Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Horizontal analysis refers to changes in financial statement numbers across two or more years. Vertical analysis refers to financial amounts for each year expressed

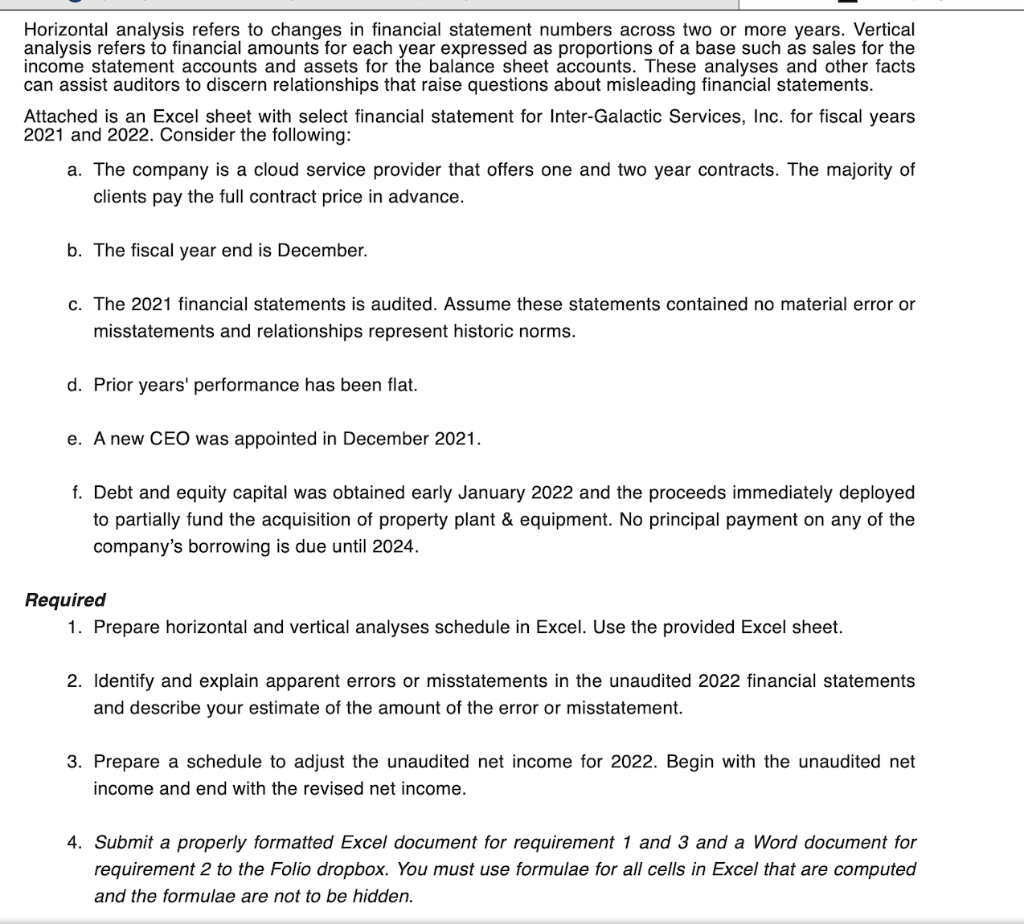

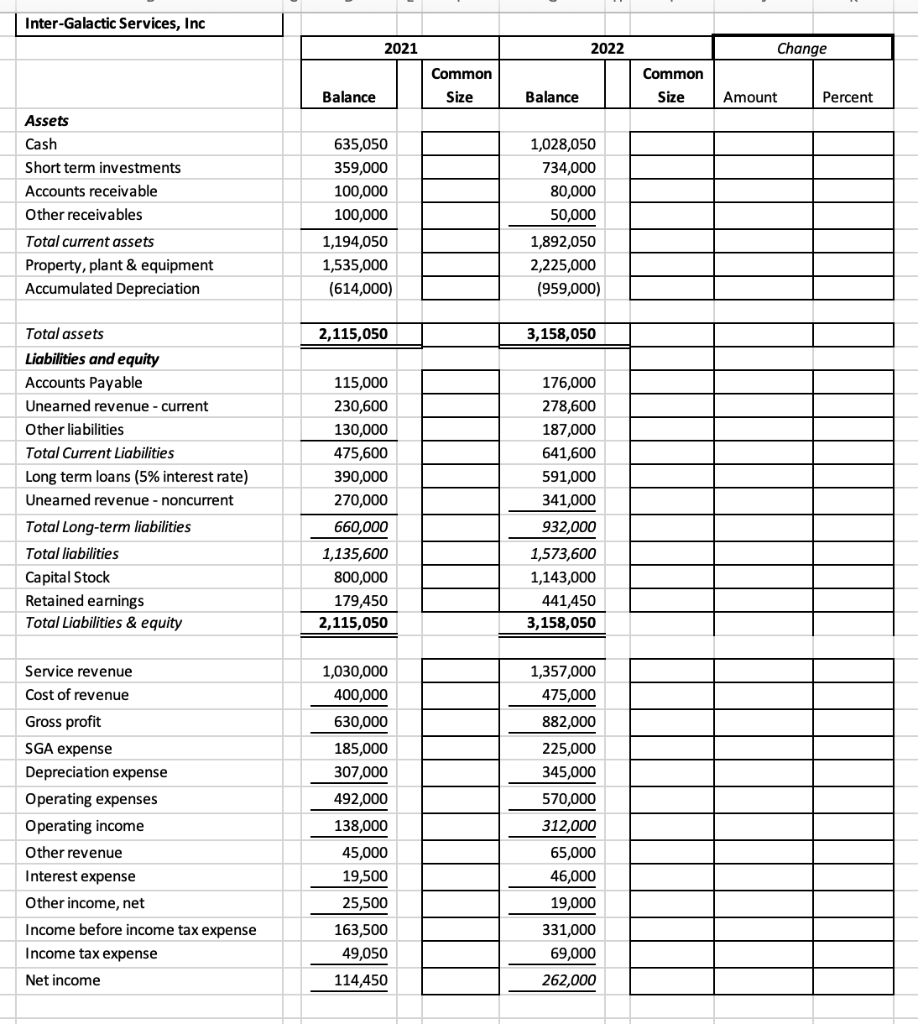

Horizontal analysis refers to changes in financial statement numbers across two or more years. Vertical analysis refers to financial amounts for each year expressed as proportions of a base such as sales for the income statement accounts and assets for the balance sheet accounts. These analyses and other facts can assist auditors to discern relationships that raise questions about misleading financial statements. Attached is an Excel sheet with select financial statement for Inter-Galactic Services, Inc. for fiscal years 2021 and 2022. Consider the following: a. The company is a cloud service provider that offers one and two year contracts. The majority of clients pay the full contract price in advance. b. The fiscal year end is December. c. The 2021 financial statements is audited. Assume these statements contained no material error or misstatements and relationships represent historic norms. d. Prior years' performance has been flat. e. A new CEO was appointed in December 2021. f. Debt and equity capital was obtained early January 2022 and the proceeds immediately deployed to partially fund the acquisition of property plant & equipment. No principal payment on any of the company's borrowing is due until 2024. Required 1. Prepare horizontal and vertical analyses schedule in Excel. Use the provided Excel sheet. 2. Identify and explain apparent errors or misstatements in the unaudited 2022 financial statements and describe your estimate of the amount of the error or misstatement. 