaching age, Hupported business LLLLL trende who renovate chans and boom From the start Hughed her target From 10.00 Cheetah over 10 years! trends for the Hopes and Dreams Hugh is now 70 and retiring for good. He owns 100% of his business. Ha children have their owners and have no were in the business so hapa huiness, Hugh owns the following RRSP1 valued at $100,000 (Karen beneficiwy ACE $54.000 RRSP 2 valued at $43.000 (son Todd beneficiary ACB $21,000 RAIF valued at $100,000 (estate beneficiary : ACB 580.000 Universal life insurance policy with death benefit of $1,000,000 (karena beneficiary) - segregated funds valued at $30.000 (Karen beneficiary ACB $21,000 cottage valued at $225.000, ACB 563,000 bond portfolio (non registered) valued at $60,000; ACB 343.000 stock portfolio (nonregistered valued at $90,000, ACB 545,000 Hugh and Karen own the following assets jointly with right of survivorship: principal residence valued at $280,000: ACB $150,000 segregated funds (non-registered) valued at $100.000, ACB 580,000 his wa, Karen is the beneficiary for the residue of Hugh's estate. His two adut one we co-edston 1 Ni 1) For each of Hugh's assets listed above, indicate if they are subject to tax or not. If not, why? (3 mars 2) For each of Hugh's assets listed above, indicate they are subject to Estate Administration the net, why? martes) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks et each recommandation 15 marta For the toolbar, press ALT F10 [PO) O ALTFN+F10 Mac Paragraph Arial 10pt T: 6 !!! FF universal life insurance policy with death benefit of $1,000,000 (Karen as beneficiary) segregated funds valued at $30,000 (Karen beneficiaryX ACB $21,000 . cottage valued at $225,000; ACB $63,000 bond portfolio (non-registered) valued at $60,000; ACB $43,000 stock portfolio (non-registered) valued at $90,000; ACB $45,000 Hugh and Karen can the following assets jointly with right of survivorship: principal residence valued at 280,000, ACB $150,000 . segregated funds (non-registered) valued at $100,000; ACA $80,000 In his will, Karen is the beneficiary for the residue of Hugh's estate. His two adult sons are co-exek co-executors 1) For each of Hugh's assets listed above, indicate if they are subject to tax or not. If not, why? (3 marks) 2) For each of Hugh's assets listed above, indicate if they are subject to Estate Administration tax. If not, why? (3 marks) 3) Provide Hugh with four specific recommendations to improve his estate plan by lowering tax and EAT? Explain the benefits and drawbacks of each recommendation (6 marka) For the toolbar, press ALT F10 (PC) or ALTOFN+F10(Mac) B1 VS Paragraph Arial 10pt LI a GP X XT OREC 79 MATTOO AT Question 18 Glen and Megan will both turn 71 this year and will be required to convert their existing RRSP balances into an income producing retirement product. Follow a. Glen and Megan hold RRSPs with a balance of $150,000 and $450,000 respectively, b. Glen was a member of a defined benefit pension plan (DBPP) for most of his career, so he di not have opportunity to contribute as much to a RRSP $50,000 per year. Megan has no pension income from her former employer. C. In general, Glen and Megan can sustain their current lifestyle based upon Glen's pension income and both of their government pension incomes). d. It is increasingly important to Glen and Megan that they leave some monies to their two children upon their death. e. Currently, Megan's health is deteriorating with minor issues; however, Glen is still in good health. Given her health, Megan wants to enjoy life now; ta grandchildren before it is too late. She believes that she may need large sums of money when the time is right in order to meet this short-term objective . Megan also is relatively unsophisticated with money and would just like to have a steady income stream that she can rely upon in the event of Glen's du 9. The survivor benefit from Glen's pension would leave Megan 60% of his current benefits, if he should predecease her. h. Glen enjoys managing the money (and investments) that is held in their self-directed RRSPs. Required: a) Based upon these facts, comment on the suitability (including tax implications) of each of the following options for the conversion of Megan's RRSP.(Mark options to the objectives and facts stated above) (Use point form) (8 marks) Option: 1) Life Annuity with a 5 year guaranteed term 2) Registered Retirement Income Fund (RRIF) For the toolbar, press ALT F10 (PC) or ALT+FN.F10 (Mac). B I y s Paragraph 10pt Y Arial > A IN 4 I 8 points convert their existing RRSP balances into an income producing retirement product. Following information relates to their situation: od $450,000 respectively. P) for most of his career, so he dil not have opportunity to contribute as much to a RRSP, however, now receives a full pension from his employer of Former employer le based upon Glen's pension income and both of their government pension incomes). ave some monies to their two children upon their death. s; however, Glen is still in good health. Given her health, Megan wants to enjoy life now, take some trips with her husband and even her children and ay need large sums of money when the time is right in order to meet this short-term objective vould just like to have a steady income stream that she can rely upon in the event of Glen's death. egan 60% of his current benefits, if he should predeceasc her. as held in their self-directed RRSPs. tax implications) of each of the following options for the conversion of Megan's RRSP. (Marks are awarded by linking the characteristics of these m) (8 marks) T y @ Q 6