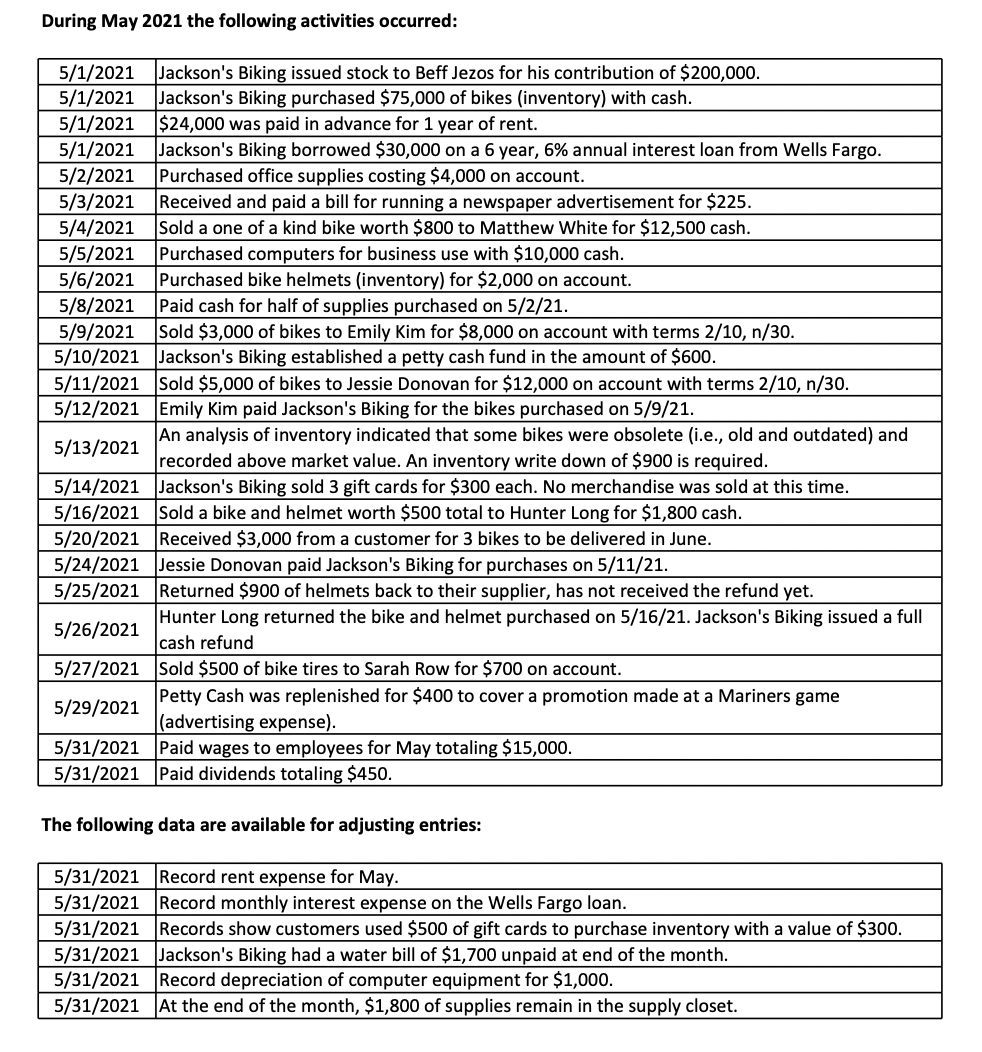

How can I make an 1. income statement 2. statement of retained earnings 3. closing entries and 4. accounting ratios for this?

