How did you assess Code 4 Changes overall financial position and performance below? Why?

Working

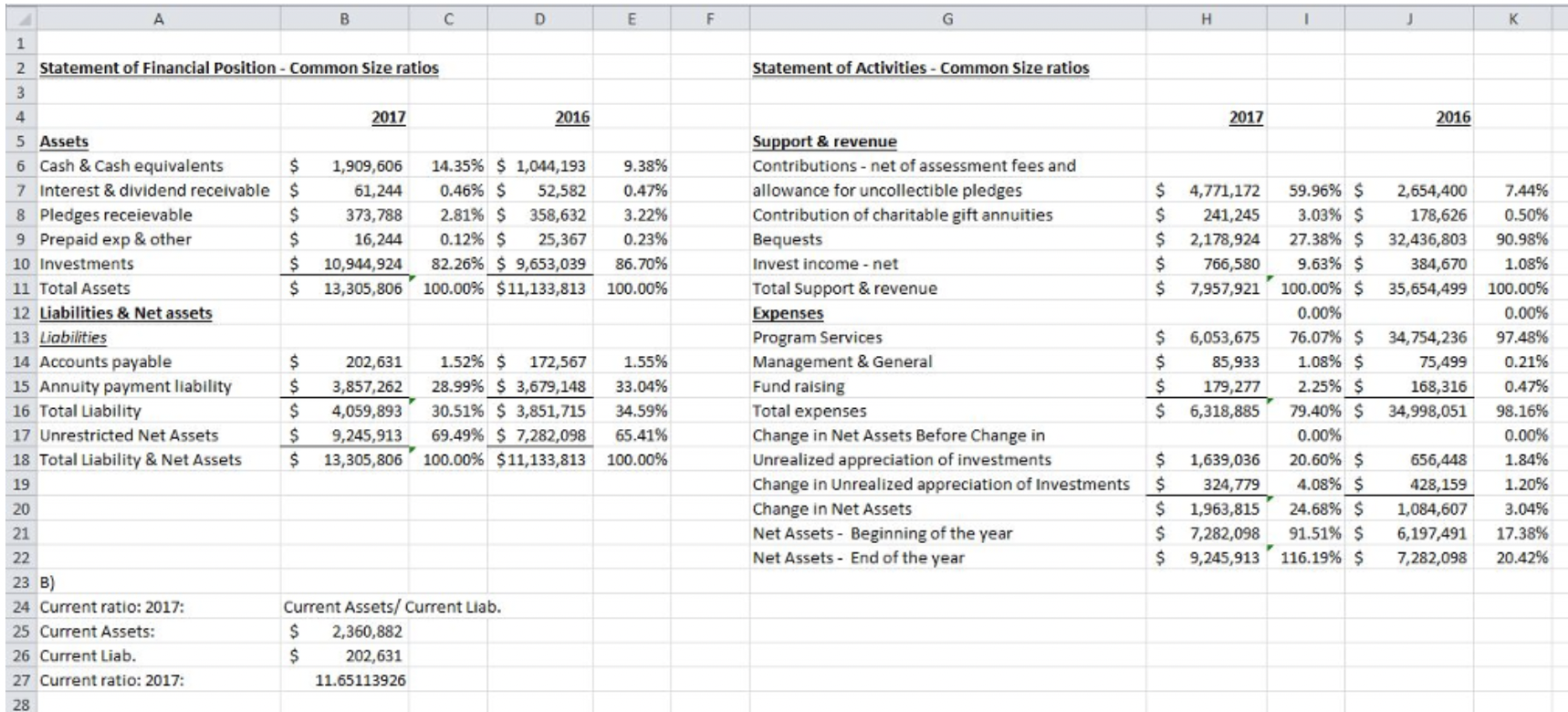

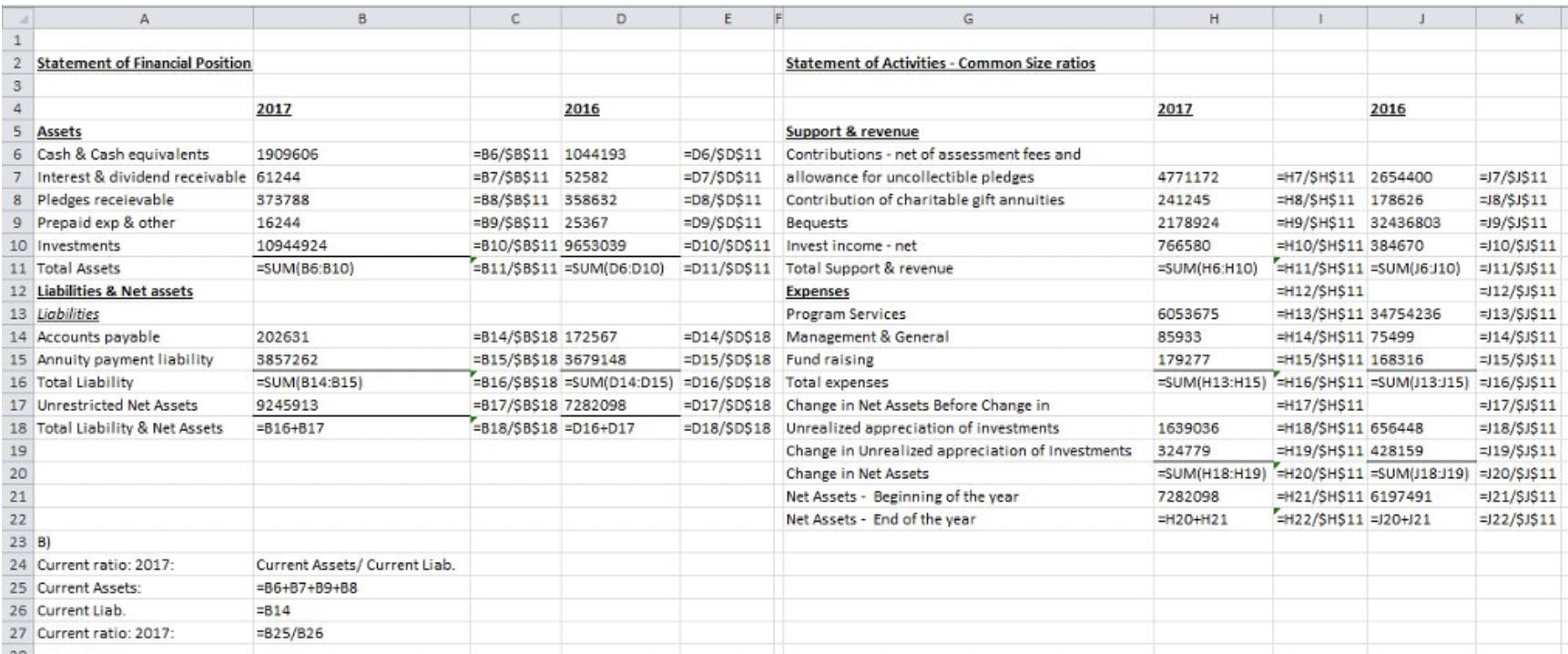

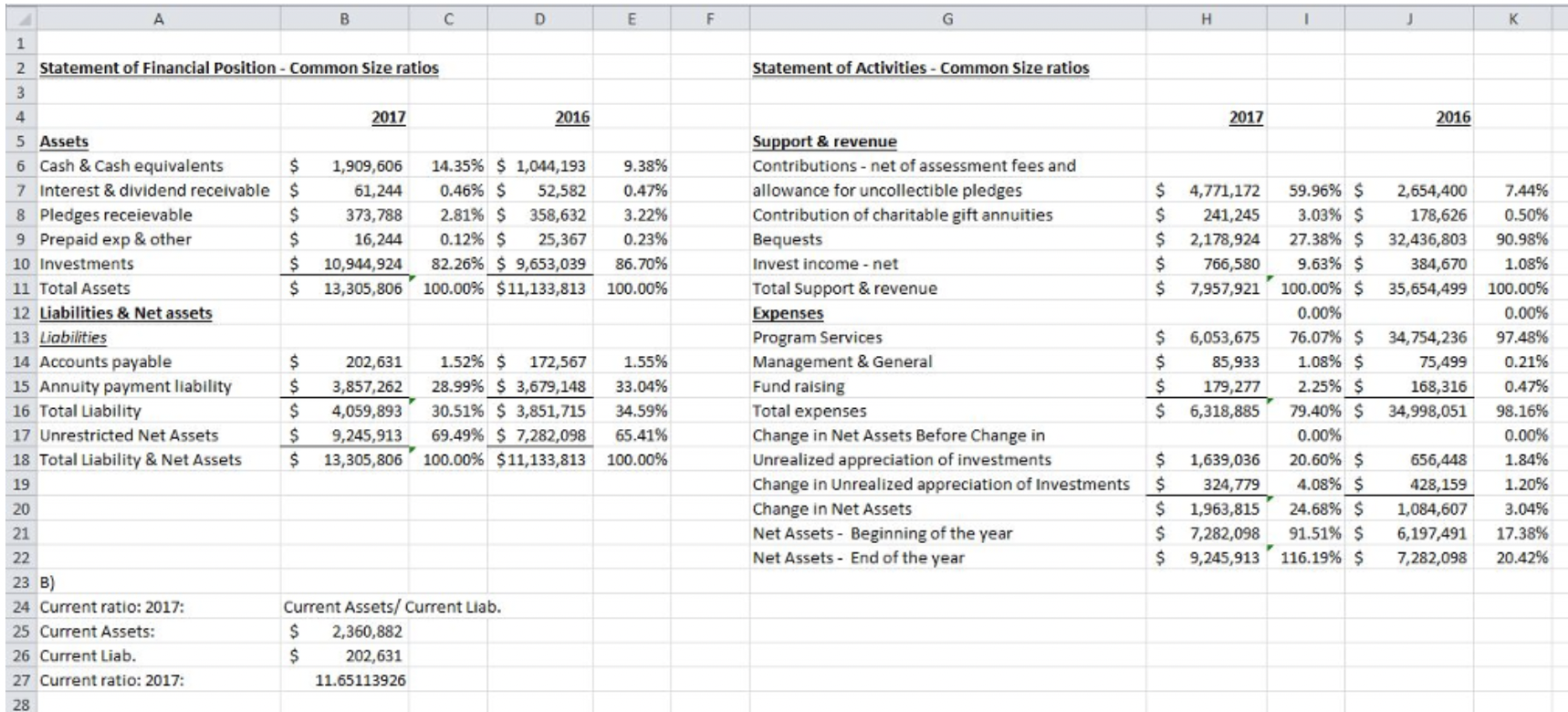

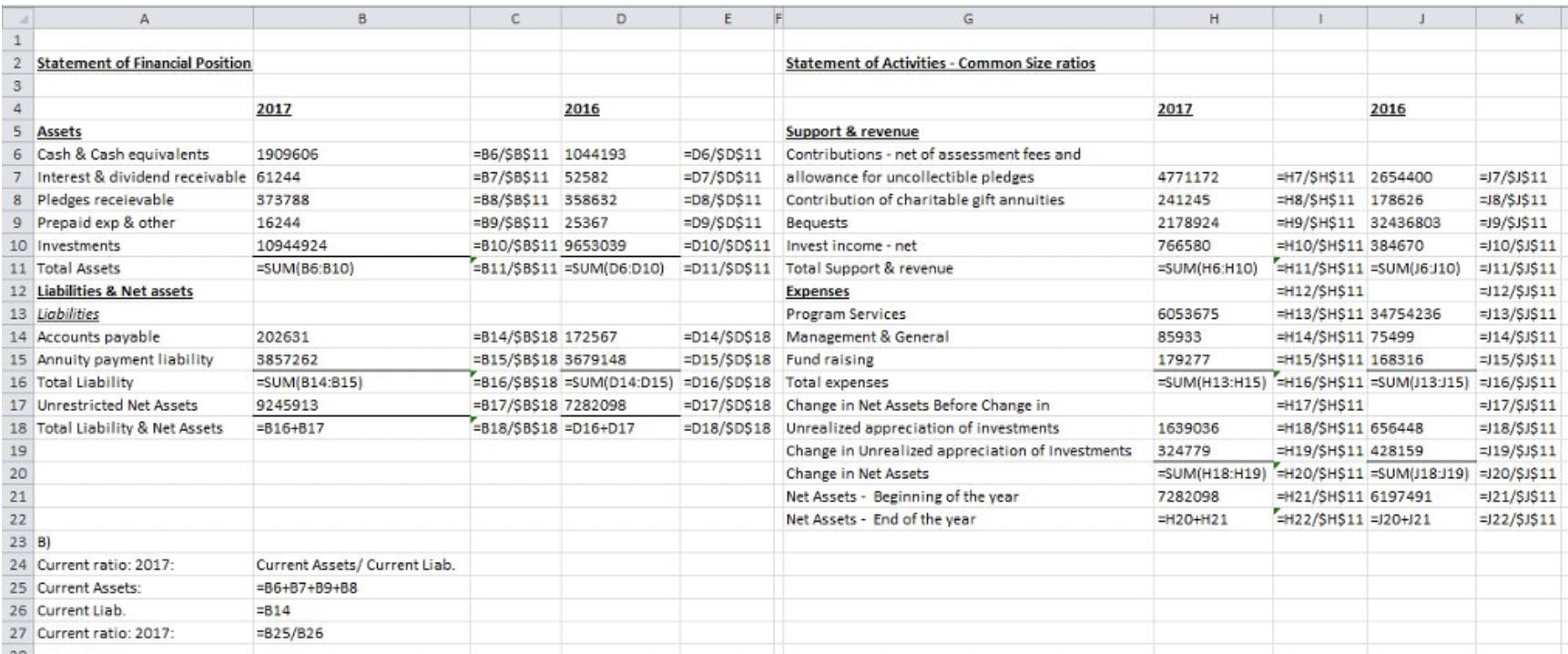

b. Current ratio = current assets/current liabilities

| | 2017 | 2016 |

| Current assets: | | |

| Cash | 1,909,606.00 | 1,044,193.00 |

| Interest receivables | 61,244.00 | 52,582.00 |

| Pledges receivables | 373,788.00 | 358,632.00 |

| Prepaid expenses | 16,244.00 | 25,367.00 |

| | | |

| Total current assets | 2,360,882.00 | 1,480,774.00 |

| | | |

| Current liabilities: | | |

| Accounts payable | 202,631.00 | 172,567.00 |

| | | |

| Current ratio | 11.65 | 8.58 |

c. days of cash on hand = cash on hand/(operating expenses - non cash expenses)/365

