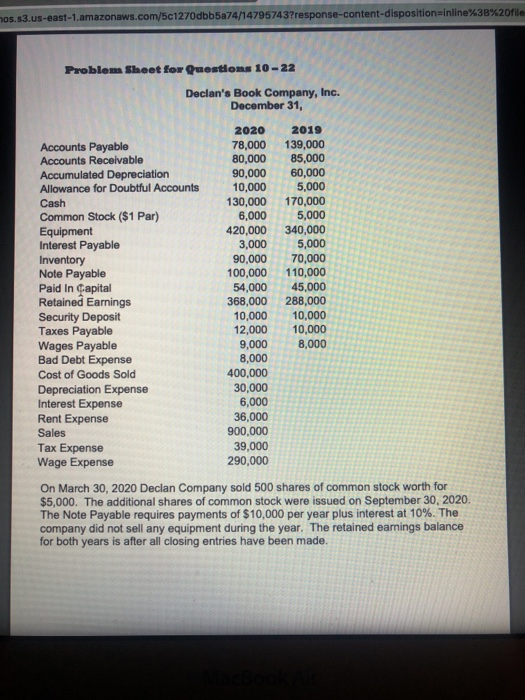

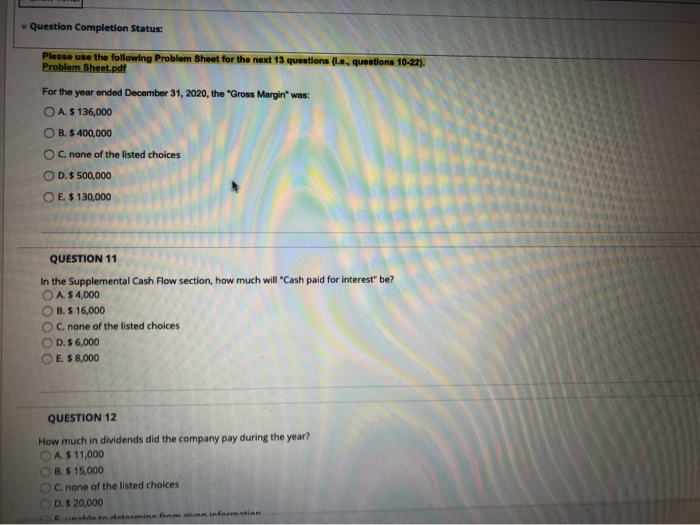

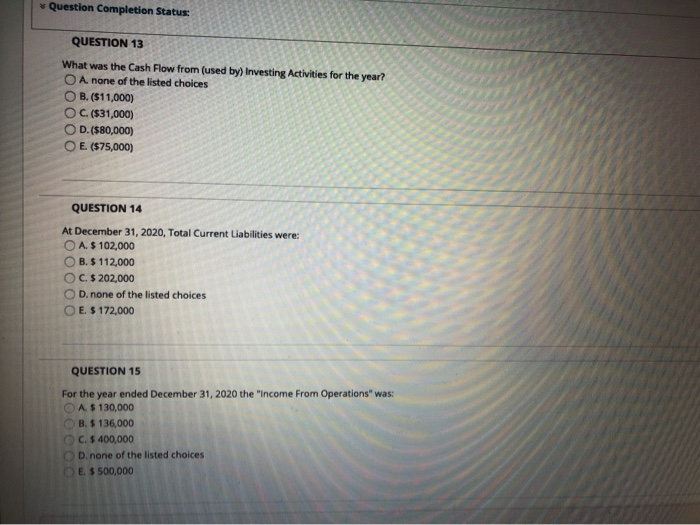

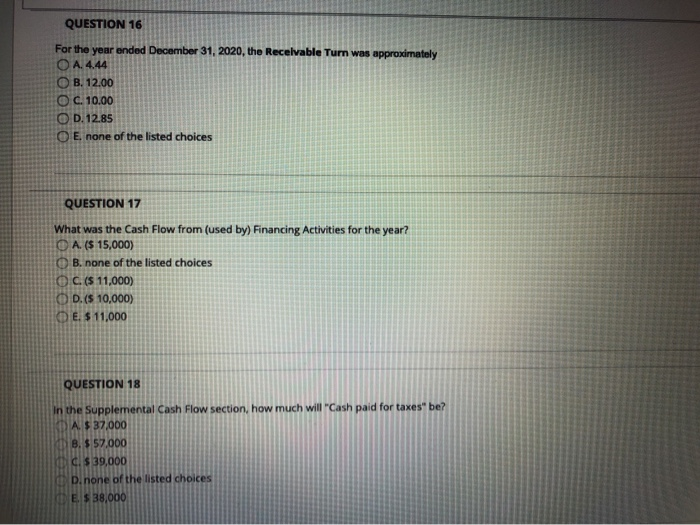

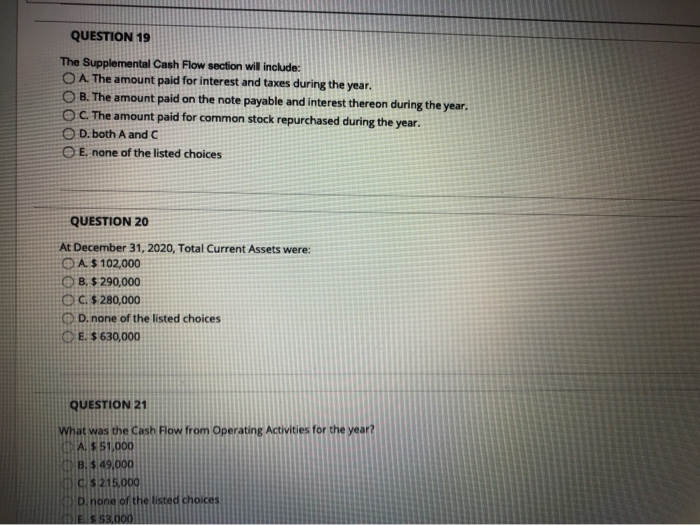

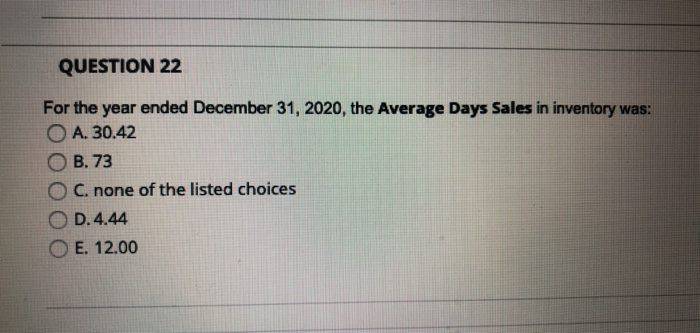

hos.s3.us-east-1.amazonaws.com/bc1270dbb5a74/14795743?response-content-disposition=inline%3B%20file Problem Sheet for Questions 10-22 Declan's Book Company, Inc. December 31, 2020 2019 Accounts Payable 78,000 139,000 Accounts Receivable 80,000 85,000 Accumulated Depreciation 90,000 60,000 Allowance for Doubtful Accounts 10,000 5,000 Cash 130,000 170,000 Common Stock ($1 Par) 6,000 5,000 Equipment 420,000 340,000 Interest Payable 3,000 5,000 Inventory 90,000 70,000 Note Payable 100,000 110,000 Paid In Capital 54,000 45,000 Retained Earnings 368,000 288,000 Security Deposit 10,000 10,000 Taxes Payable 12,000 10,000 Wages Payable 9,000 8,000 Bad Debt Expense 8,000 Cost of Goods Sold 400,000 Depreciation Expense 30,000 Interest Expense 6,000 Rent Expense 36,000 Sales 900,000 Tax Expense 39,000 Wage Expense 290,000 On March 30, 2020 Declan Company sold 500 shares of common stock worth for $5,000. The additional shares of common stock were issued on September 30, 2020. The Note Payable requires payments of $10,000 per year plus interest at 10%. The company did not sell any equipment during the year. The retained earnings balance for both years is after all closing entries have been made. Question Completion Status: Please use the following Problem Sheet for the next 13 questions (le, questions 10-22). Problem Sheet.pdf For the year ended December 31, 2020, the "Gross Marginwas: O A. $ 136,000 OB. $ 400,000 O c. none of the listed choices OD.$ 500,000 E. $ 130,000 QUESTION 11 In the Supplemental Cash Flow section, how much will "Cash paid for interest" be? O A $4,000 OB. $ 16,000 O none of the listed choices OD. $ 6,000 E. $ 8,000 QUESTION 12 How much in dividends did the company pay during the year? OA $ 11,000 B. $ 15,000 C none of the listed choices OD. $ 20,000 Question Completion Status: QUESTION 13 What was the Cash Flow from (used by) Investing Activities for the year? O A. none of the listed choices OB. ($11,000) OC. ($31,000) OD. (580,000) O E. ($75,000) QUESTION 14 At December 31, 2020, Total Current Liabilities were: O A. $ 102,000 OB. $ 112,000 OC. $ 202,000 OD. none of the listed choices E. $ 172,000 QUESTION 15 For the year ended December 31, 2020 the "Income From