Answered step by step

Verified Expert Solution

Question

1 Approved Answer

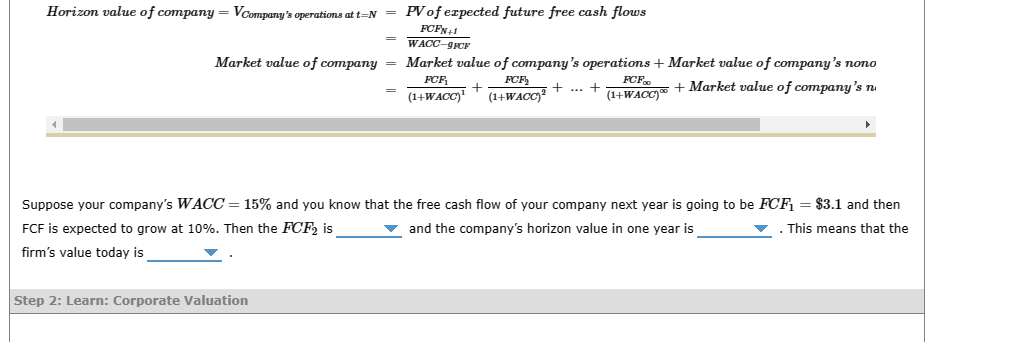

Horizon value of company =VCompanysoperationsatt=N=PV of expected future free cash flows =WACCgFCFFCFN+1 Marketvalueofcompany=Marketvalueofcompanysoperations+Marketvalueofcompanysnono=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF+Marketvalueofcompanysn 1 Suppose your company's WACC=15% and you know that the free cash

