Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How can I prepare statement of retain earning and statement of cash flow (direct& indirect method) how to do close nominal accounts to trading and

How can I prepare statement of retain earning and statement of cash flow (direct& indirect method) how to do close nominal accounts to trading and profit &loss

the text book : I have done 2 tasks from text book balance sheet and financial statement and trial balance from previous journal entries. I just dont understand how to prepare cash flow statement (direct,indirect method) how to prepare retained earnings statement and close nominal accounts to trading and profit&loss.

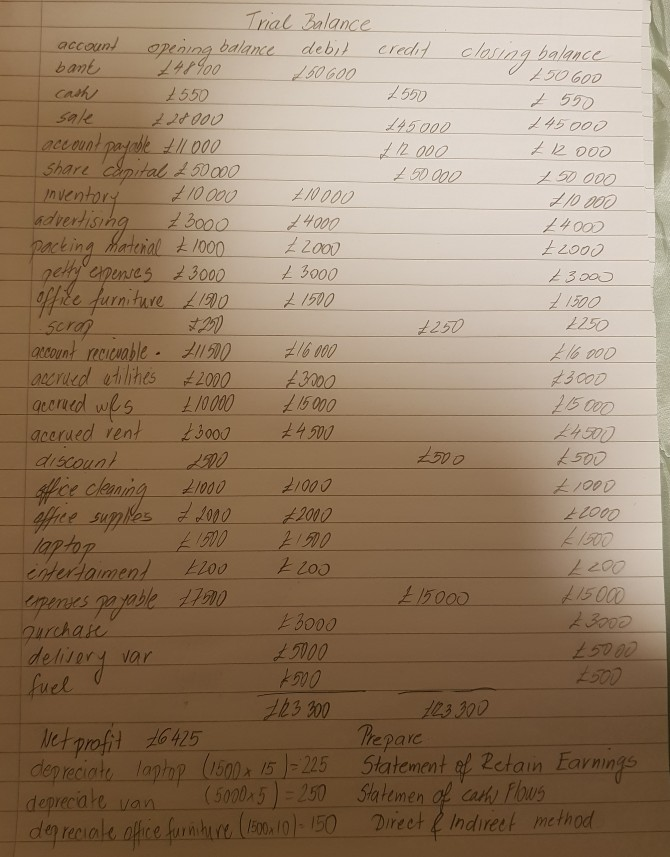

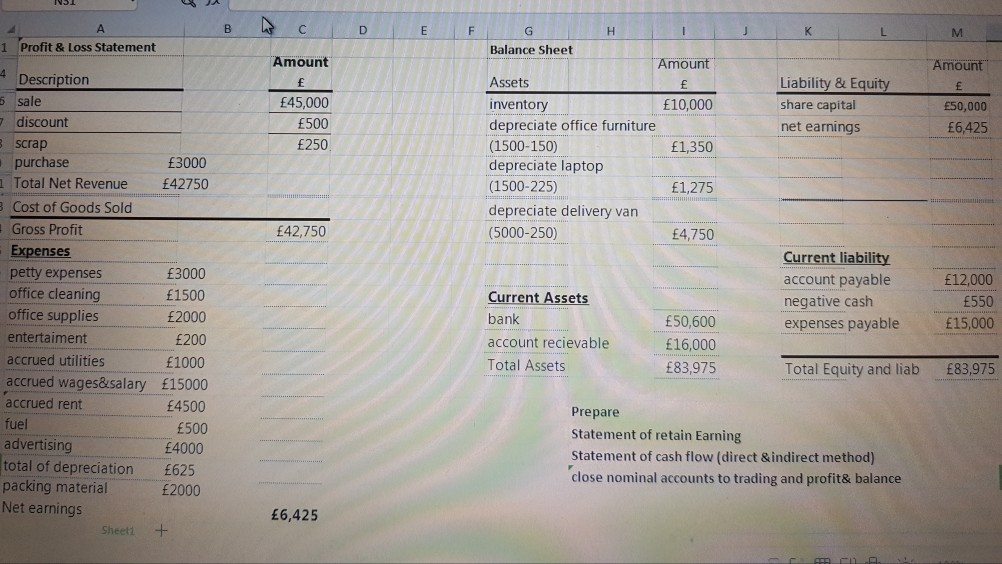

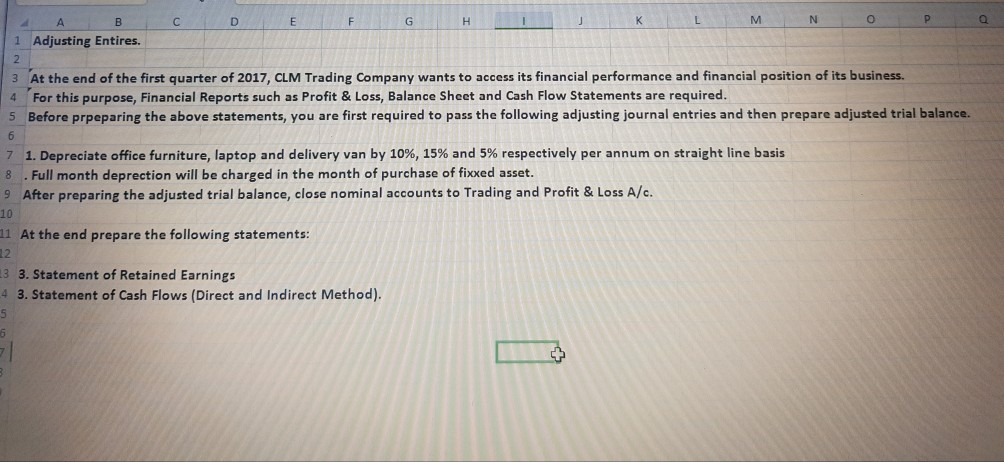

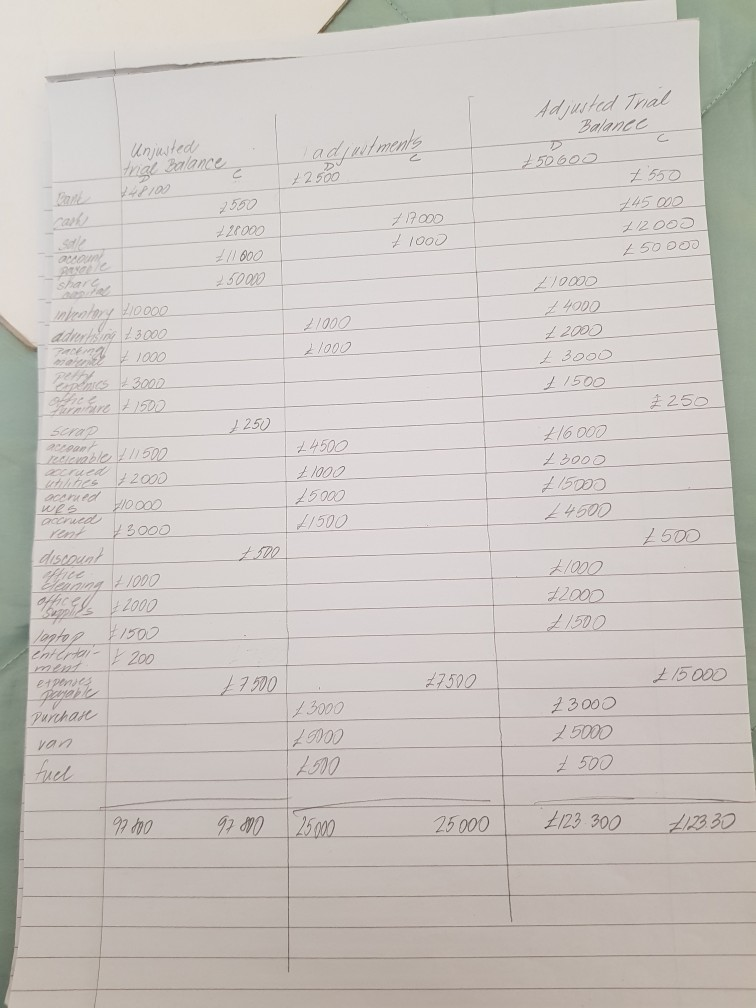

credit closing balance 150600 2570 45000 2 12 000 Trial Balance account opening balance debit bant 1/100 250 600 2550 sale 228000 account payok ll 000 Share capital 20000 inventory 10000 210000 advertising 3000 24000 packing material 000 22000 petty expenses 300 3000 office furniture 1500 1500 soron 20 account recievable - 1120 716000 accrued chilies 2000 73000 accrued wes 10000 25 000 accrued rent 3000 4500 discount 200 office cleaning 21000 21000 thee suples 2 2000 2000 laptop 21500 entertaiment 2200 2200 Cipenes payable 47970 purchase 3000 delivery var 100 2 550 145000 t 2ooo 250 000 210000 14000 2000 23000 1500 2250 26.000 43000 215000 4500 2500 21000 22000 250 200 215000 23000 25000 fuel 263 300 Net profit 26425 depreciate laptop (1500* 15 )=225 depreciate van (5000+5) = 250 depreciate office furniture (1500x100 - 150 123300 Prepare Statement of Retain Earnings Statemen of cash Flows Direct & Indirect method V I 1 Profit & Loss Statement Balance Sheet Amount "Amount "Amount Assets 10,000 45,000 500 250 Liability & Equity share capital net earnings 50,000 6,425 1,350 inventory depreciate office furniture (1500-150) depreciate laptop (1500-225) depreciate delivery van (5000-250) 1,275 42,750 4,750 4 Description 5 sale discount scrap purchase 3000 Total Net Revenue 42750 3 Cost of Goods Sold Gross Profit Expenses petty expenses 3000 office cleaning 1500 office supplies entertaiment 200 accrued utilities 1000 accrued wages&salary 15000 accrued rent 4500 fuel 500 advertising 4000 total of depreciation 625 packing material 2000 Net earnings Sheet1 + Current liability account payable negative cash expenses payable 12,000 550 15,000 2000 Current Assets bank account recievable Total Assets 50,600 16,000 83,975 Total Equity and liab 83,975 Prepare Statement of retain Earning Statement of cash flow (direct & indirect method) close nominal accounts to trading and profit& balance 6,425 C D E M N O P Q A B 1 Adjusting Entires. 