Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how are P/A and P/F calculated and what are they? Desktop/10%20chapter 07.pdf +63 D Page view l A Read aloud Add to Draw WHO Example

how are P/A and P/F calculated and what are they?

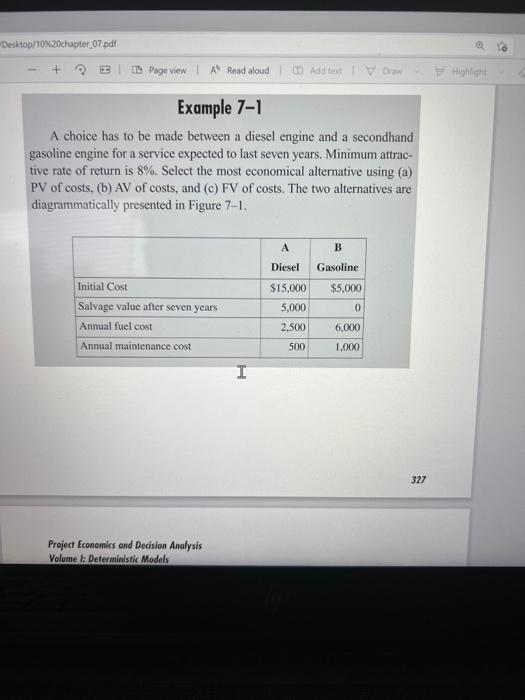

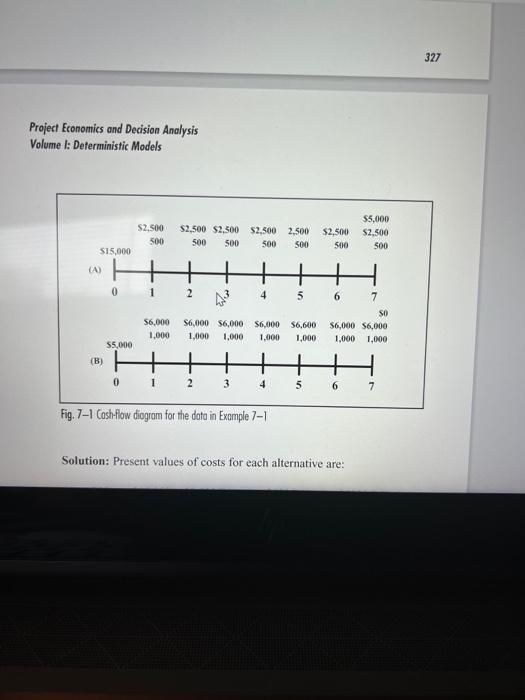

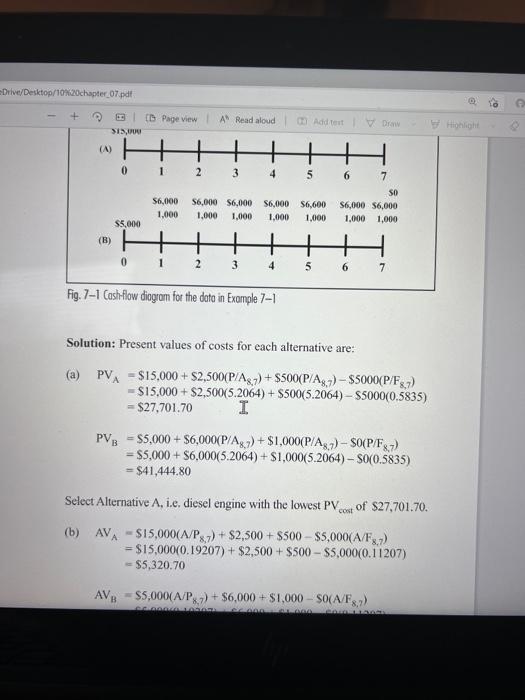

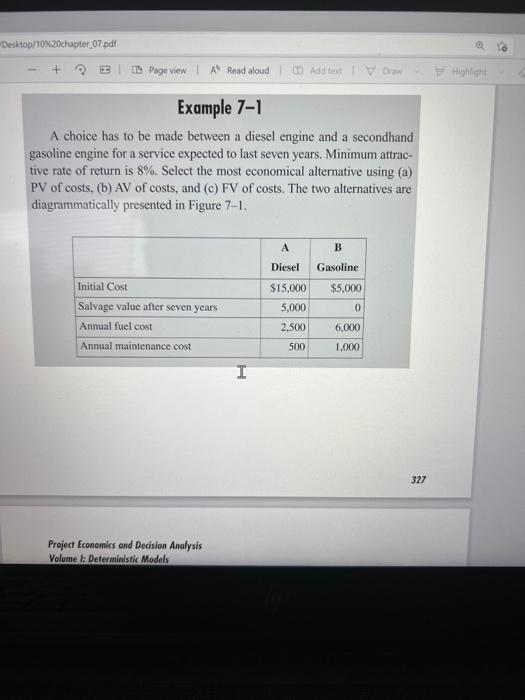

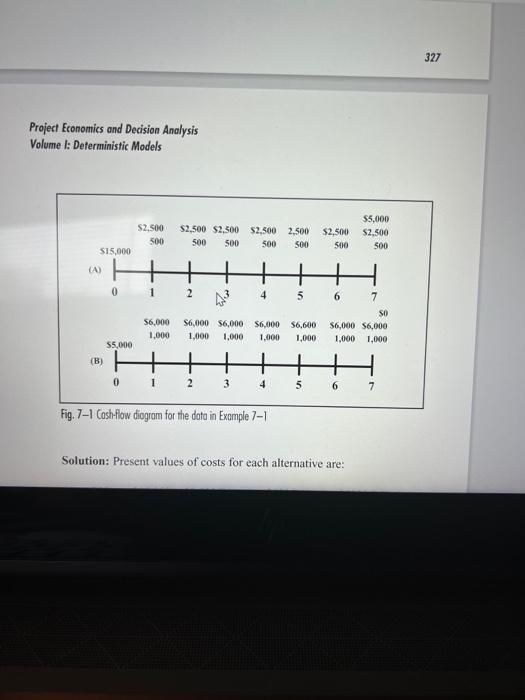

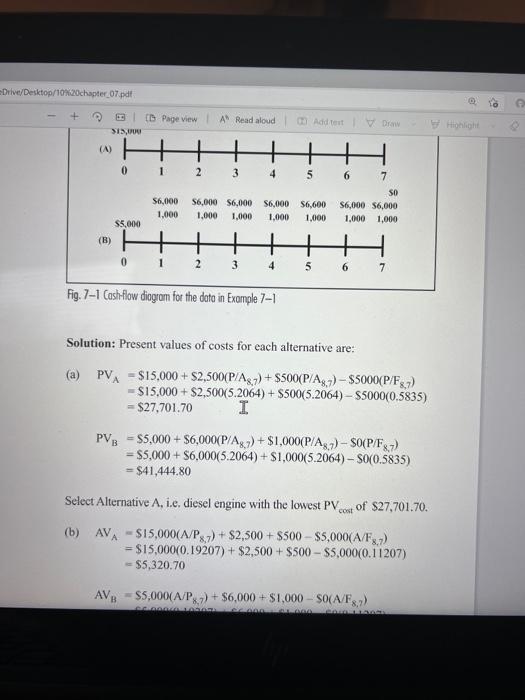

Desktop/10%20chapter 07.pdf +63 D Page view l A Read aloud Add to Draw WHO Example 7-1 A choice has to be made between a diesel engine and a secondhand gasoline engine for a service expected to last seven years. Minimum attrac- tive rate of return is 8%. Select the most economical alternative using (a) PV of costs, (b) AV of costs, and (c) FV of costs. The two alternatives are diagrammatically presented in Figure 7-1. A B Diesel Gasoline $5,000 Initial Cost Salvage value after seven years Annual fuel cost 0 $15,000 5,000 2,500 500 6.000 Annual maintenance cost 1.000 I 327 Project Economics and Decision Analysis Volume I: Deterministic Models 327 Project Economics and Decision Analysis Volume I: Deterministic Models $2.500 500 $2,500 $2,300 $2,500 500 500 500 2,500 500 $2,500 500 $5,000 $2.500 500 $15,000 (A) 0 1 2 4 5 56,000 1,000 S6,000 $6,000 $6,000 S6,600 1,000 1,000 1.000 1,000 6 7 SO $6,000 $6,000 1,000 1,000 S5,000 (B) 0 1 2 3 4 5 6 7 Fig. 7-1 Cash-flow