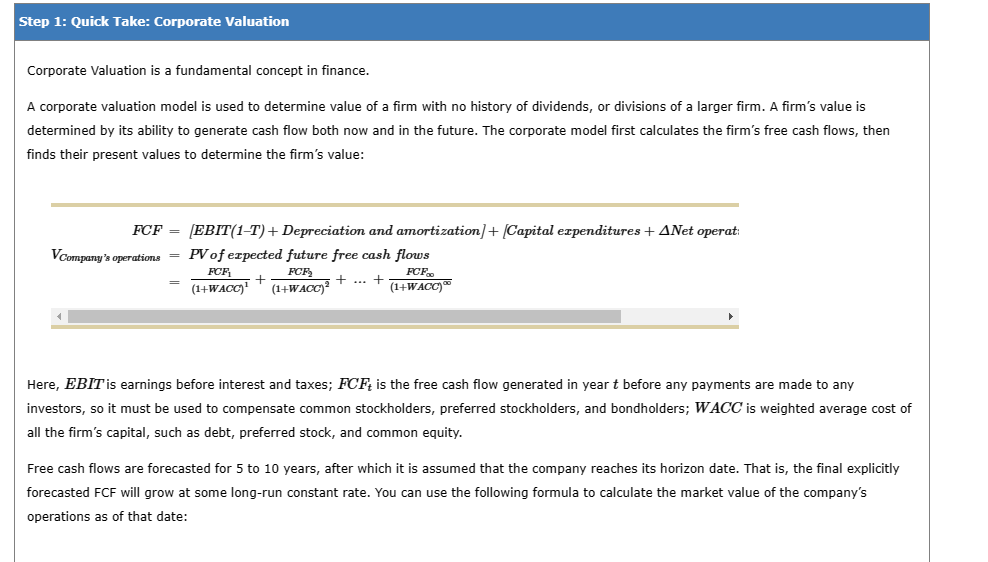

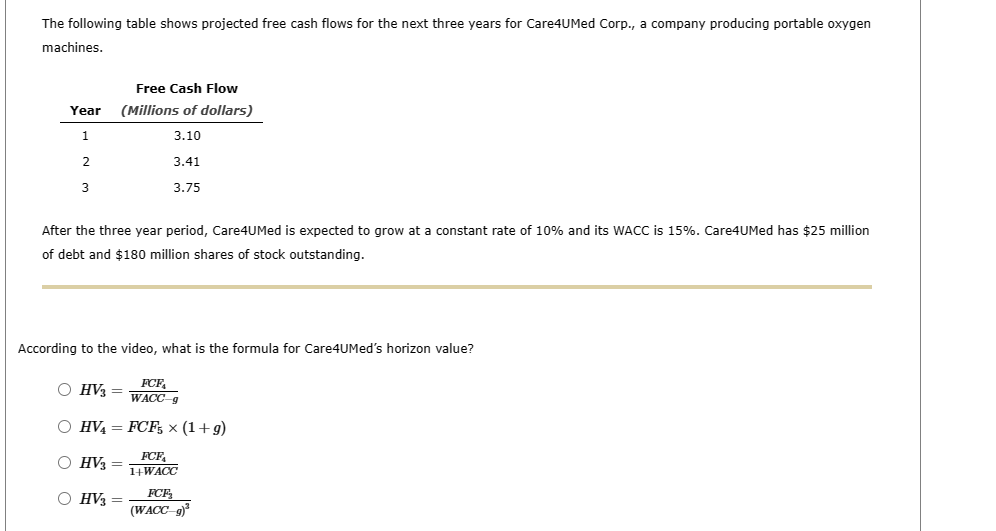

Horizon value of company =VCompanysoperationsatt=N=PV of expected future free cash flows =WACCgFCFFCFN+1 Marketvalueofcompany=Marketvalueofcompanysoperations+Marketvalueofcompanysnono=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF+Marketvalueofcompanysn 1 Suppose your company's WACC=15% and you know that the free cash flow of your company next year is going to be FCF1=$3.1 and then CF is expected to grow at 10%. Then the FCF2 is and the company's horizon value in one year is . This means that the irm's value today is Care4UMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0V0V0V0=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)3HV3=(1+WACC)4HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)4HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4UMed's equity is million. According to the video, the price per share is found as Care4UMed's the price per share is Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. After the four year period, Quick Sky is expected to grow at a constant rate of 10% and its WACC is 15%. Quick Sky has $25 million of debt and $180 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is Corporate Valuation is a fundamental concept in finance. A corporate valuation model is used to determine value of a firm with no history of dividends, or divisions of a larger firm. A firm's value is determined by its ability to generate cash flow both now and in the future. The corporate model first calculates the firm's free cash flows, then finds their present values to determine the firm's value: FCFVCompanysoperations=[EBIT(1T)+Depreciationandamortization]+[Capitalexpenditures+Netoperat=PVofexpectedfuturefreecashflows=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF 1 Here, EBIT is earnings before interest and taxes; FCFt is the free cash flow generated in year t before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and bondholders; WACC is weighted average cost of all the firm's capital, such as debt, preferred stock, and common equity. Free cash flows are forecasted for 5 to 10 years, after which it is assumed that the company reaches its horizon date. That is, the final explicitly forecasted FCF will grow at some long-run constant rate. You can use the following formula to calculate the market value of the company's operations as of that date: The following table shows projected free cash flows for the next three years for Care4UMed Corp., a company producing portable oxygen machines. After the three year period, Care4UMed is expected to grow at a constant rate of 10% and its WACC is 15%. Care4UMed has $25 million of debt and $180 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=WACCgFCF4HV4=FCF5(1+g)HV3=1+WACCFCF4HV3=(WACCg)3FCF3 Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.10000.0300$1.03=$14.71 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 5.00% rather than 3.00%, the stock's forecasted intrinsic value would be P0=0.10000.0500$1.03=$20.60, which is greater than $14.71. In this case, you would call the stock a "Buy". Suppose that the growth rate is expected to be 2.00%. In this case, the stock's forecasted intrinsic value would be its current price, and the stock would be a If the stock is in equilibrium, rs must equal the expected dividend yield plus an expected capital gains yield. Thus, you can solve for an expected rate of return, rs : Expectedrateofreturn,rs=Expecteddividendyield+Expectedgrowthrate,orcapitalgainyield=P0D1+g Suppose that D0=$1.00 and the stock's last closing price is $14.71. It is expected that earnings and dividends will grow at a constant rate of g=3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=10.00%. The dividend received in period 1 is D1=$1.00(1+0.0300)=$1.03 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infi 3.00% 7.00% 10.00% 13.00% Constant Growth Valuation is a fundamental concept in finance. The value of the firm's stock is the present value of its expected future dividends. If Dt stands for dividend at period t and rs is the required rate of return, which is a riskless rate plus a risk premium, then the expected value of firm's stock is determined as follows: Valueofstock,P0=PVofexpectedfuturedividends=(1+rs)1D1+(1+rs)2D2++(1+rs)D=t=1(1+rs)tDt For many companies it is reasonable to predict that dividends will grow at a constant rate, g. Thus, the previous equation may be rewritten as follows: P0=(1+rs)1D0(1+g)1+(1+rs)2D0(1+g)2++(1+rs)0D0(1+g)=rsgD0(1+g)=rsgD1 Suppose D0=1 and D1=$1.03 and it is expected that earnings and dividends will grow at a constant rate of 3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 10.00%. When the growth rate is years from today P0(grs)P0(1+g)6(1+g)6P0(1+g)6D1 the required rate of return, you can use the following formula to calculate the price of the stock 6 And the price of the stock 6 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.85 at the end of this year and it is expected to grow at a constant rate of 3.00% a