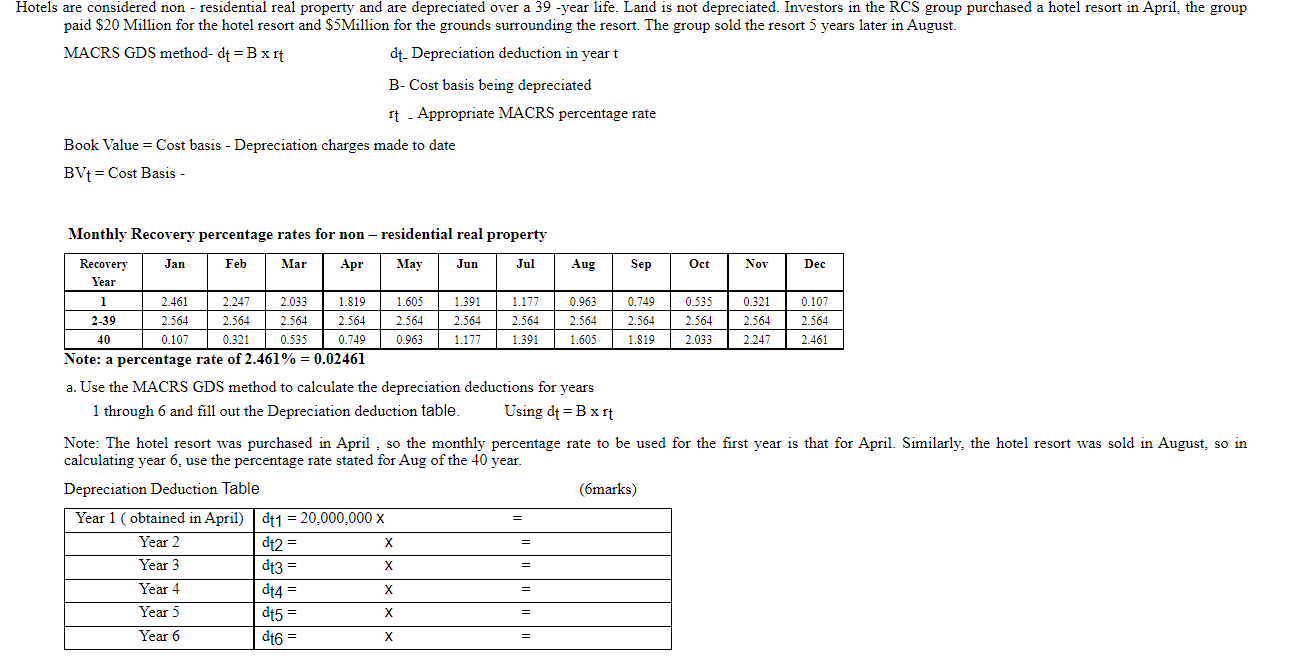

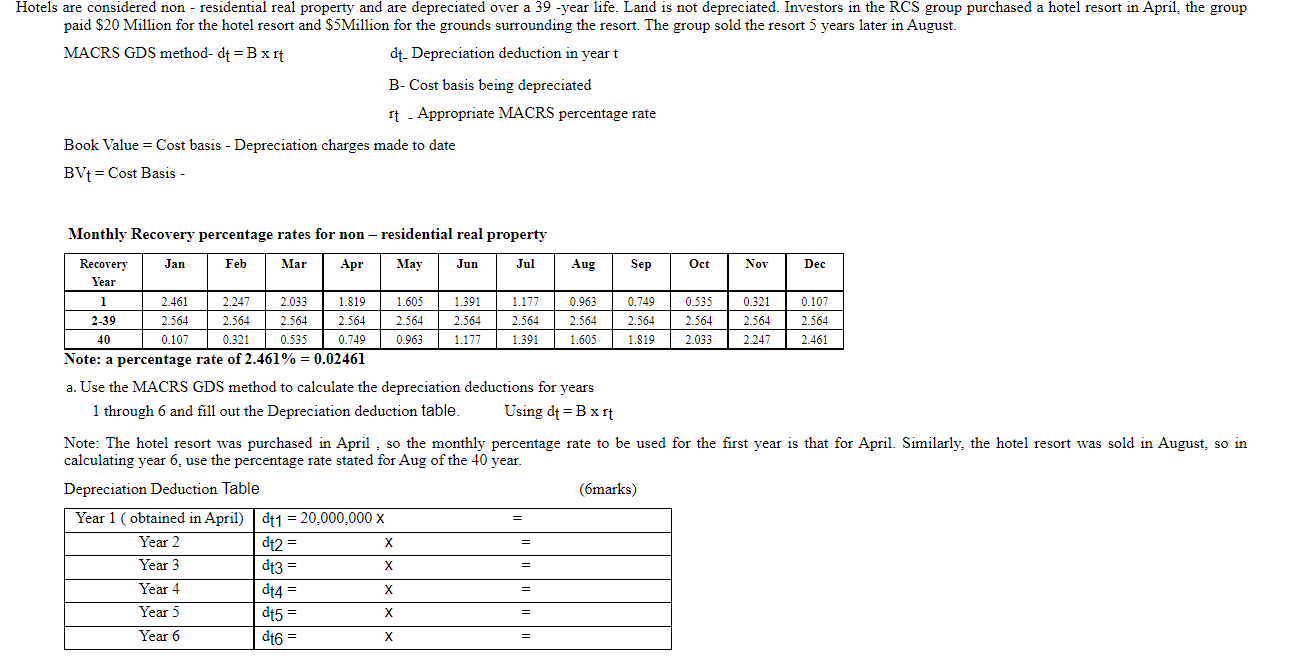

Hotels are considered non-residential real property and are depreciated over a 39-year life. Land is not depreciated. Investors in the RCS group purchased a hotel resort in April, the group paid $20 Million for the hotel resort and $5Million for the grounds surrounding the resort. The group sold the resort 5 years later in August. MACRS GDS method- dt = B x rt dt. Depreciation deduction in yeart B- Cost basis being depreciated It - Appropriate MACRS percentage rate Book Value = Cost basis - Depreciation charges made to date BVt = Cost Basis - Monthly Recovery percentage rates for non-residential real property Recovery Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 1 2.461 2.247 2.033 1.819 1.605 1.39 1.177 0.963 0.749 0.535 0.321 0.107 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 40 0.107 0.321 0.533 0.749 0.963 1.177 1.391 1.605 1.819 2.033 2.247 2.461 Note: a percentage rate of 2.461% = 0.02461 a. Use the MACRS GDS method to calculate the depreciation deductions for years 1 through 6 and fill out the Depreciation deduction table. Using dt =Bxrt Note: The hotel resort was purchased in April , so the monthly percentage rate to be used for the first year is that for April. Similarly, the hotel resort was sold in August, so in calculating year 6, use the percentage rate stated for Aug of the 40 year. Depreciation Deduction Table Omarks) Year 1 (obtained in April)dt = 20,000,000 X Year 2 dt2 = Year 3 dt3 = Year 4 