how did the compute the NCI SHARE GOOD WILL AND NCI 1/1 NCI 12/31 ?

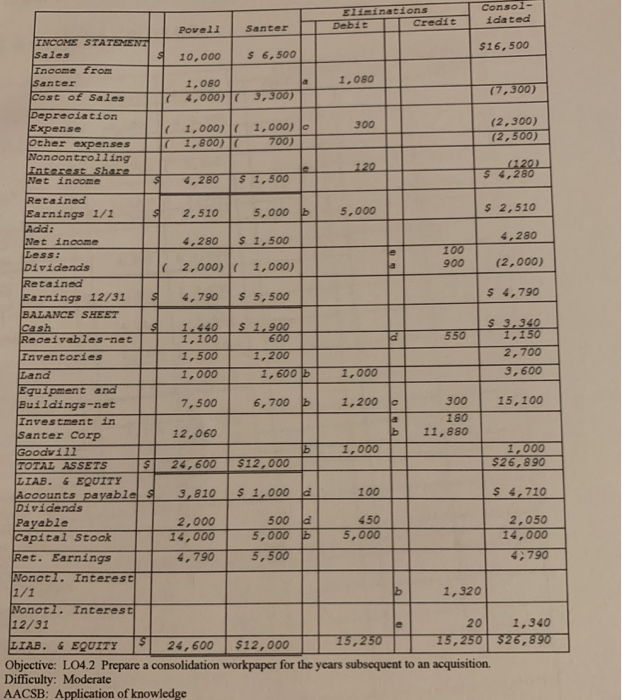

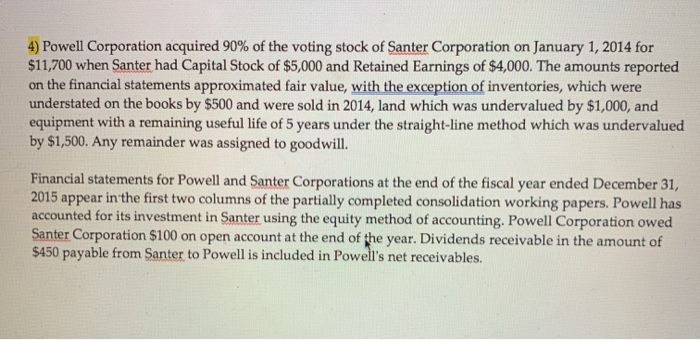

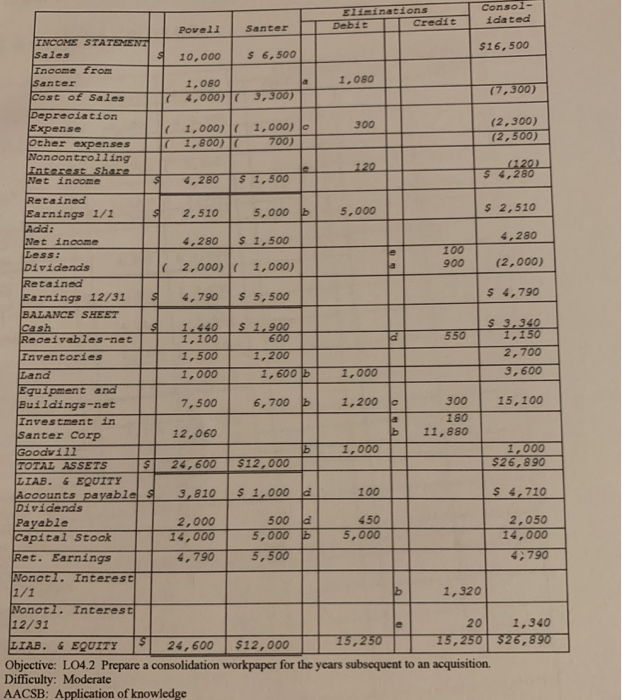

4) Powell Corporation acquired 90 % of the voting stock of Santer Corporation on January 1, 2014 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000. The amounts reported on the financial statements approximated fair value, with the exception of inventories, which were understated on the books by $500 and were sold in 2014, land which was undervalued by $1,000, and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500. Any remainder was assigned to goodwill. Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31, 2015 appear in the first two columns of the partially completed consolidation working papers. Powell has accounted for its investment in Santer using the equity method of accounting. Powell Corporation owed Santer Corporation $100 on open account at the end of the year. Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables Consol- idated Eliminations Debit Credit Santer Povell INCOMS STATEMEN2 Sales $16,500 $6,500 10,000 Inoome from Santer Cost of Sales 1,080 1,080 (7,300) 4,000) 3,300) Depreciation Expense Other expenses Nonoontrolling Interest Share Net inoome (2,300) 300 1,000) o 700) 1,000) ( (2,500) 1,800) (120) $ 4,280 120 $1,500 4,280 S Retained Earnings 1/1 Add: Net income Less: Dividends $ 2,510 5,000 b 5,000 2,510 4,280 $1,500 4,280 100 900 (2,000) 2,000) | 1,000) Retained Earnings 12/31 BALANCE HEET Cash Receivables-net $ 4,790 $ 5,500 4,790 $3,340 1,150 $ 1,900 600 1.440 1,100 550 2,700 1,500 1,000 Inventories 1,200 3,600 1,000 Land 1,600 b Equipment and Buildings-net 300 15,100 6,700 b 1,200 7,500 180 Investment in Santer Corp 11,880 12,060 1,000 $26,890 1,000 b Goodyill TOTAL ASSETS LIAB. &EQUITY Accounts payable S Dividends Payable Capital Stook $12,000 24,600 $ 4,710 100 $1,000 3,810 450 2,050 2,000 14,000 500 5,000 5,000 14,000 5,500 4790 Ret. Earnings Nonotl. Interest 1/1 4,790 1,320 Nonatl. Interest 1,340 12/31 20 15,250 $26,890 15,250 LIAB. $12,000 &EQUITY 24,600 acquisition. Objective: LO4.2 Prepare a consolidation workpaper for the years subsequent to an Difficulty: Moderate AACSB: Application of knowledge

how did the compute the NCI SHARE GOOD WILL AND NCI 1/1 NCI 12/31 ?

how did the compute the NCI SHARE GOOD WILL AND NCI 1/1 NCI 12/31 ?