Answered step by step

Verified Expert Solution

Question

1 Approved Answer

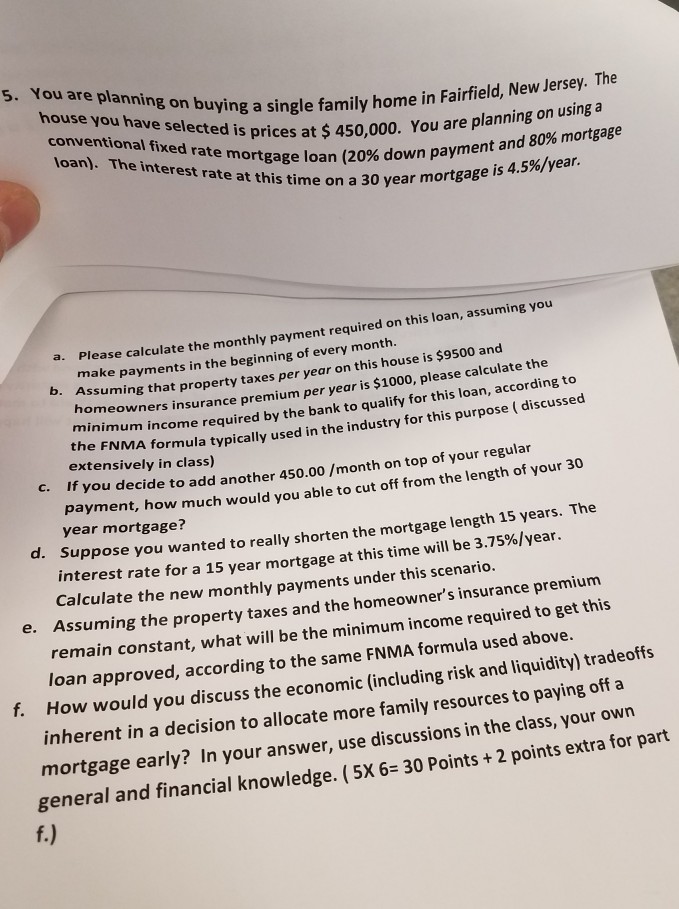

house you have selected is prices at $ 450,000. You ing a single family home in Fairfield, New Jersey. The nterest rateortgage loan (20% down

house you have selected is prices at $ 450,000. You ing a single family home in Fairfield, New Jersey. The nterest rateortgage loan (20% down payment and 80% mortgage at this time on a 30 year mortgage is 4.5%/year. uming you Please calculate the monthly payment required on this loan, ass a. make payments in the beginning of every month. Assuming that property taxes per year on this homeowners insurance premium per year is $1000, please calculate the minimum income required by the bank to qualify for this loan, according to the FNMA formula typically used in the industry for this purpose ( discussed b. house is $9500 and extensively in class) c. If you decide to add another 450.00 /month on top of your regular payment, how much would you able to cut off from the length of your 30 year mortgage? d. Suppose you wanted to really shorten the mortgage length 15 years. The interest rate for a 15 year mortgage at this time will be 3.75%/year. Calculate the new monthly payments under this scenario. e. Assuming the property taxes and the homeowner's insurance premium remain constant, what will be the minimum income required to get this loan approved, according to the same FNMA formula used above. f. How would you discuss the economic (including risk and liquidity) tradeoffs inherent in a decision to allocate more family resources to paying off a mortgage early? In your answer, use discussions in the class, your owr general and financial knowledge. (5X 6 30 Points + 2 points extra for part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started