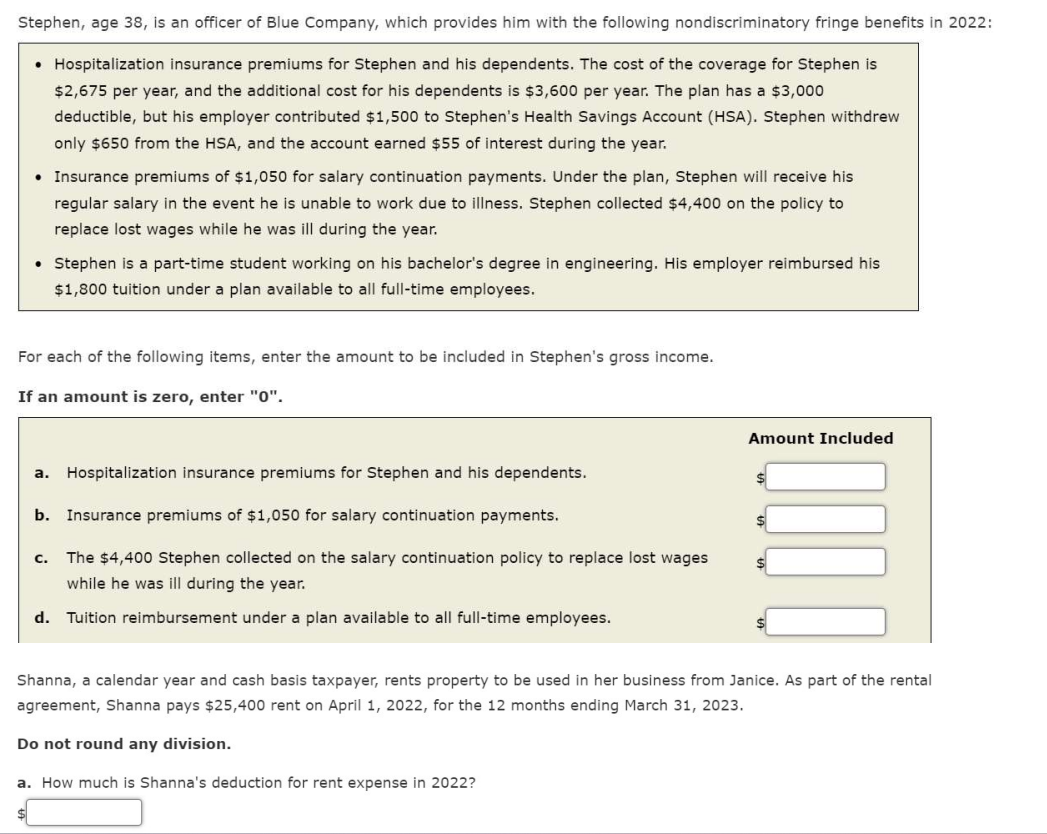

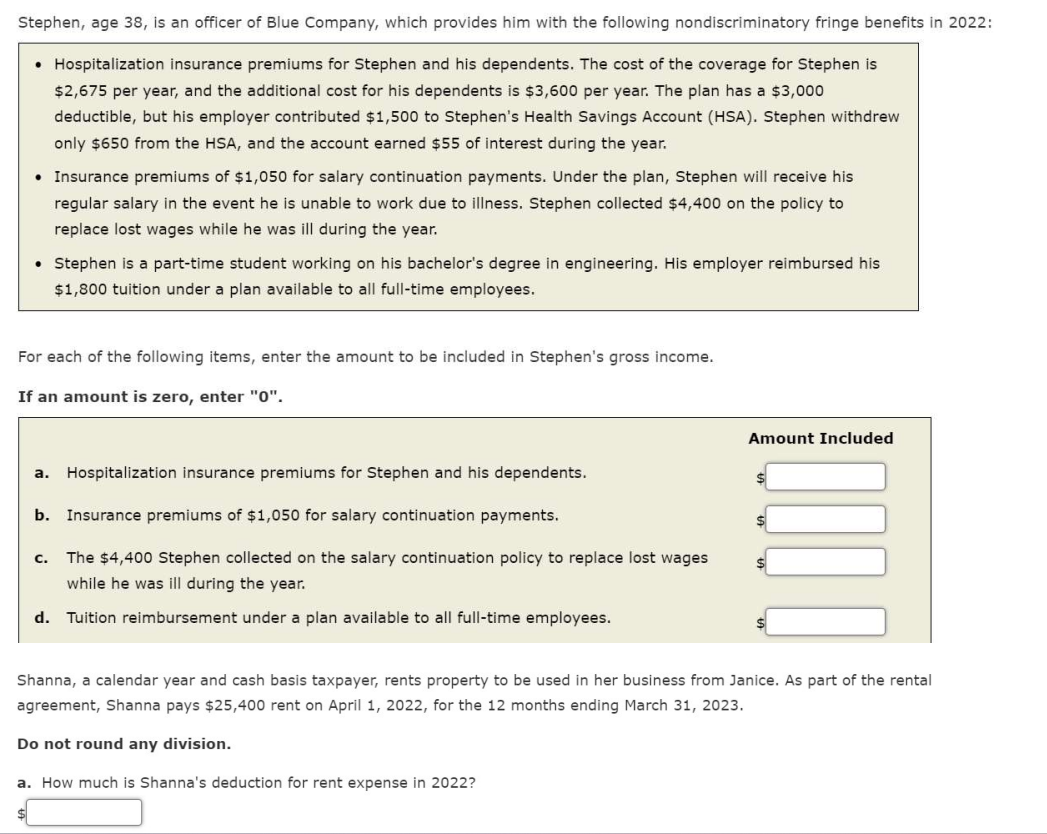

- Hospitalization insurance premiums for Stephen and his dependents. The cost of the coverage for Stephen is $2,675 per year, and the additional cost for his dependents is $3,600 per year. The plan has a $3,000 deductible, but his employer contributed $1,500 to Stephen's Health Savings Account (HSA). Stephen withdrew only $650 from the HSA, and the account earned $55 of interest during the year. - Insurance premiums of $1,050 for salary continuation payments. Under the plan, Stephen will receive his regular salary in the event he is unable to work due to illness. Stephen collected $4,400 on the policy to replace lost wages while he was ill during the year. - Stephen is a part-time student working on his bachelor's degree in engineering. His employer reimbursed his $1,800 tuition under a plan available to all full-time employees. For each of the following items, enter the amount to be included in Stephen's gross income. If an amount is zero, enter " 0 ". Shanna, a calendar year and cash basis taxpayer, rents property to be used in her business from Janice. As part of the rental agreement, Shanna pays $25,400 rent on April 1, 2022, for the 12 months ending March 31, 2023. Do not round any division. a. How much is Shanna's deduction for rent expense in 2022? - Hospitalization insurance premiums for Stephen and his dependents. The cost of the coverage for Stephen is $2,675 per year, and the additional cost for his dependents is $3,600 per year. The plan has a $3,000 deductible, but his employer contributed $1,500 to Stephen's Health Savings Account (HSA). Stephen withdrew only $650 from the HSA, and the account earned $55 of interest during the year. - Insurance premiums of $1,050 for salary continuation payments. Under the plan, Stephen will receive his regular salary in the event he is unable to work due to illness. Stephen collected $4,400 on the policy to replace lost wages while he was ill during the year. - Stephen is a part-time student working on his bachelor's degree in engineering. His employer reimbursed his $1,800 tuition under a plan available to all full-time employees. For each of the following items, enter the amount to be included in Stephen's gross income. If an amount is zero, enter " 0 ". Shanna, a calendar year and cash basis taxpayer, rents property to be used in her business from Janice. As part of the rental agreement, Shanna pays $25,400 rent on April 1, 2022, for the 12 months ending March 31, 2023. Do not round any division. a. How much is Shanna's deduction for rent expense in 2022