Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how can I solve this with a financial calculator? or by hand? Post a question A 10- year, 12% semiannual coupon bond with a par

how can I solve this with a financial calculator? or by hand?

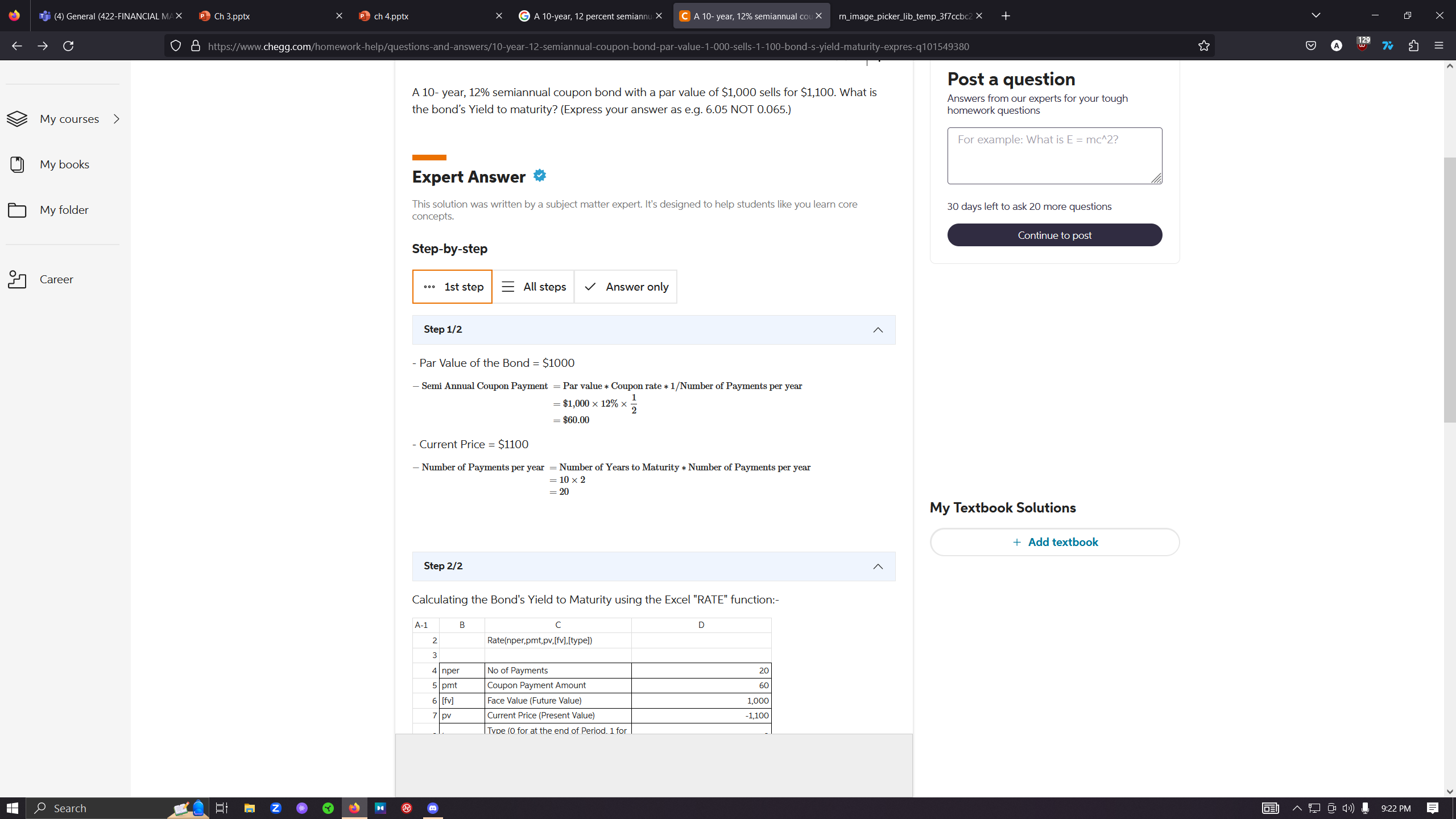

Post a question A 10- year, 12% semiannual coupon bond with a par value of $1,000 sells for $1,100. What is the bond's Yield to maturity? (Express your answer as e.g. 6.05 NOT 0.065.) Expert Answer This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Step-by-step Step 1/2 - Par Value of the Bond =$1000 - Semi Annual Coupon Payment = Par value Coupon rate 1/ Number of Payments per year =$1,00012%21=$60.00 - Current Price =$1100 - Number of Payments per year = Number of Years to Maturity Number of Payments per year =102=20 Step 2/2 Answers from our experts for your tough homework questions For example: What is E=mc2? 30 days left to ask 20 more questions Continue to post My Textbook Solutions Calculating the Bond's Yield to Maturity using the Excel "RATE" function

Post a question A 10- year, 12% semiannual coupon bond with a par value of $1,000 sells for $1,100. What is the bond's Yield to maturity? (Express your answer as e.g. 6.05 NOT 0.065.) Expert Answer This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Step-by-step Step 1/2 - Par Value of the Bond =$1000 - Semi Annual Coupon Payment = Par value Coupon rate 1/ Number of Payments per year =$1,00012%21=$60.00 - Current Price =$1100 - Number of Payments per year = Number of Years to Maturity Number of Payments per year =102=20 Step 2/2 Answers from our experts for your tough homework questions For example: What is E=mc2? 30 days left to ask 20 more questions Continue to post My Textbook Solutions Calculating the Bond's Yield to Maturity using the Excel "RATE" function Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started