year. If it is required return is 10.00%. Horizon value of company =VCompanysoperationsatt=N=PV of expected future free cash flows =WACCgFCFFCFN+1 Marketvalueofcompany=Marketvalueofcompanysoperations+Marketvalueofcompanysnono=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF+Marketvalueofcompanysn 1 Suppose your company's WACC=15% and you know that the free cash flow of your company next year is going to be FCF1=$3.1 and then CF is expected to grow at 10%. Then the FCF2 is and the company's horizon value in one year is . This means that the irm's value today is Care4UMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0V0V0V0=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)3HV3=(1+WACC)4HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)4HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4UMed's equity is million. According to the video, the price per share is found as Care4UMed's the price per share is Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. After the four year period, Quick Sky is expected to grow at a constant rate of 10% and its WACC is 15%. Quick Sky has $25 million of debt and $180 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is Corporate Valuation is a fundamental concept in finance. A corporate valuation model is used to determine value of a firm with no history of dividends, or divisions of a larger firm. A firm's value is determined by its ability to generate cash flow both now and in the future. The corporate model first calculates the firm's free cash flows, then finds their present values to determine the firm's value: FCFVCompanysoperations=[EBIT(1T)+Depreciationandamortization]+[Capitalexpenditures+Netoperat=PVofexpectedfuturefreecashflows=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF 1 Here, EBIT is earnings before interest and taxes; FCFt is the free cash flow generated in year t before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and bondholders; WACC is weighted average cost of all the firm's capital, such as debt, preferred stock, and common equity. Free cash flows are forecasted for 5 to 10 years, after which it is assumed that the company reaches its horizon date. That is, the final explicitly forecasted FCF will grow at some long-run constant rate. You can use the following formula to calculate the market value of the company's operations as of that date: The following table shows projected free cash flows for the next three years for Care4UMed Corp., a company producing portable oxygen machines. After the three year period, Care4UMed is expected to grow at a constant rate of 10% and its WACC is 15%. Care4UMed has $25 million of debt and $180 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=WACCgFCF4HV4=FCF5(1+g)HV3=1+WACCFCF4HV3=(WACCg)3FCF3 Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.10000.0300$1.03=$14.71 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 5.00% rather than 3.00%, the stock's forecasted intrinsic value would be P0=0.10000.0500$1.03=$20.60, which is greater than $14.71. In this case, you would call the stock a "Buy". Suppose that the growth rate is expected to be 2.00%. In this case, the stock's forecasted intrinsic value would be its current price, and the stock would be a If the stock is in equilibrium, rs must equal the expected dividend yield plus an expected capital gains yield. Thus, you can solve for an expected rate of return, rs : Expectedrateofreturn,rs=Expecteddividendyield+Expectedgrowthrate,orcapitalgainyield=P0D1+g Suppose that D0=$1.00 and the stock's last closing price is $14.71. It is expected that earnings and dividends will grow at a constant rate of g=3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=10.00%. The dividend received in period 1 is D1=$1.00(1+0.0300)=$1.03 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infi 3.00% 7.00% 10.00% 13.00% Constant Growth Valuation is a fundamental concept in finance. The value of the firm's stock is the present value of its expected future dividends. If Dt stands for dividend at period t and rs is the required rate of return, which is a riskless rate plus a risk premium, then the expected value of firm's stock is determined as follows: Valueofstock,P0=PVofexpectedfuturedividends=(1+rs)1D1+(1+rs)2D2++(1+rs)D=t=1(1+rs)tDt For many companies it is reasonable to predict that dividends will grow at a constant rate, g. Thus, the previous equation may be rewritten as follows: P0=(1+rs)1D0(1+g)1+(1+rs)2D0(1+g)2++(1+rs)0D0(1+g)=rsgD0(1+g)=rsgD1 Suppose D0=1 and D1=$1.03 and it is expected that earnings and dividends will grow at a constant rate of 3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 10.00%. When the growth rate is years from today P0(grs)P0(1+g)6(1+g)6P0(1+g)6D1 the required rate of return, you can use the following formula to calculate the price of the stock 6 And the price of the stock 6 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.85 at the end of this year and it is expected to grow at a constant rate of 3.00% a year. If it is required return is 10.00%