| | 2017 | 2016 |

| Cash | 1,909,606.00 | 1,044,193.00 |

| | | |

| Operating expenses | | |

| Program services | 6,053,675.00 | 34,754,236.00 |

| Management | 85,933.00 | 75,499.00 |

| Fundraising | 179,277.00 | 168,316.00 |

| Total expenses | 6,318,885.00 | 34,998,051.00 |

| | | |

| Non cash expense | 0.00 | 0.00 |

| (Total operating expense - non cash expense)/365 | 17,312.01 | 95,885.07 |

| | | |

| Days cash on hand | 110.31 | 10.89 |

d. Debt to equity ratio = total liabilities/shareholders equity

| | 2017 | 2016 |

| Total liabilities | 4,059,893.00 | 3,851,715.00 |

| Unrestricted net assets (equity) | 9,245,913.00 | 7,282,098.00 |

| | | |

| Debt equity ratio | 0.4391 | 0.5289 |

e. Total margin = (revenue - expenses)/revenue

| | 2017 | 2016 |

| Total revenue | 7,957,921.00 | 35,654,499.00 |

| Expenses | 6,318,885.00 | 34,998,051.00 |

| | | |

| Revenue - expenses | 1,639,036.00 | 656,448.00 |

| Total margin | 20.60% | 1.84% |

f. Program services ratio = program service expense/total expense

| | 2017 | 2016 |

| Program services | 6,053,675.00 | 34,754,236.00 |

| Total expense | 6,318,885.00 | 34,998,051.00 |

| Program service ratio | 95.80% | 99.30% |

B D E F H 1 K Statement of Activities - Common Size ratios 2017 2016 1 2 Statement of Financial Position 3 4 2017 5 Assets 6 Cash & Cash equivalents 1909606 7 Interest & dividend receivable 61244 8 Pledges receievable 373788 9 Prepaid exp & other 16244 10 Investments 10944924 11 Total Assets ESUM(B6:10) 12 Liabilities & Net assets 13 Lobilities 14 Accounts payable 202631 15 Annuity payment liability 3857262 16 Total Liability SUM(B14:315) 17 Unrestricted Net Assets 9245913 18 Total Liability & Net Assets =B16+817 19 2016 Support & revenue =B6/$B$11 1044193 =D6/$D$11 Contributions - net of assessment fees and =B7/$B$ 11 52582 =D7/$D$11 allowance for uncollectible pledges =B8/$B$11 358632 =D8/$D$11 Contribution of charitable gift annuities =B9/$B$11 25367 =D9/$D$11 Bequests =B10/$B$11 9653039 =D10/SD$11 Invest income.net =B11/$B$11 =SUM(D6:010) =D11/SD$11 Total Support & revenue Expenses Program Services =B14/$B$18 172567 =D14/SD$18 Management & General =B15/$B$18 3679148 =D15/SD$18 Fundraising =B16/$B$18 =SUM(D14:015) =D16/$D$18 Total expenses =B17/$B$18 7282098 =D17/$D$18 Change in Net Assets Before Change in =B18/$B$18 =D16+D17 =D18/SD$18 Unrealized appreciation of investments Change in Unrealized appreciation of Investments Change in Net Assets Net Assets - Beginning of the year Net Assets - End of the year 4771172 =H7/SH$ 11 2654400 =)7/$J$11 241245 =H8/$H$ 11 178626 =18/$J$11 2178924 =H9/SH$11 32436803 =J9/$J$11 766580 =H10/SH$11 384670 = 