Answered step by step

Verified Expert Solution

Question

1 Approved Answer

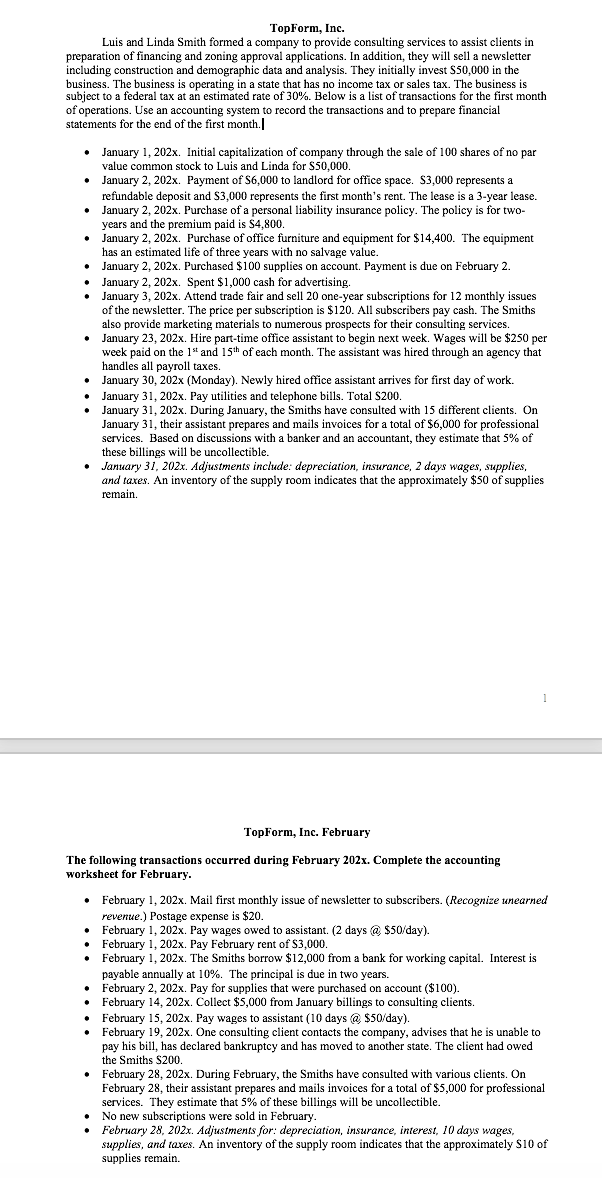

How are these transactions logged as journal entries? TopForm, Inc. Luis and Linda Smith formed a company to provide consulting services to assist clients in

How are these transactions logged as journal entries?

TopForm, Inc. Luis and Linda Smith formed a company to provide consulting services to assist clients in preparation of financing and zoning approval applications. In addition, they will sell a newsletter including construction and demographic data and analysis. They initially invest $50,000 in the business. The business is operating in a state that has no income tax or sales tax. The business is subject to a federal tax at an estimated rate of 30%. Below is a list of transactions for the first month of operations. Use an accounting system to record the transactions and to prepare financial statements for the end of the first month.I - January 1, 202x. Initial capitalization of company through the sale of 100 shares of no par value common stock to Luis and Linda for $50,000. - January 2, 202x. Payment of $6,000 to landlord for office space. $3,000 represents a refundable deposit and $3,000 represents the first month's rent. The lease is a 3-year lease. - January 2, 202x. Purchase of a personal liability insurance policy. The policy is for twoyears and the premium paid is $4,800. - January 2, 202x. Purchase of office furniture and equipment for $14,400. The equipment has an estimated life of three years with no salvage value. - January 2, 202x. Purchased $100 supplies on account. Payment is due on February 2. - January 2, 202x. Spent $1,000 cash for advertising. - January 3, 202x. Attend trade fair and sell 20 one-year subscriptions for 12 monthly issues of the newsletter. The price per subscription is $120. All subscribers pay cash. The Smiths also provide marketing materials to numerous prospects for their consulting services. - January 23,202x. Hire part-time office assistant to begin next week. Wages will be $250 per week paid on the 1st and 15th of each month. The assistant was hired through an agency that handles all payroll taxes. - January 30, 202x (Monday). Newly hired office assistant arrives for first day of work. - January 31, 202x. Pay utilities and telephone bills. Total \$200. - January 31, 202x. During January, the Smiths have consulted with 15 different clients. On January 31 , their assistant prepares and mails invoices for a total of $6,000 for professional services. Based on discussions with a banker and an accountant, they estimate that 5% of these billings will be uncollectible. - Jantary 31, 202x. Adjustments include: depreciation, instrance, 2 days wages, supplies, and taxes. An inventory of the supply room indicates that the approximately $50 of supplies remain. TopForm, Inc. February The following transactions occurred during February 202x. Complete the accounting worksheet for February. - February 1, 202x. Mail first monthly issue of newsletter to subscribers. (Recognize tuearned revenue.) Postage expense is $20. - February 1,202x. Pay wages owed to assistant. (2 days @50/ day). - February 1, 202x. Pay February rent of $3,000. - February 1, 202x. The Smiths borrow \$12,000 from a bank for working capital. Interest is payable annually at 10%. The principal is due in two years. - February 2, 202x. Pay for supplies that were purchased on account (\$100). - February 14,202x. Collect $5,000 from January billings to consulting clients. - February 15, 202x. Pay wages to assistant (10 days @, $50/ day). - February 19, 202x. One consulting client contacts the company, advises that he is unable to pay his bill, has declared bankruptcy and has moved to another state. The client had owed the Smiths \$200. - February 28, 202x. During February, the Smiths have consulted with various clients. On February 28 , their assistant prepares and mails invoices for a total of $5,000 for professional services. They estimate that 5% of these billings will be uncollectible. - No new subscriptions were sold in February. - February 28, 202x. Adjustments for: depreciation, insurance, interest, 10 days wages, supplies, and taxes. An inventory of the supply room indicates that the approximately $10 of supplies remainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started