3 At the end of the first quarter of 2017, CLM Trading Company wants to access its financial performance and financial position of its business. 4 For this purpose, Financial Reports such as Profit & Loss, Balance Sheet and Cash Flow Statements are required. 5 Before prpeparing the above statements, you are first required to pass the following adjusting journal entries and then prepare adjusted trial balance. 7 1. Depreciate office furniture, laptop and delivery van by 10%, 15% and 5% respectively per annum on straight line basis 8 . Full month deprection will be charged in the month of purchase of fixxed asset. 9 After preparing the adjusted trial balance, close nominal accounts to Trading and Profit & Loss A/c. 11 At the end prepare the following statements: 13 3. Statement of Retained Earnings 4 3. Statement of Cash Flows (Direct and Indirect Method). Adjusted Trial Balance ad intments 250 Goo 2500 Unjusted al Balance Kop100 2500 227000 77000 71000 145000 21200 250 000 009/ 200097 210000 21000 2100 200 12000 L 3000 1500 000172 250 1250 roan Rize 1500 20 rued les H6000 73000 15000 24600 00017 00097 2000 ocenild 10000 2.500 00017 wes rent 3000 discount Walang 11000 s 2000 saston #1500 enteri 200 et poncs COOG7 27500 00477 Purchase 00067 00097 2300 25000 2 500 van tuel 97000 97.000 25000 25000 123 300 123.30 credit closing balance 150600 2570 45000 2 12 000 Trial Balance account opening balance debit bant 1/100 250 600 2550 sale 228000 account payok ll 000 Share capital 20000 inventory 10000 210000 advertising 3000 24000 packing material 000 22000 petty expenses 300 3000 office furniture 1500 1500 soron 20 account recievable - 1120 716000 accrued chilies 2000 73000 accrued wes 10000 25 000 accrued rent 3000 4500 discount 200 office cleaning 21000 21000 thee suples 2 2000 2000 laptop 21500 entertaiment 2200 2200 Cipenes payable 47970 purchase 3000 delivery var 100 2 550 145000 t 2ooo 250 000 210000 14000 2000 23000 1500 2250 26.000 43000 215000 4500 2500 21000 22000 250 200 215000 23000 25000 fuel 263 300 Net profit 26425 depreciate laptop (1500* 15 )=225 depreciate van (5000+5) = 250 depreciate office furniture (1500x100 - 150 123300 Prepare