How can the Vizio company manage its organizational structure according to the international business architecture

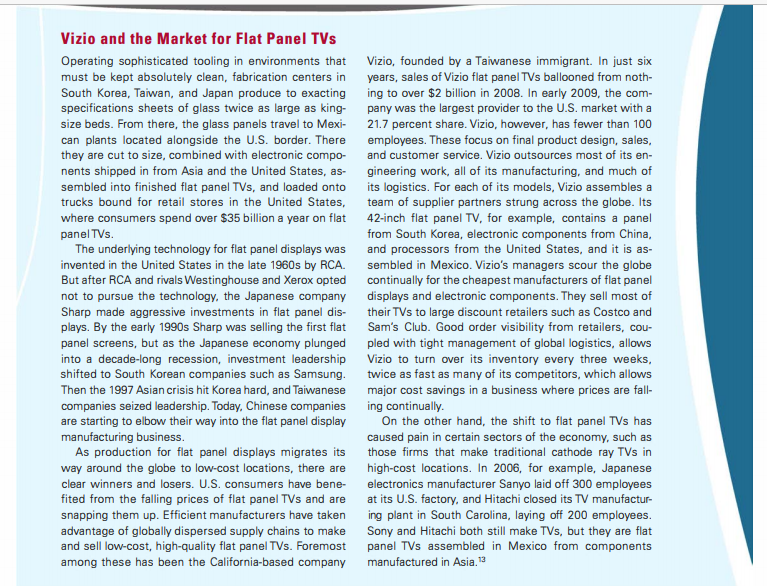

Vizio and the Market for Flat Panel TVs Operating sophisticated tooling in environments that Vizio, founded by a Taiwanese immigrant. In just six must be kept absolutely clean, fabrication centers in years, sales of Vizio flat panel TVs ballooned from noth- South Korea, Taiwan, and Japan produce to exacting ing to over $2 billion in 2008. In early 2009, the com- specifications sheets of glass twice as large as king- pany was the largest provider to the U.S. market with a size beds. From there, the glass panels travel to Mexi- 21.7 percent share. Vizio, however, has fewer than 100 can plants located alongside the U.S. border. There employees. These focus on final product design, sales, they are cut to size, combined with electronic compo- and customer service. Vizio outsources most of its en- nents shipped in from Asia and the United States, as- gineering work, all of its manufacturing, and much of sembled into finished flat panel TVs, and loaded onto its logistics. For each of its models, Vizio assembles a trucks bound for retail stores in the United States, team of supplier partners strung across the globe. Its where consumers spend over $35 billion a year on flat 42-inch flat panel TV, for example, contains a panel panel TVs. from South Korea, electronic components from China, The underlying technology for flat panel displays was and processors from the United States, and it is as- invented in the United States in the late 1960s by RCA. sembled in Mexico. Vizio's managers scour the globe But after RCA and rivals Westinghouse and Xerox opted continually for the cheapest manufacturers of flat panel not to pursue the technology. the Japanese company displays and electronic components. They sell most of Sharp made aggressive investments in flat panel dis- their TVs to large discount retailers such as Costco and plays. By the early 1990s Sharp was selling the first flat Sam's Club. Good order visibility from retailers, cou- panel screens, but as the Japanese economy plunged pled with tight management of global logistics, allows into a decade-long recession, investment leadership Vizio to turn over its inventory every three weeks, shifted to South Korean companies such as Samsung. twice as fast as many of its competitors, which allows Then the 1997 Asian crisis hit Korea hard, and Taiwanese major cost savings in a business where prices are fall- companies seized leadership. Today, Chinese companies ing continually. are starting to elbow their way into the flat panel display On the other hand, the shift to flat panel TVs has manufacturing business. caused pain in certain sectors of the economy, such as As production for flat panel displays migrates its those firms that make traditional cathode ray TVs in way around the globe to low-cost locations, there are high-cost locations. In 2006, for example, Japanese clear winners and losers. U.S. consumers have bene- electronics manufacturer Sanyo laid off 300 employees fited from the falling prices of flat panel TVs and are at its U.S. factory, and Hitachi closed its TV manufacture snapping them up. Efficient manufacturers have taken ing plant in South Carolina, laying off 200 employees. advantage of globally dispersed supply chains to make Sony and Hitachi both still make TVs, but they are flat and sell low-cost, high-quality flat panel TVs. Foremost panel TVs assembled in Mexico from components among these has been the California-based company manufactured in Asia. "3