Operations" was. OA $ 130,000 OB. $ 136,000 C. $ 400,000 D. none of the listed choices E $ 500,000 QUESTION 16 For the year ended December 31, 2020, the Recelvable Turn was approximately A. 4.44 OB. 12.00 O C. 10.00 O D.12.85 O E. none of the listed choices QUESTION 17 What was the Cash Flow from (used by) Financing Activities for the year? O A. ($ 15,000) OB. none of the listed choices OC. ($ 11,000) OD. ($ 10,000) E. $ 11,000 QUESTION 18 in the supplemental Cash Flow section, how much will "Cash paid for taxes" be? DA. $ 37.000 B. $ 57,000 C. $ 39,000 D. none of the listed choices E. S 38,000 QUESTION 19 The Supplemental Cash Flow section will include: O A. The amount paid for interest and taxes during the year. O B. The amount paid on the note payable and interest thereon during the year. OC. The amount paid for common stock repurchased during the year. D. both A and C E. none of the listed choices QUESTION 20 At December 31, 2020, Total Current Assets were: A. $ 102,000 B. $ 290,000 OC. $ 280,000 D. none of the listed choices E. $ 630,000 QUESTION 21 What was the Cash Flow from Operating Activities for the ye A. $ 51,000 B. $ 49,000 C S 215,000 D. none of the listed choices QUESTION 22 For the year ended December 31, 2020, the Average Days Sales in inventory was: O A. 30.42 O B. 73 O C. none of the listed choices D.4.44 O E. 12.00 hos.s3.us-east-1.amazonaws.com/bc1270dbb5a74/14795743?response-content-disposition=inline%3B%20file Problem Sheet for Questions 10-22 Declan's Book Company, Inc. December 31, 2020 2019 Accounts Payable 78,000 139,000 Accounts Receivable 80,000 85,000 Accumulated Depreciation 90,000 60,000 Allowance for Doubtful Accounts 10,000 5,000 Cash 130,000 170,000 Common Stock ($1 Par) 6,000 5,000 Equipment 420,000 340,000 Interest Payable 3,000 5,000 Inventory 90,000 70,000 Note Payable 100,000 110,000 Paid In Capital 54,000 45,000 Retained Earnings 368,000 288,000 Security Deposit 10,000 10,000 Taxes Payable 12,000 10,000 Wages Payable 9,000 8,000 Bad Debt Expense 8,000 Cost of Goods Sold 400,000 Depreciation Expense 30,000 Interest Expense 6,000 Rent Expense 36,000 Sales 900,000 Tax Expense 39,000 Wage Expense 290,000 On March 30, 2020 Declan Company sold 500 shares of common stock worth for $5,000. The additional shares of common stock were issued on September 30, 2020. The Note Payable requires payments of $10,000 per year plus interest at 10%. The company did not sell any equipment during the year. The retained earnings balance for both years is after all closing entries have been made. Question Completion Status: Please use the following Problem Sheet for the next 13 questions (le, questions 10-22). Problem Sheet.pdf For the year ended December 31, 2020, the "Gross Marginwas: O A. $ 136,000 OB. $ 400,000 O c. none of the listed choices OD.