Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How can I resolved it? reported equity of $303.4 million. nbi. 3 Name: 1. Baird Products Inc. A wholesaler of office products was organized on

How can I resolved it?

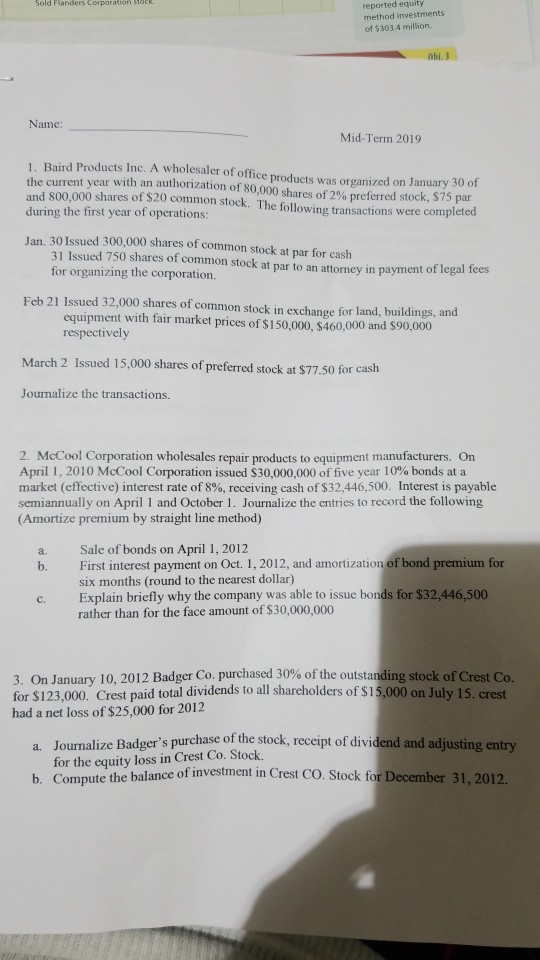

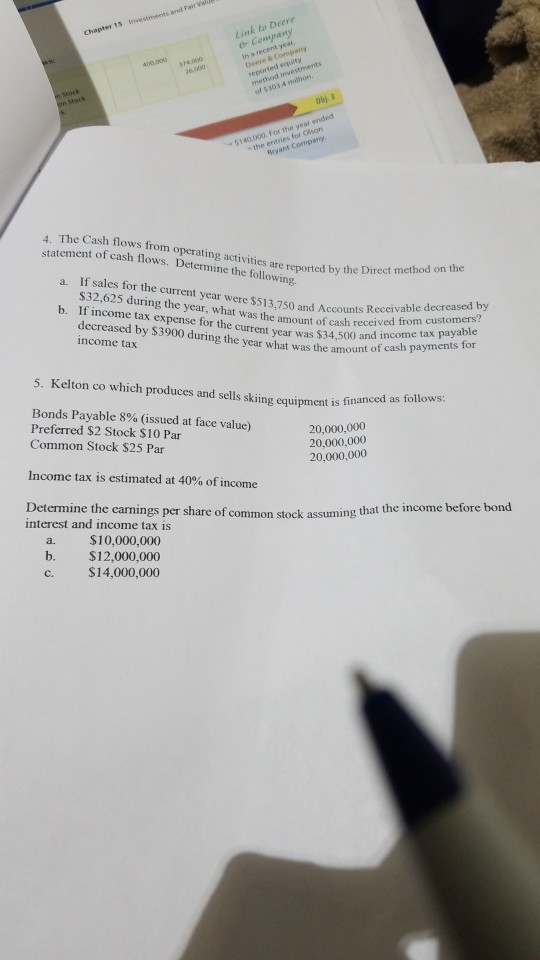

reported equity of $303.4 million. nbi. 3 Name: 1. Baird Products Inc. A wholesaler of office products was organized on January 30 of the current year with an authorization of 80,000 shares of 2% preferred stock, $75 par and 800,000 shares of $20 common stock. The following transactions were completed during the first year of operations Jan. 30 Issued 300,000 shares of common stock at par for cash 31 Issued 750 shares of common stock at par to an attorney in payment of legal fees Feb 21 Issued 32,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $150,000, S460,000 and S90,000 respectively March 2 Issued 15,000 shares of preferred stock at $77.50 for cash Journalize the transactions. 2. McCool Corporation wholesales repair products to equipment manufacturers. On April 1 , 2010 McCool Corporation issued S30,000,000 of five year 10% bonds at a market (effective) interest rate of 8%, receiving cash of$32,446 500 Interest is payable semiannually on April 1 and October 1. Journalize the entries to record the following (Amortize premium by straight line method) Sale of bonds on April 1, 2012 First interest payment on Oct. 1, 2012, and amortization of bond premium for six months (round to the nearest dollar) Explain briefly why the company was able to issue bonds for $32,446,500 rather than for the face amount of $30,000,000 a. b. c. 3 On January 10, 2012 Badger Co. purchased 30% of the outstanding stock of Crest Co. for $123,000. Crest paid total dividends to all shareholders of $15,000 on July 15, crest a. Journalize Badger's purchase of the stock, receipt of dividend and adjusting entry b. Compute the balance of investment in Crest CO. Stock for December 31, 2012. had a net loss of $25,000 for 2012 for the equity loss in Crest Co. Stock. to Deere n Stnck obi The Cash flows from operating activities are report of cash flows. Determine the following. If sales for the current year were $513.750 and Accounts Receiva $32,625 during the year, what was the amount of cash receive a. ccounts Reccivable decreased by b. If income tax expense for the current year was $34,500 and incots for decreased by $3900 during the year what was the amount of cash Pay income tax payments for 5. Kelton co which produces and sells skiing equipment is Bonds Payable 8% (issued at face value) Preferred $2 Stock S10 Par Common Stock $25 Par 20,000,000 20,000,000 20,000,000 Income tax is estimated at 40% of income Determine the carnings per share of common stock assuming that the income before bond interest and income tax is a. $10,000,000 b. $12,000,000 c. $14,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started