Answered step by step

Verified Expert Solution

Question

1 Approved Answer

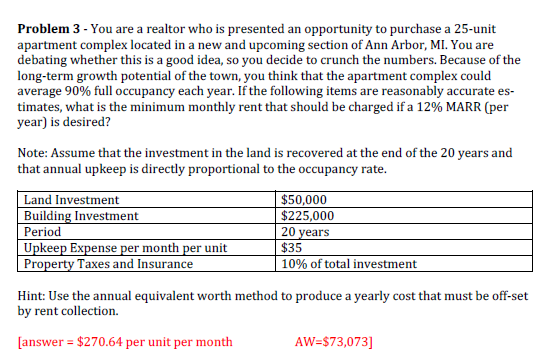

How did they get $73,073? I keep getting $73,556.66 Problem 3 - You are a realtor who is presented an opportunity to purchase a 25-unit

How did they get $73,073? I keep getting $73,556.66

Problem 3 - You are a realtor who is presented an opportunity to purchase a 25-unit apartment complex located in a new and upcoming section of Ann Arbor, MI. You are debating whether this is a good idea, so you decide to crunch the numbers. Because of the long-term growth potential of the town, you think that the apartment complex could average 90% full occupancy each year. If the following items are reasonably accurate es- timates, what is the minimum monthly rent that should be charged if a 12% MARR (per year) is desired? Note: Assume that the investment in the land is recovered at the end of the 20 years and that annual upkeep is directly proportional to the occupancy rate. Land Investment $50,000 Building Investment $225,000 Period Upkeep Expense per month per unit $35 Property Taxes and Insurance 10% of total investment 20 years Hint: Use the annual equivalent worth method to produce a yearly cost that must be off-set by rent collection. [answer = $270.64 per unit per month AW=$73,073]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started