diogram for the data in Example 7-1 Solution: Present values of costs for each alternative are: Drive/Desktop/10%20chapter_07.pdf + 3D Pageview | A Read aloud Add tout $13,10 (A) H+ 0 1 2 3 4 5 6 7 SO $6,600 S6,000 $6,000 1.000 1.000 1,000 S6,000 1,000 S6,000 $6,000 $6,000 1,000 1,000 1,000 $5,000 (B) 0 1 2 3 4 5 6 7 Fig. 7-1 Cash-flow diagram for the data in Example 7-1 Solution: Present values of costs for each alternative are: (a) PVA -$15.000 + $2,500(P/A2.7) + $500(P/Ag.7) - $5000(P/F37) - $15,000 + $2,500(5.2064) + $500(5.2064) - $5000(0.5835) = $27.701.70 I PV = $5,000 + $6,000(P/AU 7) + $1,000(P/A3,7) - S0(P/F37) = $5,000 + $6,000(5.2064) +$1,000(5.2064) - S0(0.5835) = $41,444.80 Select Alternative A, i.e. diesel engine with the lowest PVcost of $27,701.70. (b) AVA - $15,000(A/P 7) + $2,500 + $500 - $5,000(A/F3.7) = $15,000(0.19207) + $2,500 + $500 - $5,000(0.11207) - $5,320.70 AVB $5,000(A/P .-) + $6,000+ $1,000 - SO(A/F8,7) LAGU Desktop/10%20chapter 07.pdf +63 D Page view l A Read aloud Add to Draw WHO Example 7-1 A choice has to be made between a diesel engine and a secondhand gasoline engine for a service expected to last seven years. Minimum attrac- tive rate of return is 8%. Select the most economical alternative using (a) PV of costs, (b) AV of costs, and (c) FV of costs. The two alternatives are diagrammatically presented in Figure 7-1. A B Diesel Gasoline $5,000 Initial Cost Salvage value after seven years Annual fuel cost 0 $15,000 