Horizon value of company =VCompanysoperationsatt=N=PV of expected future free cash flows =WACCgFCFFCFN+1 Marketvalueofcompany=Marketvalueofcompanysoperations+Marketvalueofcompanysnono=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF+Marketvalueofcompanysn 1 Suppose your company's WACC=15% and you know that the free cash flow of your company next year is going to be FCF1=$3.1 and then CF is expected to grow at 10%. Then the FCF2 is and the company's horizon value in one year is . This means that the irm's value today is Care4UMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0V0V0V0=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)3HV3=(1+WACC)4HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)4HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4UMed's equity is million. According to the video, the price per share is found as Care4UMed's the price per share is Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. After the four year period, Quick Sky is expected to grow at a constant rate of 10% and its WACC is 15%. Quick Sky has $25 million of debt and $180 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is Corporate Valuation is a fundamental concept in finance. A corporate valuation model is used to determine value of a firm with no history of dividends, or divisions of a larger firm. A firm's value is determined by its ability to generate cash flow both now and in the future. The corporate model first calculates the firm's free cash flows, then finds their present values to determine the firm's value: FCFVCompanysoperations=[EBIT(1T)+Depreciationandamortization]+[Capitalexpenditures+Netoperat=PVofexpectedfuturefreecashflows=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF 1 Here, EBIT is earnings before interest and taxes; FCFt is the free cash flow generated in year t before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and bondholders; WACC is weighted average cost of all the firm's capital, such as debt, preferred stock, and common equity. Free cash flows are forecasted for 5 to 10 years, after which it is assumed that the company reaches its horizon date. That is, the final explicitly forecasted FCF will grow at some long-run constant rate. You can use the following formula to calculate the market value of the company's operations as of that date: The following table shows projected free cash flows for the next three years for Care4UMed Corp., a company producing portable oxygen machines. After the three year period, Care4UMed is expected to grow at a constant rate of 10% and its WACC is 15%. Care4UMed has $25 million of debt and $180 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=WACCgFCF4HV4=FCF5(1+g)HV3=1+WACCFCF4HV3=(WACCg)3FCF3 Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.10000.0300$1.03=$14.71 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 5.00% rather than 3.00%, the stock's forecasted intrinsic value would be P0=0.10000.0500$1.03=$20.60, which is greater than $14.71. In this case, you would call the stock a "Buy". Suppose that the growth rate is expected to be 2.00%. In this case, the stock's forecasted intrinsic value would be its current price, and the stock would be a If the stock is in equilibrium, rs must equal the expected dividend yield plus an expected capital gains yield. Thus, you can solve for an expected rate of return, rs : Expectedrateofreturn,rs=Expecteddividendyield+Expectedgrowthrate,orcapitalgainyield=P0D1+g Suppose that D0=$1.00 and the stock's last closing price is $14.71. It is expected that earnings and dividends will grow at a constant rate of g=3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=10.00%. The dividend received in period 1 is D1=$1.00(1+0.0300)=$1.03 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infi 3.00% 7.00% 10.00% 13.00% Constant Growth Valuation is a fundamental concept in finance. The value of the firm's stock is the present value of its expected future dividends. If Dt stands for dividend at period t and rs is the required rate of return, which is a riskless rate plus a risk premium, then the expected value of firm's stock is determined as follows: Valueofstock,P0=PVofexpectedfuturedividends=(1+rs)1D1+(1+rs)2D2++(1+rs)D=t=1(1+rs)tDt For many companies it is reasonable to predict that dividends will grow at a constant rate, g. Thus, the previous equation may be rewritten as follows: P0=(1+rs)1D0(1+g)1+(1+rs)2D0(1+g)2++(1+rs)0D0(1+g)=rsgD0(1+g)=rsgD1 Suppose D0=1 and D1=$1.03 and it is expected that earnings and dividends will grow at a constant rate of 3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 10.00%. When the growth rate is years from today P0(grs)P0(1+g)6(1+g)6P0(1+g)6D1 the required rate of return, you can use the following formula to calculate the price of the stock 6 And the price of the stock 6 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.85 at the end of this year and it is expected to grow at a constant rate of 3.00% a year. If it is required return is 10.00%. Horizon value of company =VCompanysoperationsatt=N=PV of expected future free cash flows =WACCgFCFFCFN+1 Marketvalueofcompany=Marketvalueofcompanysoperations+Marketvalueofcompanysnono=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF+Marketvalueofcompanysn 1 Suppose your company's WACC=15% and you know that the free cash flow of your company next year is going to be