Question

How did they calculate the Max debt and Min debt as well as the WACC? According to the rating category, if Deluxe tends to maintain

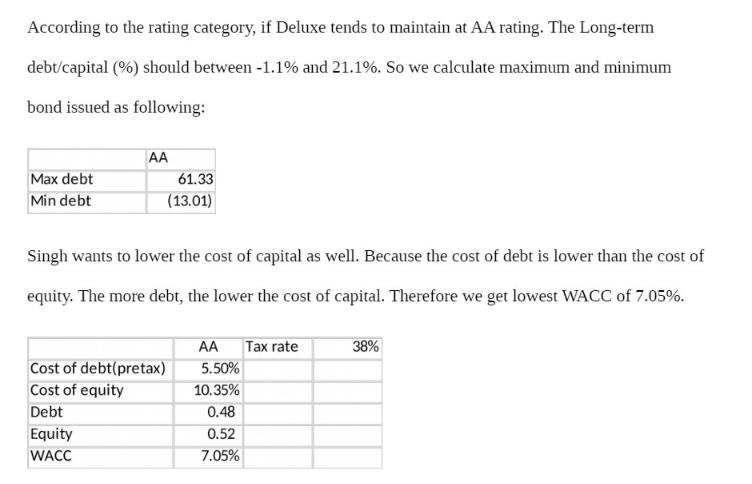

According to the rating category, if Deluxe tends to maintain at AA rating. The Long-term debt/capital (%) should between -1.1% and 21.1%. So we calculate maximum and minimum bond issued as following: Max debt Min debt AA 61.33 (13.01) Singh wants to lower the cost of capital as well. Because the cost of debt is lower than the cost of equity. The more debt, the lower the cost of capital. Therefore we get lowest WACC of 7.05%. Cost of debt(pretax) AA 5.50% Tax rate 38% Cost of equity 10.35% Debt 0.48 Equity 0.52 WACC 7.05%

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The debttoequity ratio DE ratio is a financial metric that compares a companys total debt to its tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App