Answered step by step

Verified Expert Solution

Question

1 Approved Answer

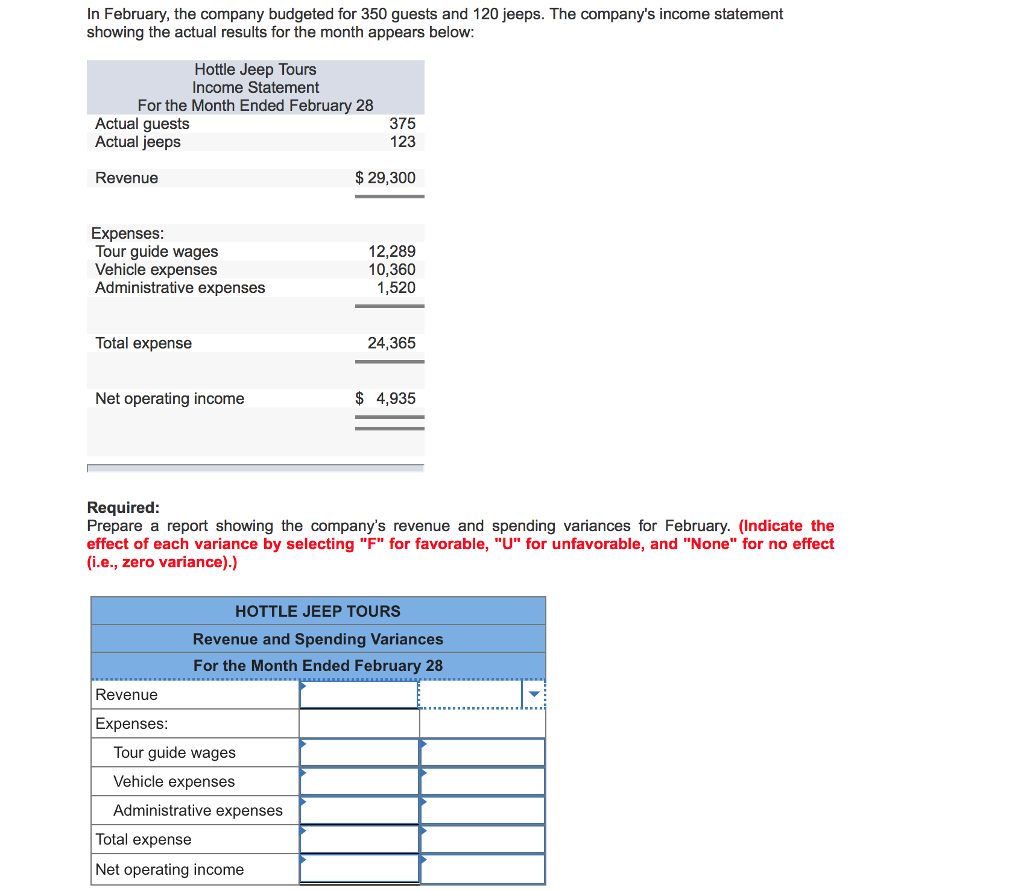

Hottle Jeep Tours operates jeep tours in the heart of the Colorado Rockies. The company bases its budgets on two measures of activity (i.e., cost

| Hottle Jeep Tours operates jeep tours in the heart of the Colorado Rockies. The company bases its budgets on two measures of activity (i.e., cost drivers), namely guests and jeeps. One vehicle used in one tour on one day counts as a jeep. Each jeep has one tour guide. The company uses the following data in its budgeting: |

| Fixed element per month | Variable element per guest | Variable element per jeep | |||||||

| Revenue | $ | 0 | $ | 80 | $ | 0 | |||

| Tour guide wages | $ | 0 | $ | 0 | $ | 100 | |||

| Vehicle expenses | $ | 3,000 | $ | 4 | $ | 50 | |||

| Administrative expenses | $ | 1,100 | $ | 1 | $ | 0 | |||

| | |||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started