3. Prepare a schedule to adjust the unaudited net income for 2022. Begin with the unaudited net income and end with the revised net income. 4. Submit a properly formatted Excel document for requirement 1 and 3 and a Word document for requirement 2 to the Folio dropbox. You must use formulae for all cells in Excel that are computed and the formulae are not to be hidden. Inter-Galactic Services, Inc Assets Cash Short term investments Accounts receivable Other receivables Total current assets Property, plant & equipment Accumulated Depreciation Total assets Liabilities and equity Accounts Payable Unearned revenue - current Other liabilities Total Current Liabilities Long term loans (5% interest rate) Unearned revenue - noncurrent Total Long-term liabilities Total liabilities Capital Stock Retained earnings Total Liabilities & equity Service revenue Cost of revenue Gross profit SGA expense Depreciation expense Operating expenses Operating income Other revenue Interest expense Other income, net Income before income tax expense Income tax expense Net income Balance 2021 635,050 359,000 100,000 100,000 1,194,050 1,535,000 (614,000) 2,115,050 115,000 230,600 130,000 475,600 390,000 270,000 660,000 1,135,600 800,000 179,450 2,115,050 1,030,000 400,000 630,000 185,000 307,000 492,000 138,000 45,000 19,500 25,500 163,500 49,050 114,450 Common Size Balance 2022 1,028,050 734,000 80,000 50,000 1,892,050 2,225,000 (959,000) 3,158,050 176,000 278,600 187,000 641,600 591,000 341,000 932,000 1,573,600 1,143,000 441,450 3,158,050 1,357,000 475,000 882,000 225,000 345,000 570,000 312,000 65,000 46,000 19,000 331,000 69,000 262,000 Common Size Change Amount Percent

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the requirements in separate files 1 Horizontal and Vertical Analysis in Excel See attached ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started