how did they calculate interest expense?

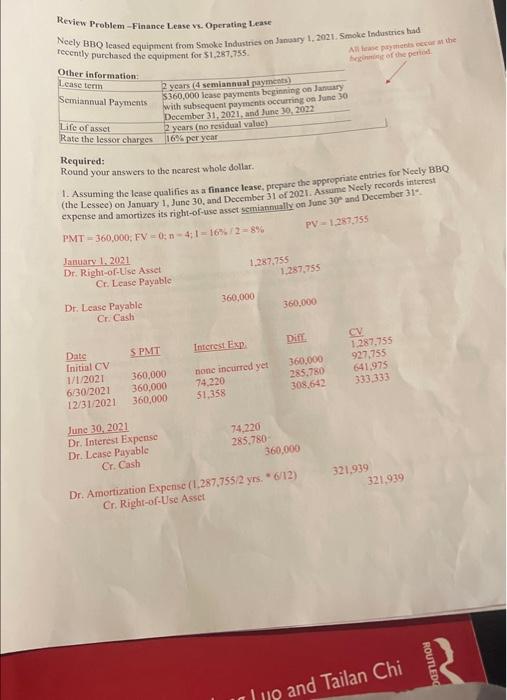

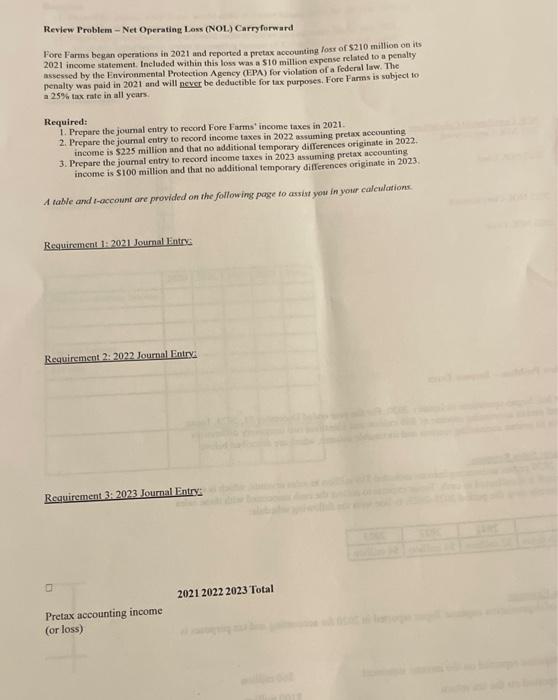

Review Problem - Finance Lease vs. Operatine Lease Necly BBQ leased equipruent from Smoke Industries on January 1, 2021. Smole lindustrics had recently purchased the equipment for $1,257,755. Required: Round your answers to the nearest whole dollar. 1. Assuming the lense qualifies as a finance lease, prepare the appropriate entries for Necly BBQ (the Lessec) on January 1, June 30, and December 31 of 2021. Assume Neely recotds interest expense and amortizes its right-of-use asset semianmally on June 30 and December 31. PMT=360,000;FV=0;n4;1=16%,12=8% PV=1.283,755 Review Problem - Net Operating Loss (NOL) Carryforward Fore Farms began eperations in 2021 and reported a pretax accounting fosx of $210 million on its 2021 income statement. Included within this loss was a $10 million expense related to a penalty assessed by the Environmental Protection Agency (EPA) for violation of a federal law. The penalty was paid in 2021 and will nexsr be deductible for tax purposes. Fore Farms is subject to a 25% tax rate in all years. Required: 1. Prepare the joumal entry to record Fore Farms' income taxes in 2021. 2. Prepare the joumal entry to record income taxes in 2022 assuming pretax accounting Prepare the journai entry to reoord income taxes in 2022 assuming pretax accosnting 3. Prepare the joumal entry to record income taxes in 2023 assuming pretax accounting income is $100 miltion and that no additional temporary differences originate in 2023. A table and t-account are provided on the following page to assist you in your calculations. Requiremen! 1: 2021 Joumal Entro: Requirement 2: 2022 Journal Entry: Requirement 3: 2023 Journal Entry: Review Problem - Finance Lease vs. Operatine Lease Necly BBQ leased equipruent from Smoke Industries on January 1, 2021. Smole lindustrics had recently purchased the equipment for $1,257,755. Required: Round your answers to the nearest whole dollar. 1. Assuming the lense qualifies as a finance lease, prepare the appropriate entries for Necly BBQ (the Lessec) on January 1, June 30, and December 31 of 2021. Assume Neely recotds interest expense and amortizes its right-of-use asset semianmally on June 30 and December 31. PMT=360,000;FV=0;n4;1=16%,12=8% PV=1.283,755 Review Problem - Net Operating Loss (NOL) Carryforward Fore Farms began eperations in 2021 and reported a pretax accounting fosx of $210 million on its 2021 income statement. Included within this loss was a $10 million expense related to a penalty assessed by the Environmental Protection Agency (EPA) for violation of a federal law. The penalty was paid in 2021 and will nexsr be deductible for tax purposes. Fore Farms is subject to a 25% tax rate in all years. Required: 1. Prepare the joumal entry to record Fore Farms' income taxes in 2021. 2. Prepare the joumal entry to record income taxes in 2022 assuming pretax accounting Prepare the journai entry to reoord income taxes in 2022 assuming pretax accosnting 3. Prepare the joumal entry to record income taxes in 2023 assuming pretax accounting income is $100 miltion and that no additional temporary differences originate in 2023. A table and t-account are provided on the following page to assist you in your calculations. Requiremen! 1: 2021 Joumal Entro: Requirement 2: 2022 Journal Entry: Requirement 3: 2023 Journal Entry