5,000 2,500 500 6.000 Annual maintenance cost 1.000 I 327 Project Economics and Decision Analysis Volume I: Deterministic Models 327 Project Economics and Decision Analysis Volume I: Deterministic Models $2.500 500 $2,500 $2,300 $2,500 500 500 500 2,500 500 $2,500 500 $5,000 $2.500 500 $15,000 (A) 0 1 2 4 5 56,000 1,000 S6,000 $6,000 $6,000 S6,600 1,000 1,000 1.000 1,000 6 7 SO $6,000 $6,000 1,000 1,000 S5,000 (B) 0 1 2 3 4 5 6 7 Fig. 7-1 Cash-flow diogram for the data in Example 7-1 Solution: Present values of costs for each alternative are: Drive/Desktop/10%20chapter_07.pdf + 3D Pageview | A Read aloud Add tout $13,10 (A) H+ 0 1 2 3 4 5 6 7 SO $6,600 S6,000 $6,000 1.000 1.000 1,000 S6,000 1,000 S6,000 $6,000 $6,000 1,000 1,000 1,000 $5,000 (B) 0 1 2 3 4 5 6 7 Fig. 7-1 Cash-flow diagram for the data in Example 7-1 Solution: Present values of costs for each alternative are: (a) PVA -$15.000 + $2,500(P/A2.7) + $500(P/Ag.7) - $5000(P/F37) - $15,000 + $2,500(5.2064) + $500(5.2064) - $5000(0.5835) = $27.701.70 I PV = $5,000 + $6,000(P/AU 7) + $1,000(P/A3,7) - S0(P/F37) = $5,000 + $6,000(5.2064) +$1,000(5.2064) - S0(0.5835) = $41,444.80 Select Alternative A, i.e. diesel engine with the lowest PVcost of $27,701.70. (b) AVA - $15,000(A/P 7) + $2,500 + $500 - $5,000(A/F3.7) = $15,000(0.19207) + $2,500 + $500 - $5,000(0.11207) - $5,320.70 AVB $5,000(A/P .-) + $6,000+ $1,000 - SO(A/F8,7) LAGU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started