How can I solve it?

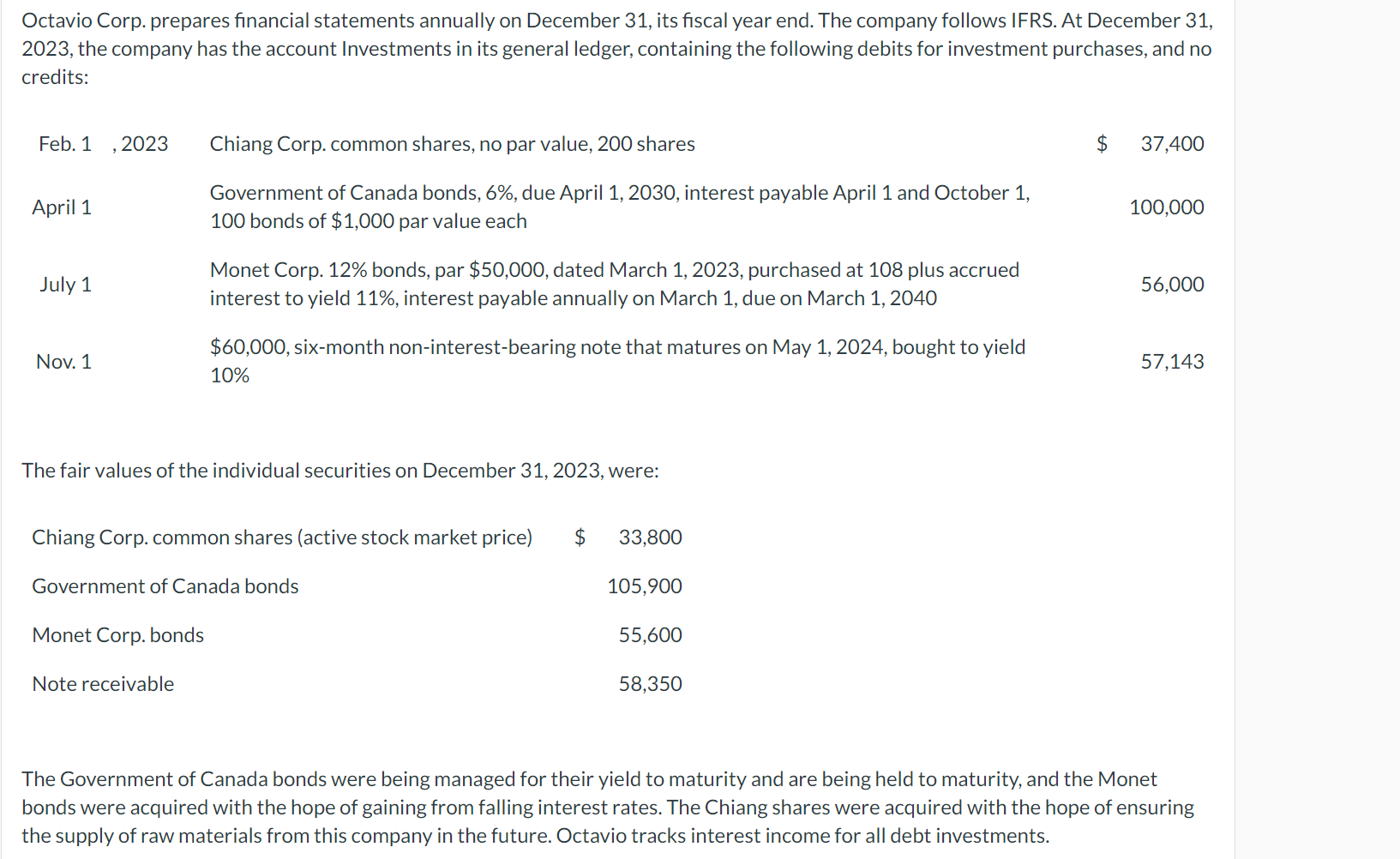

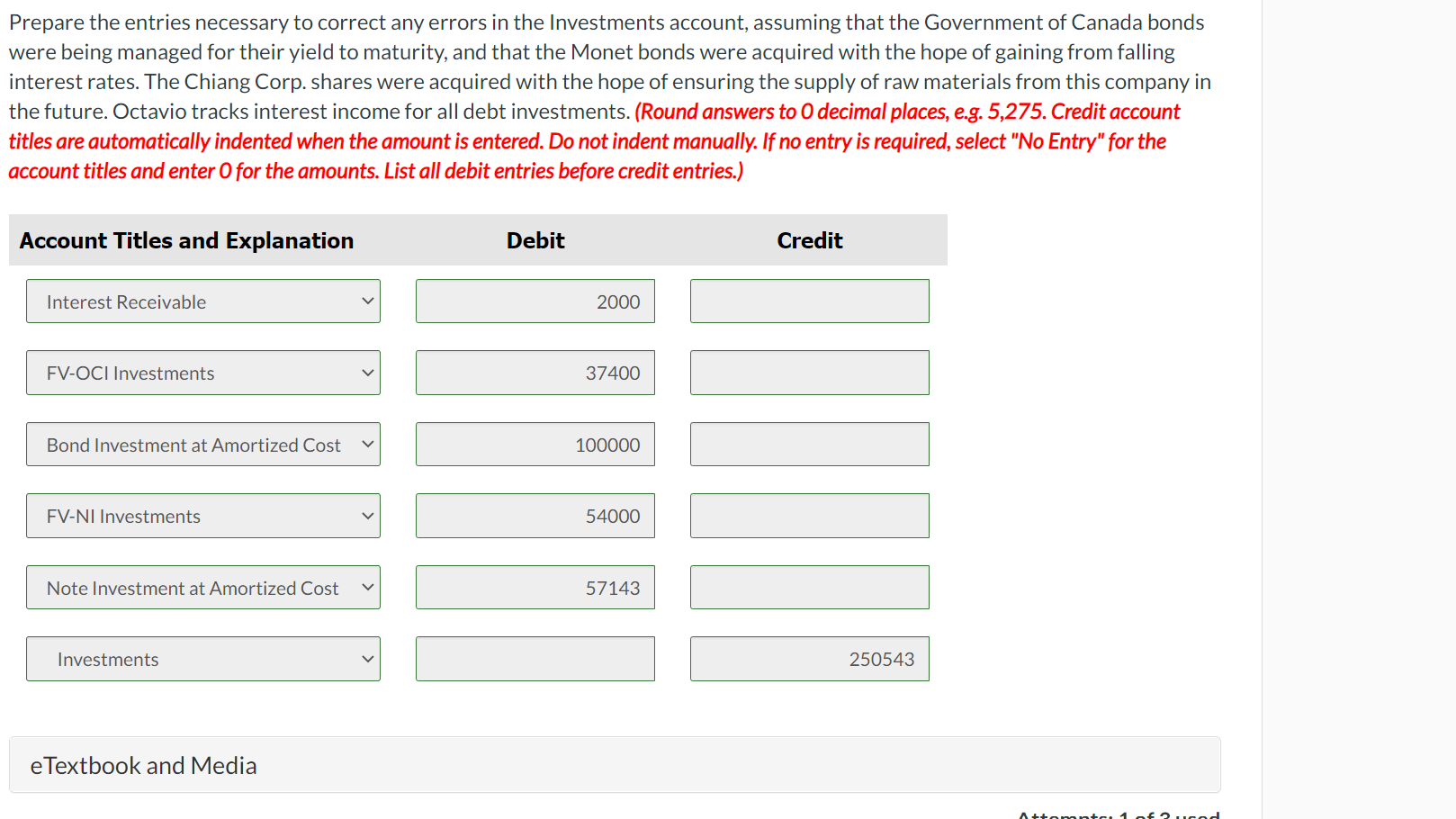

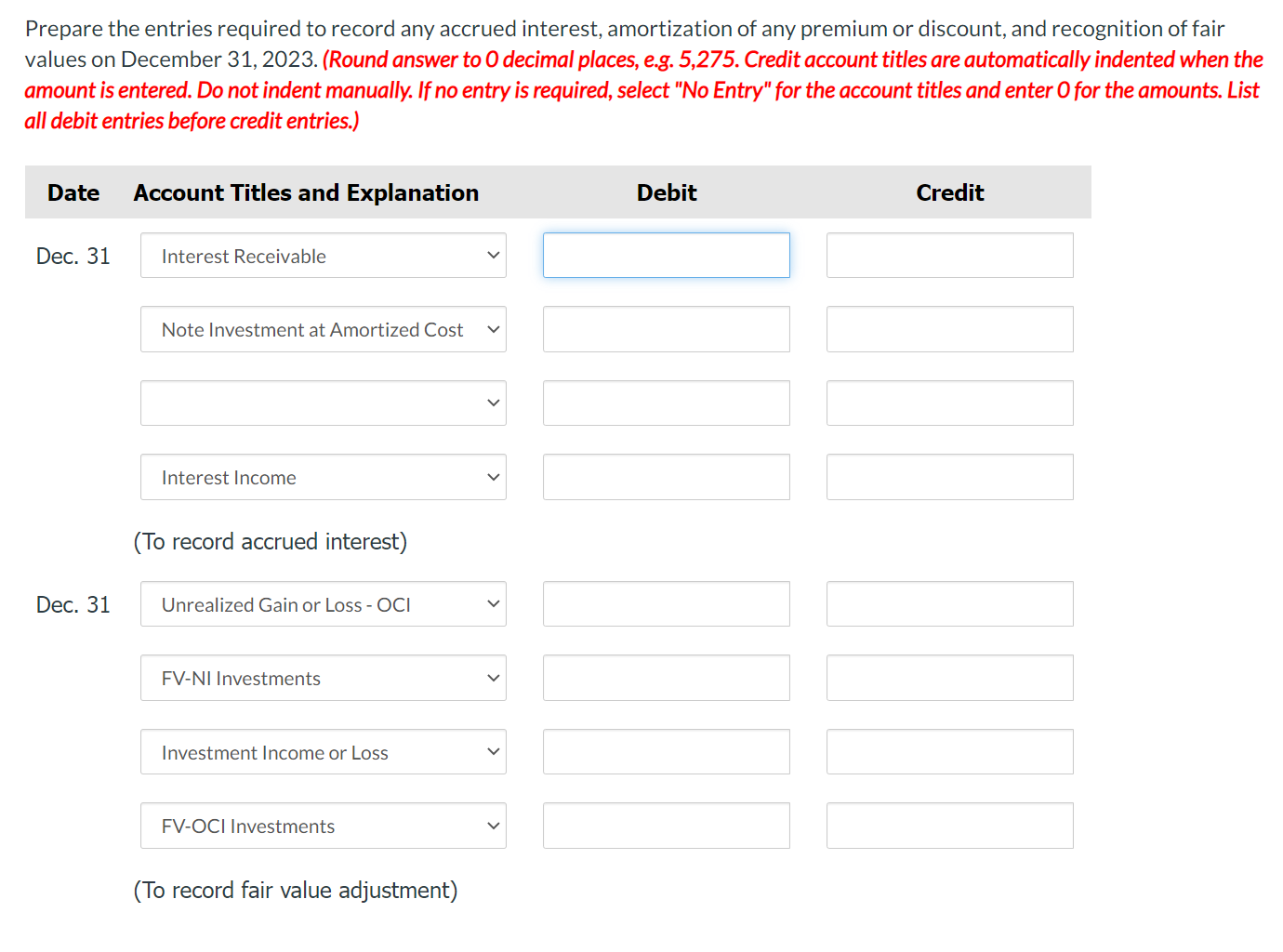

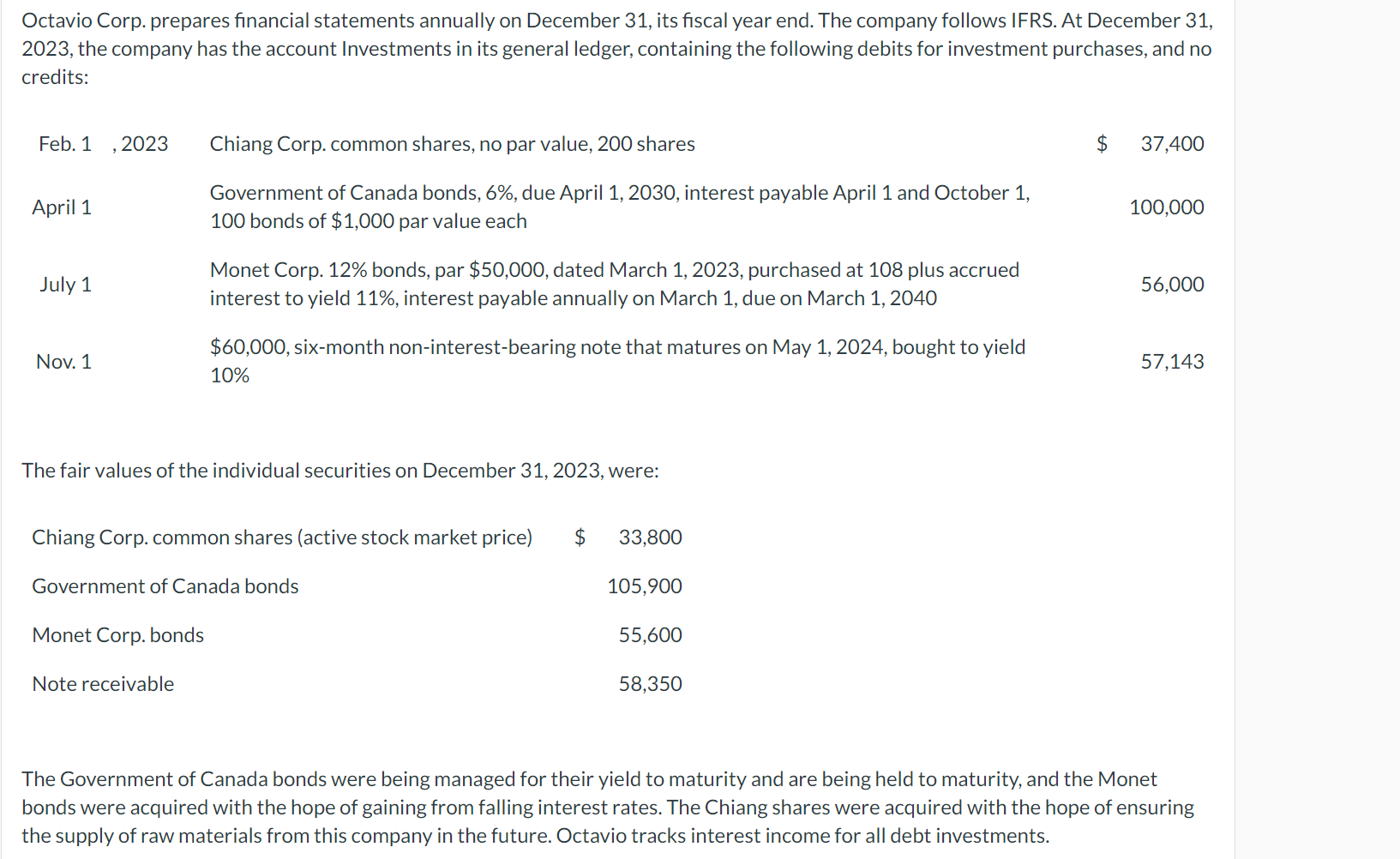

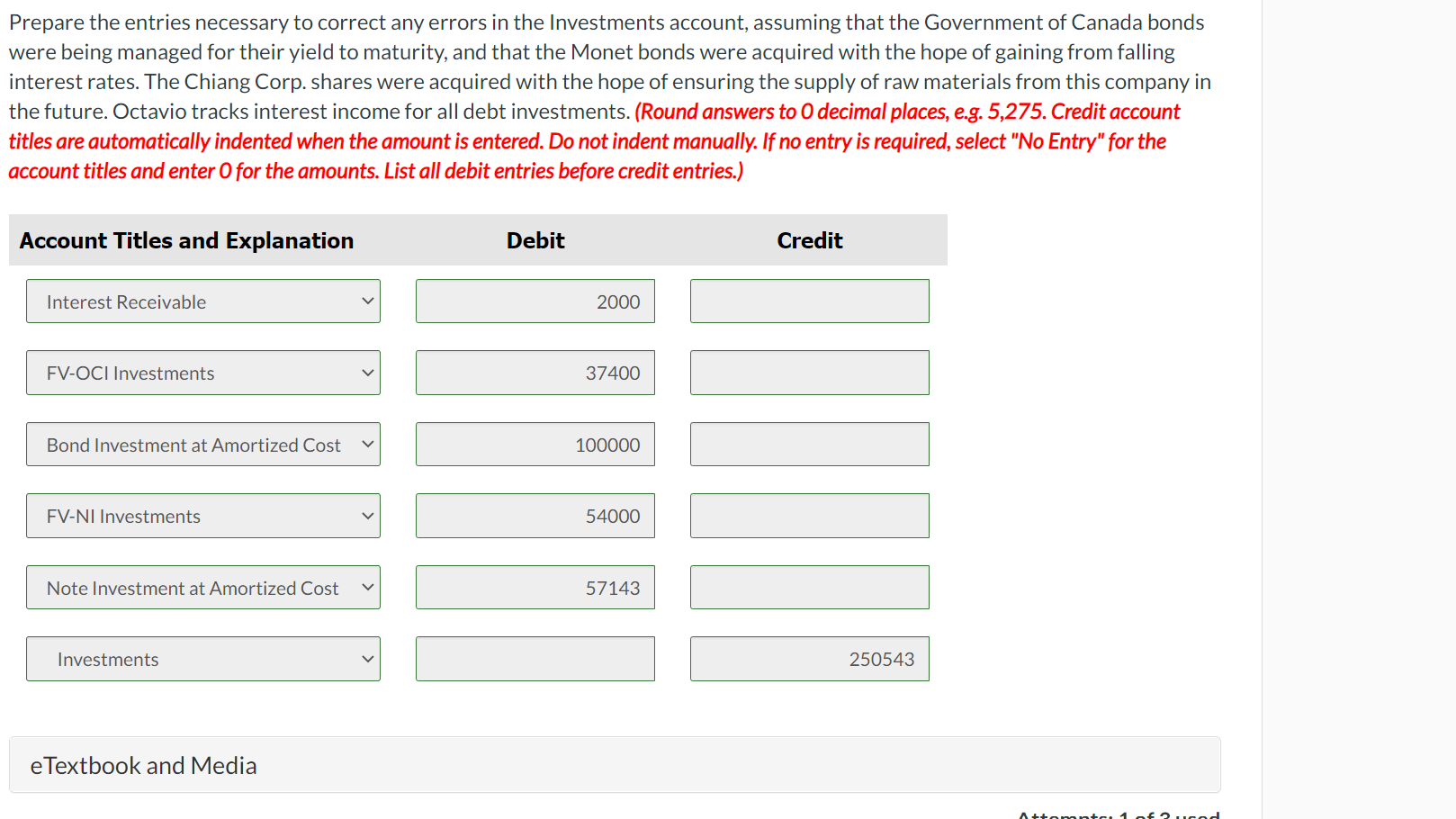

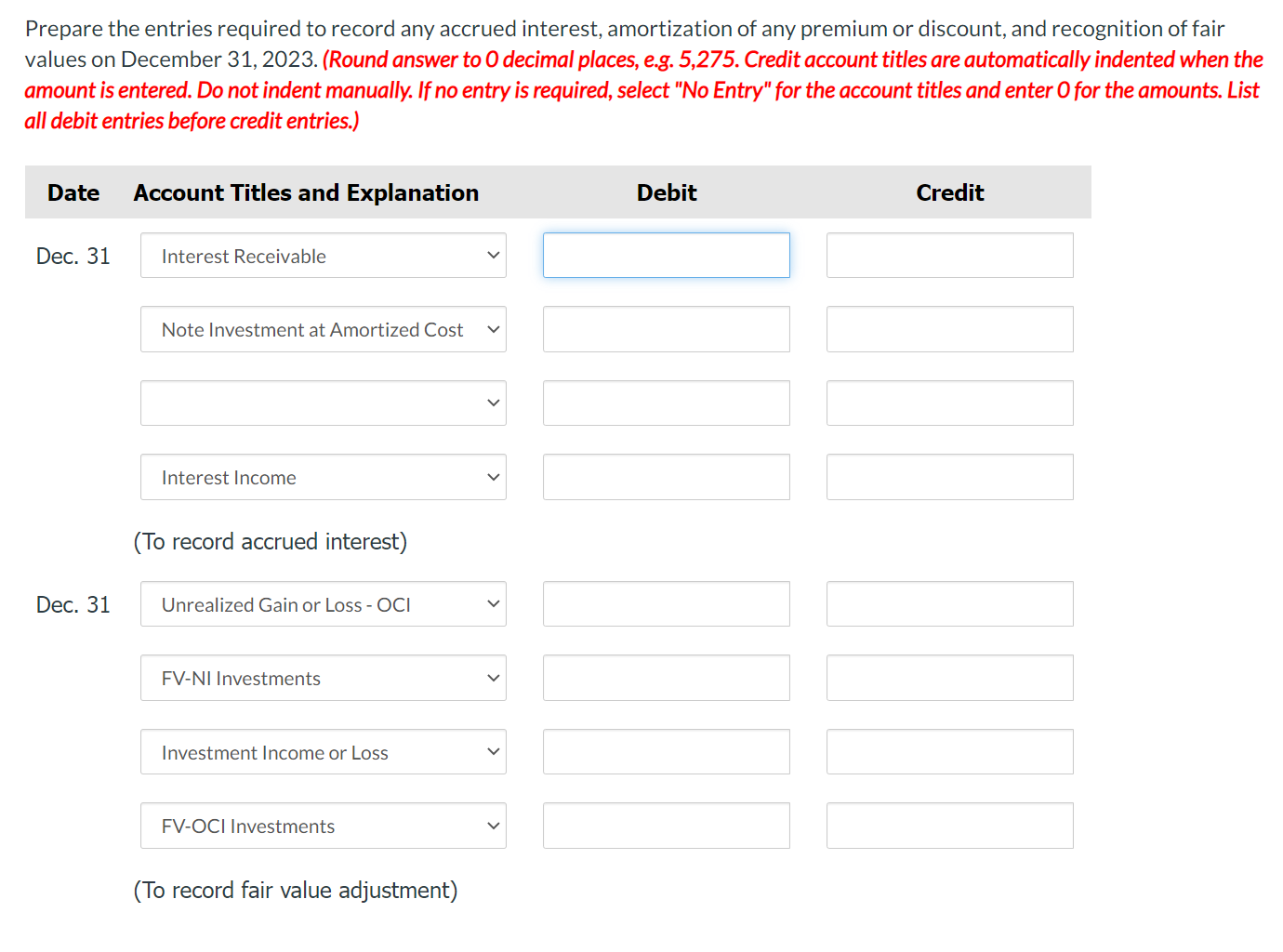

Octavio Corp. prepares financial statements annually on December 31, its fiscal year end. The company follows IFRS. At December 31 , 2023 , the company has the account Investments in its general ledger, containing the following debits for investment