Statement of Retain Earnings Statemen of cash Flows Direct & Indirect method V I 1 Profit & Loss Statement Balance Sheet Amount "Amount "Amount Assets 10,000 45,000 500 250 Liability & Equity share capital net earnings 50,000 6,425 1,350 inventory depreciate office furniture (1500-150) depreciate laptop (1500-225) depreciate delivery van (5000-250) 1,275 42,750 4,750 4 Description 5 sale discount scrap purchase 3000 Total Net Revenue 42750 3 Cost of Goods Sold Gross Profit Expenses petty expenses 3000 office cleaning 1500 office supplies entertaiment 200 accrued utilities 1000 accrued wages&salary 15000 accrued rent 4500 fuel 500 advertising 4000 total of depreciation 625 packing material 2000 Net earnings Sheet1 + Current liability account payable negative cash expenses payable 12,000 550 15,000 2000 Current Assets bank account recievable Total Assets 50,600 16,000 83,975 Total Equity and liab 83,975 Prepare Statement of retain Earning Statement of cash flow (direct & indirect method) close nominal accounts to trading and profit& balance 6,425 C D E M N O P Q A B 1 Adjusting Entires. 3 At the end of the first quarter of 2017, CLM Trading Company wants to access its financial performance and financial position of its business. 4 For this purpose, Financial Reports such as Profit & Loss, Balance Sheet and Cash Flow Statements are required. 5 Before prpeparing the above statements, you are first required to pass the following adjusting journal entries and then prepare adjusted trial balance. 7 1. Depreciate office furniture, laptop and delivery van by 10%, 15% and 5% respectively per annum on straight line basis 8 . Full month deprection will be charged in the month of purchase of fixxed asset. 9 After preparing the adjusted trial balance, close nominal accounts to Trading and Profit & Loss A/c. 11 At the end prepare the following statements: 13 3. Statement of Retained Earnings 4 3. Statement of Cash Flows (Direct and Indirect Method). Adjusted Trial Balance ad intments 250 Goo 2500 Unjusted al Balance Kop100 2500 227000 77000 71000 145000 21200 250 000 009/ 200097 210000 21000 2100 200 12000 L 3000 1500 000172 250 1250 roan Rize 1500 20 rued les H6000 73000 15000 24600 00017 00097 2000 ocenild 10000 2.500 00017 wes rent 3000 discount Walang 11000 s 2000 saston #1500 enteri 200 et poncs COOG7 27500 00477 Purchase 00067 00097 2300 25000 2 500 van tuel 97000 97.000 25000 25000 123 300 123.30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started