Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: You can invest in two risky assets A and B, and in the risk-free asset with a return of 5%. The expected

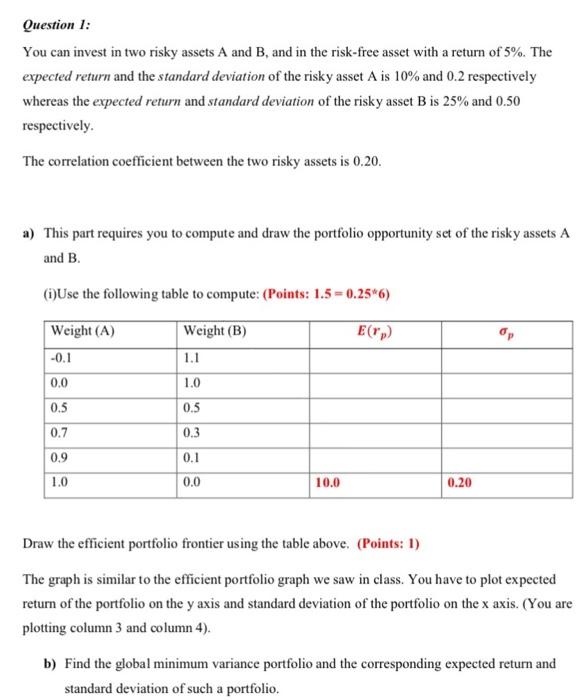

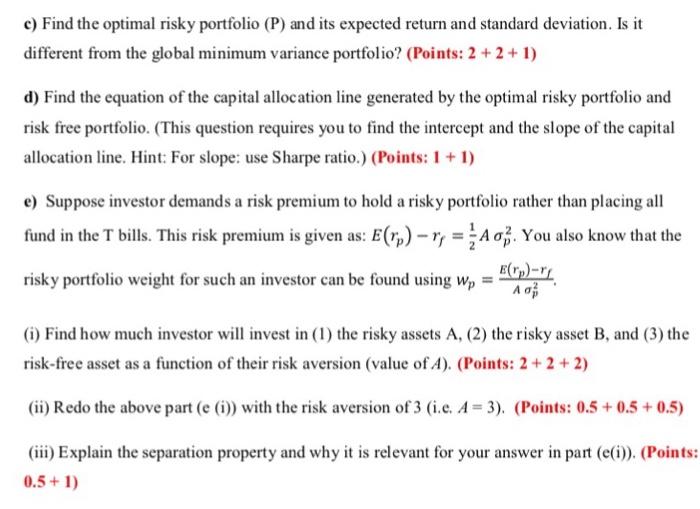

Question 1: You can invest in two risky assets A and B, and in the risk-free asset with a return of 5%. The expected return and the standard deviation of the risky asset A is 10% and 0.2 respectively whereas the expected return and standard deviation of the risky asset B is 25% and 0.50 respectively. The correlation coefficient between the two risky assets is 0.20. a) This part requires you to compute and draw the portfolio opportunity set of the risky assets A and B. (i)Use the following table to compute: (Points: 1.5-0.25*6) Weight (A) Weight (B) -0.1 1.1 0.0 1.0 0.5 0.5 0.7 0.3 0.9 0.1 1.0 0.0 10.0 E(rp) 0.20 Draw the efficient portfolio frontier using the table above. (Points: 1) The graph is similar to the efficient portfolio graph we saw in class. You have to plot expected return of the portfolio on the y axis and standard deviation of the portfolio on the x axis. (You are plotting column 3 and column 4). b) Find the global minimum variance portfolio and the corresponding expected return and standard deviation of such a portfolio. c) Find the optimal risky portfolio (P) and its expected return and standard deviation. Is it different from the global minimum variance portfolio? (Points: 2 + 2 + 1) d) Find the equation of the capital allocation line generated by the optimal risky portfolio and risk free portfolio. (This question requires you to find the intercept and the slope of the capital allocation line. Hint: For slope: use Sharpe ratio.) (Points: 1 + 1) e) Suppose investor demands a risk premium to hold a risky portfolio rather than placing all fund in the T bills. This risk premium is given as: E(rp)-r=Ao. You also know that the risky portfolio weight for such an investor can be found using Wp = E(rp)-rf Ad (i) Find how much investor will invest in (1) the risky assets A, (2) the risky asset B, and (3) the risk-free asset as a function of their risk aversion (value of 4). (Points: 2+2+2) (ii) Redo the above part (e (i)) with the risk aversion of 3 (i.c. A= 3). (Points: 0.5 +0.5 +0.5) (iii) Explain the separation property and why it is relevant for your answer in part (e(i)). (Points: 0.5 + 1)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a w A w B 01 11 00 05 Erp E w Er W Allocation of assets of optimal risky portfolio after optimizing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started