10/$J$ 11 SUM(H6 H10) H11/SH$ 11 =SUM(16:10) =)11/$J$11 FH12/$H$11 12/$J$11 6053675 =H13/SH$11 34754236 13/$J$11 85933 =H14/SH$ 11 75499 =)14/$J$11 179277 =H15/SH$11 168316 =)15/$J$ 11 SUM(H13:H15) FH16/SH$11 ESUM(J13:15) 16/$J$11 =H17/SH$11 =)17/$J$11 1639036 =H18/$HS11 656448 =)18/$J$11 324779 H19/SH$11 428159 =119/$J$11 SUM(H18:H19) H20/SH$11 =SUM(J18:19) = 20/$J$11 7282098 =H21/SH$11 6197491 =)21/$J$11 =H20+H21 =H22/SHS11 = 20+J21 =J22/$J$11 20 21 22 23 B) 24 Current ratio: 2017: 25 Current Assets: 26 Current Liab. 27 Current ratio: 2017: Current Assets/ Current Liab. =B6+7+B9+88 =B14 =B25/826 B D E F H 1 K Statement of Activities - Common Size ratios 2017 2016 1 2 Statement of Financial Position 3 4 2017 5 Assets 6 Cash & Cash equivalents 1909606 7 Interest & dividend receivable 61244 8 Pledges receievable 373788 9 Prepaid exp & other 16244 10 Investments 10944924 11 Total Assets ESUM(B6:10) 12 Liabilities & Net assets 13 Lobilities 14 Accounts payable 202631 15 Annuity payment liability 3857262 16 Total Liability SUM(B14:315) 17 Unrestricted Net Assets 9245913 18 Total Liability & Net Assets =B16+817 19 2016 Support & revenue =B6/$B$11 1044193 =D6/$D$11 Contributions - net of assessment fees and =B7/$B$ 11 52582 =D7/$D$11 allowance for uncollectible pledges =B8/$B$11 358632 =D8/$D$11 Contribution of charitable gift annuities =B9/$B$11 25367 =D9/$D$11 Bequests =B10/$B$11 9653039 =D10/SD$11 Invest income.net =B11/$B$11 =SUM(D6:010) =D11/SD$11 Total Support & revenue Expenses Program Services =B14/$B$18 172567 =D14/SD$18 Management & General =B15/$B$18 3679148 =D15/SD$18 Fundraising =B16/$B$18 =SUM(D14:015) =D16/$D$18 Total expenses =B17/$B$18 7282098 =D17/$D$18 Change in Net Assets Before Change in =B18/$B$18 =D16+D17 =D18/SD$18 Unrealized appreciation of investments Change in Unrealized appreciation of Investments Change in Net Assets Net Assets - Beginning of the year Net Assets - End of the year 4771172 =H7/SH$ 11 2654400 =)7/$J$11 241245 =H8/$H$ 11 178626 =18/$J$11 2178924 =H9/SH$11 32436803 =J9/$J$11 766580 =H10/SH$11 384670 = 10/$J$ 11 SUM(H6 H10) H11/SH$ 11 =SUM(16:10) =)11/$J$11 FH12/$H$11 12/$J$11 6053675 =H13/SH$11 34754236 13/$J$11 85933 =H14/SH$ 11 75499 =)14/$J$11 179277 =H15/SH$11 168316 =)15/$J$ 11 SUM(H13:H15) FH16/SH$11 ESUM(J13:15) 16/$J$11 =H17/SH$11 =)17/$J$11 1639036 =H18/$HS11 656448 =)18/$J$11 324779 H19/SH$11 428159 =119/$J$11 SUM(H18:H19) H20/SH$11 =SUM(J18:19) = 20/$J$11 7282098 =H21/SH$11 6197491 =)21/$J$11 =H20+H21 =H22/SHS11 = 20+J21 =J22/$J$11 20 21 22 23 B) 24 Current ratio: 2017: 25 Current Assets: 26 Current Liab. 27 Current ratio: 2017: Current Assets/ Current Liab. =B6+7+B9+88 =B14 =B25/826