dt4 = X Year 5 X Year 6 dt6 = X dt5 = Hotels are considered non-residential real property and are depreciated over a 39-year life. Land is not depreciated. Investors in the RCS group purchased a hotel resort in April, the group paid $20 Million for the hotel resort and $5Million for the grounds surrounding the resort. The group sold the resort 5 years later in August. MACRS GDS method- dt = B x rt dt. Depreciation deduction in yeart B- Cost basis being depreciated It - Appropriate MACRS percentage rate Book Value = Cost basis - Depreciation charges made to date BVt = Cost Basis - Monthly Recovery percentage rates for non-residential real property Recovery Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 1 2.461 2.247 2.033 1.819 1.605 1.39 1.177 0.963 0.749 0.535 0.321 0.107 2-39 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 2.564 40 0.107 0.321 0.533 0.749 0.963 1.177 1.391 1.605 1.819 2.033 2.247 2.461 Note: a percentage rate of 2.461% = 0.02461 a. Use the MACRS GDS method to calculate the depreciation deductions for years 1 through 6 and fill out the Depreciation deduction table. Using dt =Bxrt Note: The hotel resort was purchased in April , so the monthly percentage rate to be used for the first year is that for April. Similarly, the hotel resort was sold in August, so in calculating year 6, use the percentage rate stated for Aug of the 40 year. Depreciation Deduction Table Omarks) Year 1 (obtained in April)dt = 20,000,000 X Year 2 dt2 = Year 3 dt3 = Year 4 dt4 = X Year 5 X Year 6 dt6 = X dt5 =