$ 500,000 E. $ 130,000 QUESTION 11 In the Supplemental Cash Flow section, how much will "Cash paid for interest" be? O A $4,000 OB. $ 16,000 O none of the listed choices OD. $ 6,000 E. $ 8,000 QUESTION 12 How much in dividends did the company pay during the year? OA $ 11,000 B. $ 15,000 C none of the listed choices OD. $ 20,000 Question Completion Status: QUESTION 13 What was the Cash Flow from (used by) Investing Activities for the year? O A. none of the listed choices OB. ($11,000) OC. ($31,000) OD. (580,000) O E. ($75,000) QUESTION 14 At December 31, 2020, Total Current Liabilities were: O A. $ 102,000 OB. $ 112,000 OC. $ 202,000 OD. none of the listed choices E. $ 172,000 QUESTION 15 For the year ended December 31, 2020 the "Income From Operations" was. OA $ 130,000 OB. $ 136,000 C. $ 400,000 D. none of the listed choices E $ 500,000 QUESTION 16 For the year ended December 31, 2020, the Recelvable Turn was approximately A. 4.44 OB. 12.00 O C. 10.00 O D.12.85 O E. none of the listed choices QUESTION 17 What was the Cash Flow from (used by) Financing Activities for the year? O A. ($ 15,000) OB. none of the listed choices OC. ($ 11,000) OD. ($ 10,000) E. $ 11,000 QUESTION 18 in the supplemental Cash Flow section, how much will "Cash paid for taxes" be? DA. $ 37.000 B. $ 57,000 C. $ 39,000 D. none of the listed choices E. S 38,000 QUESTION 19 The Supplemental Cash Flow section will include: O A. The amount paid for interest and taxes during the year. O B. The amount paid on the note payable and interest thereon during the year. OC. The amount paid for common stock repurchased during the year. D. both A and C E. none of the listed choices QUESTION 20 At December 31, 2020, Total Current Assets were: A. $ 102,000 B. $ 290,000 OC. $ 280,000 D. none of the listed choices E. $ 630,000 QUESTION 21 What was the Cash Flow from Operating Activities for the ye A. $ 51,000 B. $ 49,000 C S 215,000 D. none of the listed choices QUESTION 22 For the year ended December 31, 2020, the Average Days Sales in inventory was: O A. 30.42 O B. 73 O C. none of the listed choices D.4.44 O E. 12.00