Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. You estimate a regression of the form given by equation (4.55) below in order to evaluate the effect of various firm-specific factors on

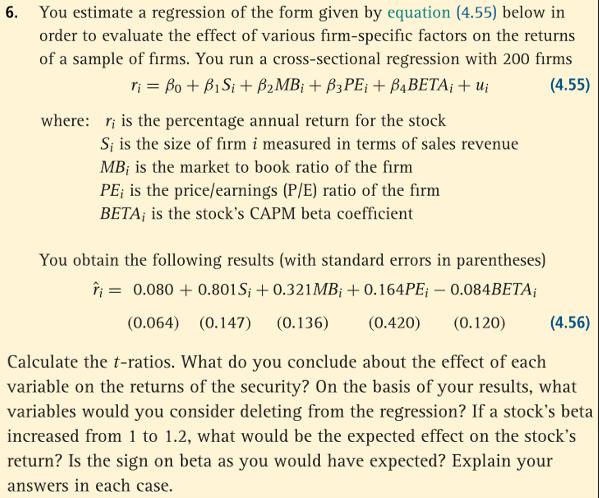

6. You estimate a regression of the form given by equation (4.55) below in order to evaluate the effect of various firm-specific factors on the returns of a sample of firms. You run a cross-sectional regression with 200 firms Ti = Bo + B1 Si + BMB + B3PE + BBETA + U (4.55) where: r; is the percentage annual return for the stock S; is the size of firm i measured in terms of sales revenue MB; is the market to book ratio of the firm PE; is the price/earnings (P/E) ratio of the firm BETA; is the stock's CAPM beta coefficient You obtain the following results (with standard errors in parentheses) = 0.080+ 0.801S; + 0.321 MB; + 0.164PE; - 0.084BETA; (0.064) (0.147) (0.136) (0.420) (0.120) (4.56) Calculate the t-ratios. What do you conclude about the effect of each variable on the returns of the security? On the basis of your results, what variables would you consider deleting from the regression? If a stock's beta increased from 1 to 1.2, what would be the expected effect on the stock's return? Is the sign on beta as you would have expected? Explain your answers in each case.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the tratios for each variable Si 08010147 545 MBi 03210136 236 PEi 01640420 039 BET...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started