purchases, and no credits: The fair values of the individual securities on December 31, 2023, were: The Government of Canada bonds were being managed for their yield to maturity and are being held to maturity, and the Monet bonds were acquired with the hope of gaining from falling interest rates. The Chiang shares were acquired with the hope of ensuring the supply of raw materials from this company in the future. Octavio tracks interest income for all debt investments. Prepare the entries necessary to correct any errors in the Investments account, assuming that the Government of Canada bonds were being managed for their yield to maturity, and that the Monet bonds were acquired with the hope of gaining from falling interest rates. The Chiang Corp. shares were acquired with the hope of ensuring the supply of raw materials from this company in the future. Octavio tracks interest income for all debt investments. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Prepare the entries required to record any accrued interest, amortization of any premium or discount, and recognition of fair values on December 31, 2023. (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Octavio Corp. prepares financial statements annually on December 31, its fiscal year end. The company follows IFRS. At December 31 , 2023 , the company has the account Investments in its general ledger, containing the following debits for investment purchases, and no credits: The fair values of the individual securities on December 31, 2023, were: The Government of Canada bonds were being managed for their yield to maturity and are being held to maturity, and the Monet bonds were acquired with the hope of gaining from falling interest rates. The Chiang shares were acquired with the hope of ensuring the supply of raw materials from this company in the future. Octavio tracks interest income for all debt investments. Prepare the entries necessary to correct any errors in the Investments account, assuming that the Government of Canada bonds were being managed for their yield to maturity, and that the Monet bonds were acquired with the hope of gaining from falling interest rates. The Chiang Corp. shares were acquired with the hope of ensuring the supply of raw materials from this company in the future. Octavio tracks interest income for all debt investments. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Prepare the entries required to record any accrued interest, amortization of any premium or discount, and recognition of fair values on December 31, 2023. (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)