FCF1=$3.1 and then CF is expected to grow at 10%. Then the FCF2 is and the company's horizon value in one year is . This means that the irm's value today is Care4UMed's horizon value is million. According to the video, what is the formula for the firm's value today? V0V0V0V0=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)3HV3=(1+WACC)4HV3=(1+WACC)1FCF1+(1+WACC)2FCF2+(1+WACC)3FCF3+(1+WACC)4HV3 Care4UMed's value today is million. According to the video, the value of equity is found as Care4UMed's equity is million. According to the video, the price per share is found as Care4UMed's the price per share is Now it's time for you to practice what you've learned. The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. After the four year period, Quick Sky is expected to grow at a constant rate of 10% and its WACC is 15%. Quick Sky has $25 million of debt and $180 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is Corporate Valuation is a fundamental concept in finance. A corporate valuation model is used to determine value of a firm with no history of dividends, or divisions of a larger firm. A firm's value is determined by its ability to generate cash flow both now and in the future. The corporate model first calculates the firm's free cash flows, then finds their present values to determine the firm's value: FCFVCompanysoperations=[EBIT(1T)+Depreciationandamortization]+[Capitalexpenditures+Netoperat=PVofexpectedfuturefreecashflows=(1+WACC)1FCF1+(1+WACC)2FCF2++(1+WACC)FCF 1 Here, EBIT is earnings before interest and taxes; FCFt is the free cash flow generated in year t before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and bondholders; WACC is weighted average cost of all the firm's capital, such as debt, preferred stock, and common equity. Free cash flows are forecasted for 5 to 10 years, after which it is assumed that the company reaches its horizon date. That is, the final explicitly forecasted FCF will grow at some long-run constant rate. You can use the following formula to calculate the market value of the company's operations as of that date: The following table shows projected free cash flows for the next three years for Care4UMed Corp., a company producing portable oxygen machines. After the three year period, Care4UMed is expected to grow at a constant rate of 10% and its WACC is 15%. Care4UMed has $25 million of debt and $180 million shares of stock outstanding. According to the video, what is the formula for Care4uMed's horizon value? HV3=WACCgFCF4HV4=FCF5(1+g)HV3=1+WACCFCF4HV3=(WACCg)3FCF3 Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price P0=rsgD1=0.10000.0300$1.03=$14.71 and the expected total return is equal to the required rate of return rs. If the market was more optimistic and the growth rate would be 5.00% rather than 3.00%, the stock's forecasted intrinsic value would be P0=0.10000.0500$1.03=$20.60, which is greater than $14.71. In this case, you would call the stock a "Buy". Suppose that the growth rate is expected to be 2.00%. In this case, the stock's forecasted intrinsic value would be its current price, and the stock would be a If the stock is in equilibrium, rs must equal the expected dividend yield plus an expected capital gains yield. Thus, you can solve for an expected rate of return, rs : Expectedrateofreturn,rs=Expecteddividendyield+Expectedgrowthrate,orcapitalgainyield=P0D1+g Suppose that D0=$1.00 and the stock's last closing price is $14.71. It is expected that earnings and dividends will grow at a constant rate of g=3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs=10.00%. The dividend received in period 1 is D1=$1.00(1+0.0300)=$1.03 and the estimated intrinsic value in the same period is based on the constant growth model: P1=rsgD2. The dividend yield for period 1 is and it will each period. The capital gain yield expected during period 1 is and it will each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infi 3.00% 7.00% 10.00% 13.00% Constant Growth Valuation is a fundamental concept in finance. The value of the firm's stock is the present value of its expected future dividends. If Dt stands for dividend at period t and rs is the required rate of return, which is a riskless rate plus a risk premium, then the expected value of firm's stock is determined as follows: Valueofstock,P0=PVofexpectedfuturedividends=(1+rs)1D1+(1+rs)2D2++(1+rs)D=t=1(1+rs)tDt For many companies it is reasonable to predict that dividends will grow at a constant rate, g. Thus, the previous equation may be rewritten as follows: P0=(1+rs)1D0(1+g)1+(1+rs)2D0(1+g)2++(1+rs)0D0(1+g)=rsgD0(1+g)=rsgD1 Suppose D0=1 and D1=$1.03 and it is expected that earnings and dividends will grow at a constant rate of 3.00% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced and the required rate of return is 10.00%. When the growth rate is years from today P0(grs)P0(1+g)6(1+g)6P0(1+g)6D1 the required rate of return, you can use the following formula to calculate the price of the stock 6 And the price of the stock 6 years from today is Step 3: Practice: Constant Growth Valuation Now it's time for you to practice what you've learned. Suppose that a stock is expected to pay a dividend of $4.85 at the end of this year and it is expected to grow at a constant rate of 3.00% a year. If it is required return is 10.00% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started