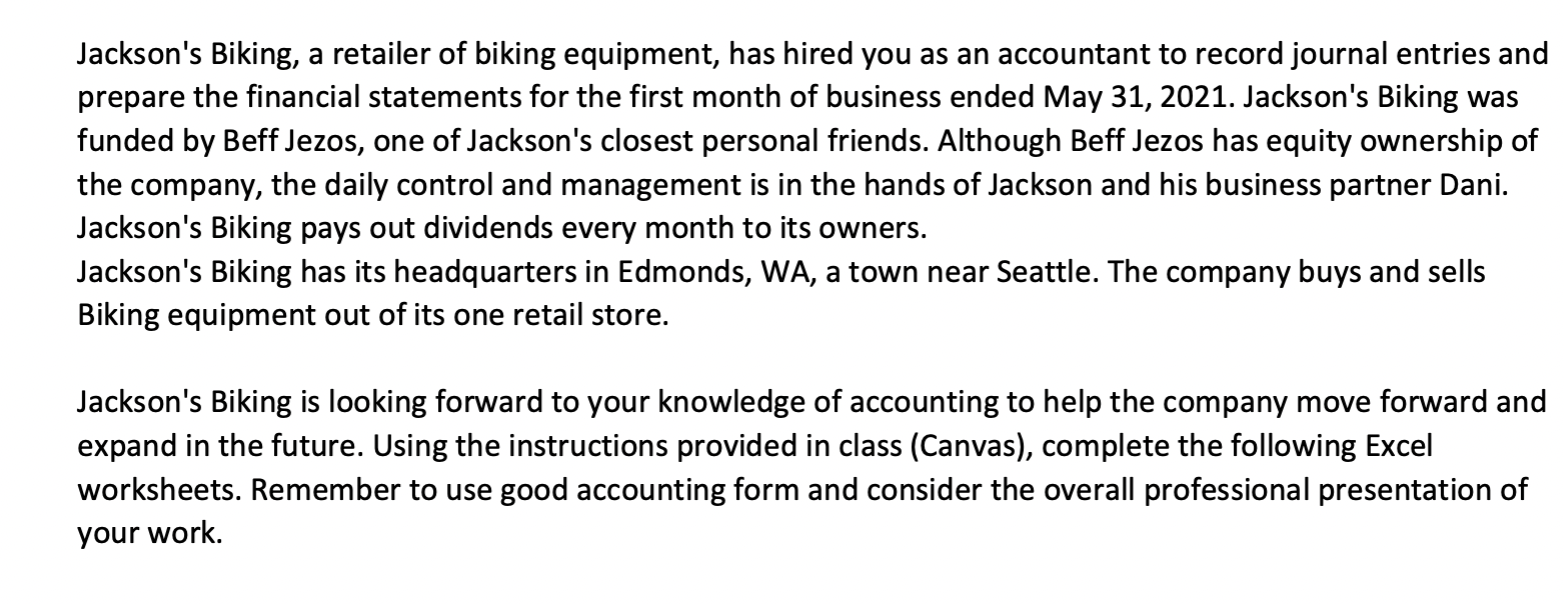

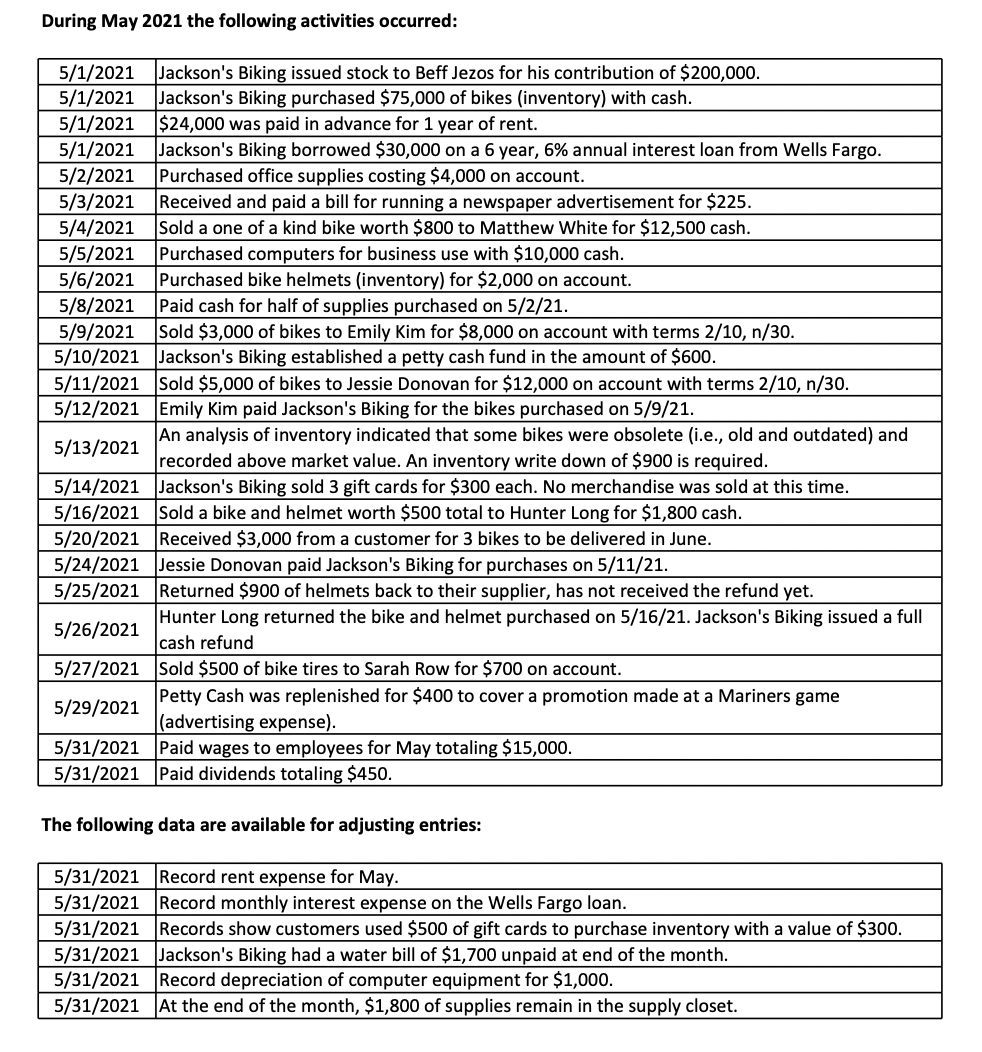

Jackson's Biking, a retailer of biking equipment, has hired you as an accountant to record journal entries and prepare the financial statements for the first month of business ended May 31, 2021. Jackson's Biking was funded by Beff Jezos, one of Jackson's closest personal friends. Although Beff Jezos has equity ownership of the company, the daily control and management is in the hands of Jackson and his business partner Dani. Jackson's Biking pays out dividends every month to its owners. Jackson's Biking has its headquarters in Edmonds, WA, a town near Seattle. The company buys and sells Biking equipment out of its one retail store. Jackson's Biking is looking forward to your knowledge of accounting to help the company move forward and expand in the future. Using the instructions provided in class (Canvas), complete the following Excel worksheets. Remember to use good accounting form and consider the overall professional presentation of your work. During May 2021 the following activities occurred: 5/1/2021 Jackson's Biking issued stock to Beff Jezos for his contribution of $200,000. 5/1/2021 Jackson's Biking purchased $75,000 of bikes (inventory) with cash. 5/1/2021 $24,000 was paid in advance for 1 year of rent. 5/1/2021 Jackson's Biking borrowed $30,000 on a 6 year, 6% annual interest loan from Wells Fargo. 5/2/2021 Purchased office supplies costing $4,000 on account. 5/3/2021 Received and paid a bill for running a newspaper advertisement for $225. 5/4/2021 Sold a one of a kind bike worth $800 to Matthew White for $12,500 cash. 5/5/2021 Purchased computers for business use with $10,000 cash. 5/6/2021 Purchased bike helmets (inventory) for $2,000 on account. 5/8/2021 Paid cash for half of supplies purchased on 5/2/21. 