Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How can I solve this problem? All problems are available in MyFinanceLab. The icon indicates problems that are easier to solve using Excel and have

How can I solve this problem?

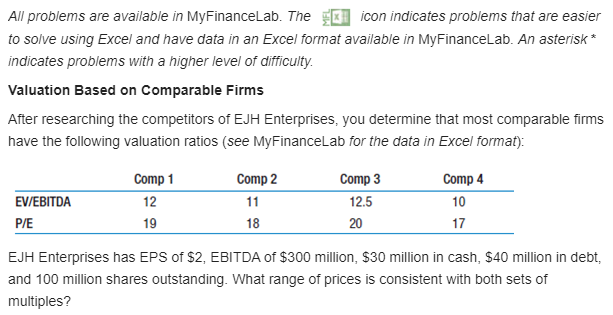

All problems are available in MyFinanceLab. The icon indicates problems that are easier to solve using Excel and have data in an Excel format available in MyFinanceLab. An asterisk* indicates problems with a higher level of difficulty. Valuation Based on comparable Firms After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios (see MyFinanceLab for the data in Excel format): EV/EBITDA P/E Comp 1 12 19 Comp 2 11 18 Comp 3 12.5 20 Comp 4 10 17 EJH Enterprises has EPS of $2, EBITDA of $300 million, $30 million in cash, $40 million in debt, and 100 million shares outstanding. What range of prices is consistent with both sets of multiplesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started