5/9/2021 Sold $3,000 of bikes to Emily Kim for $8,000 on account with terms 2/10, n/30. 5/10/2021 Jackson's Biking established a petty cash fund in the amount of $600. 5/11/2021 Sold $5,000 of bikes to Jessie Donovan for $12,000 on account with terms 2/10, n/30. 5/12/2021 Emily Kim paid Jackson's Biking for the bikes purchased on 5/9/21. 5/13/2021 An analysis of inventory indicated that some bikes were obsolete (i.e., old and outdated) and recorded above market value. An inventory write down of $900 is required. 5/14/2021 Jackson's Biking sold 3 gift cards for $300 each. No merchandise was sold at this time. 5/16/2021 Sold a bike and helmet worth $500 total to Hunter Long for $1,800 cash. 5/20/2021 Received $3,000 from a customer for 3 bikes to be delivered in June. 5/24/2021 Jessie Donovan paid Jackson's Biking for purchases on 5/11/21. 5/25/2021 Returned $900 of helmets back to their supplier, has not received the refund yet. 5/26/2021 Hunter Long returned the bike and helmet purchased on 5/16/21. Jackson's Biking issued a full cash refund 5/27/2021 Sold $500 of bike tires to Sarah Row for $700 on account. 5/29/2021 Petty Cash was replenished for $400 to cover a promotion made at a Mariners game (advertising expense). 5/31/2021 Paid wages to employees for May totaling $15,000. 5/31/2021 Paid dividends totaling $450. The following data are available for adjusting entries: 5/31/2021 Record rent expense for May. 5/31/2021 Record monthly interest expense on the Wells Fargo loan. 5/31/2021 Records show customers used $500 of gift cards to purchase inventory with a value of $300. 5/31/2021 Jackson's Biking had a water bill of $1,700 unpaid at end of the month. 5/31/2021 Record depreciation of computer equipment for $1,000. 5/31/2021 At the end of the month, $1,800 of supplies remain in the supply closet