How do I answer the following:

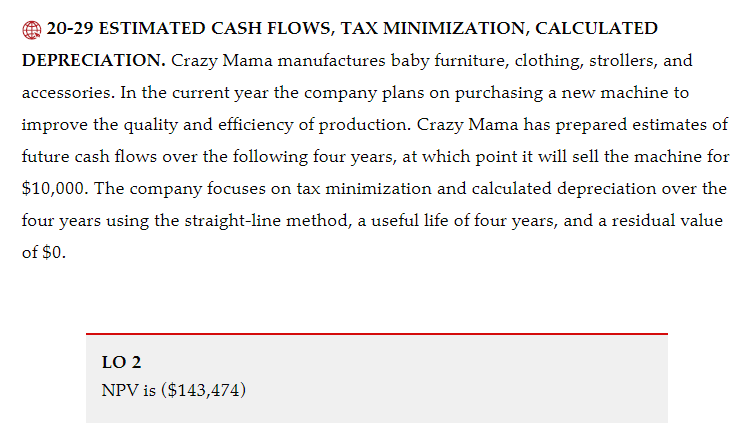

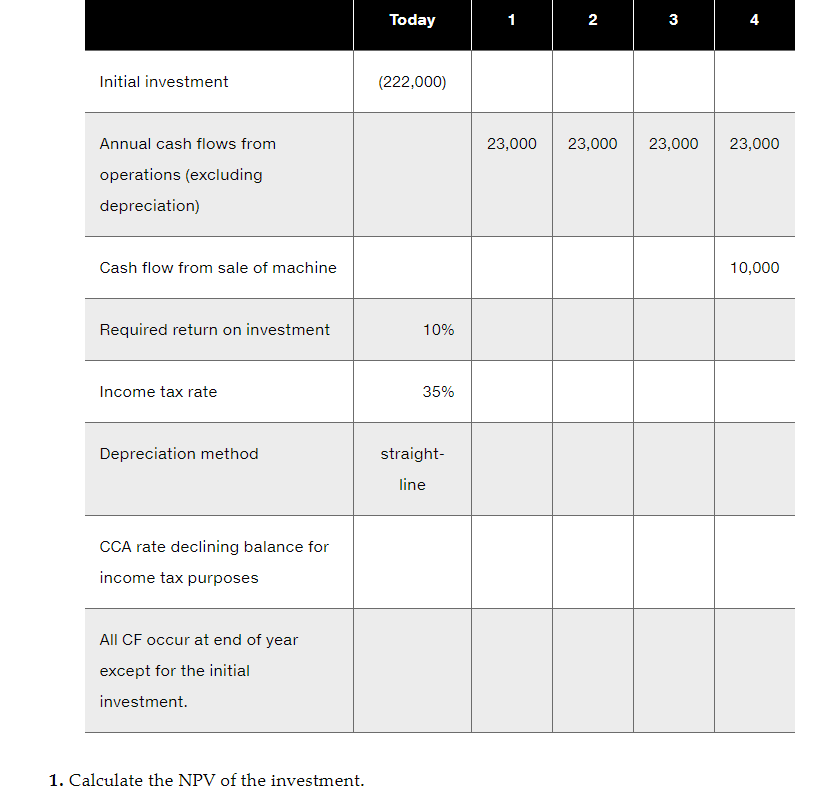

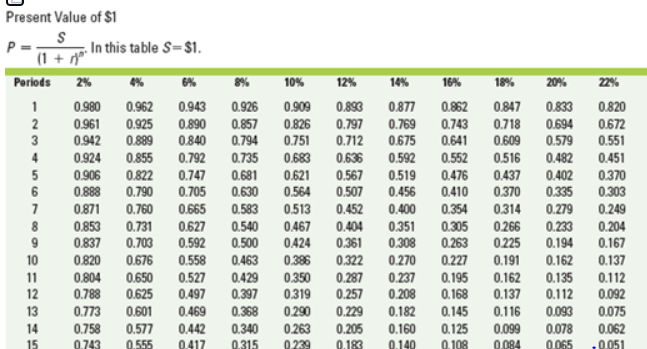

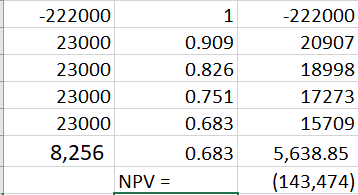

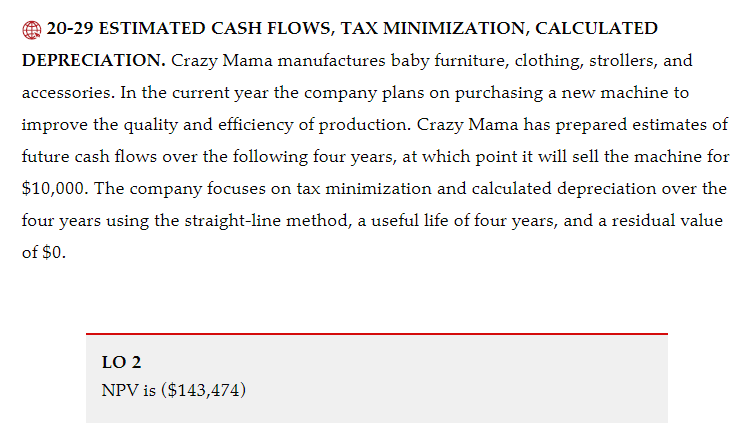

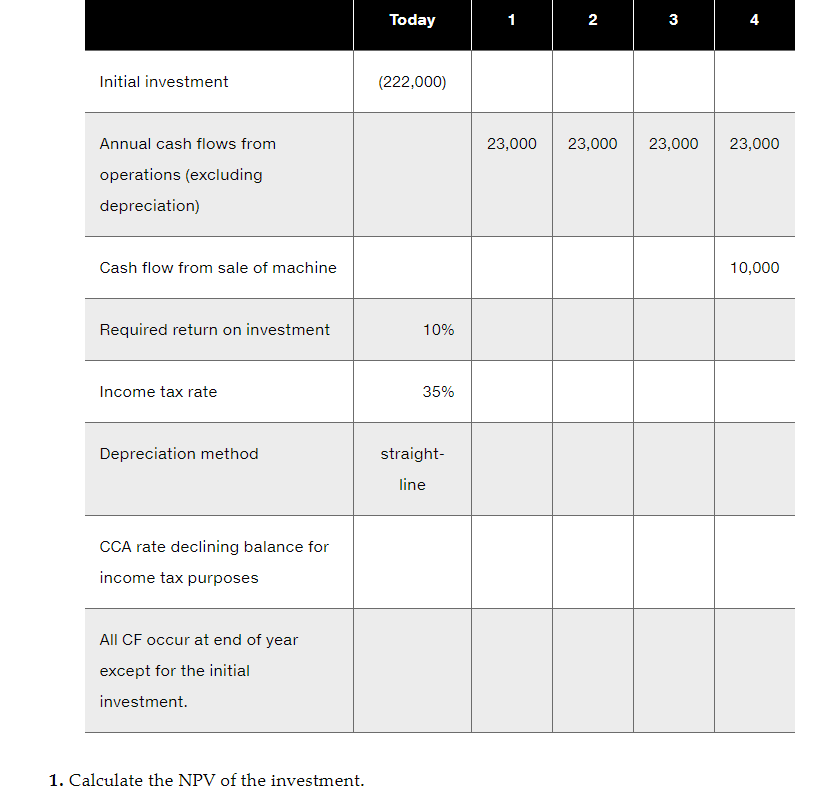

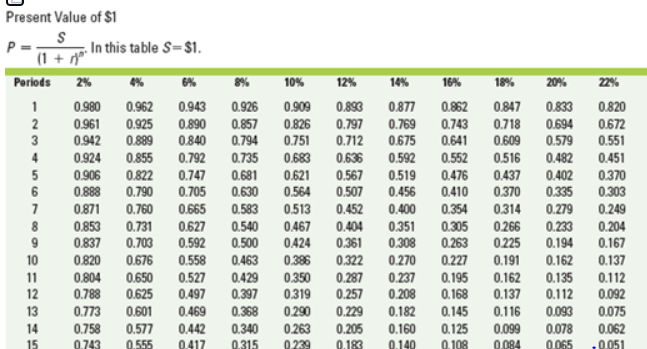

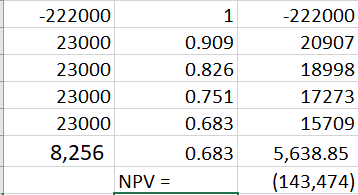

20-29 ESTIMATED CASH FLOWS, TAX MINIMIZATION, CALCULATED DEPRECIATION. Crazy Mama manufactures baby furniture, clothing, strollers, and accessories. In the current year the company plans on purchasing a new machine to improve the quality and efficiency of production. Crazy Mama has prepared estimates of future cash flows over the following four years, at which point it will sell the machine for $10,000. The company focuses on tax minimization and calculated depreciation over the four years using the straight-line method, a useful life of four years, and a residual value of $0. LO 2 NPV is ($143,474) Today 1 N 3 Initial investment (222,000) 23,000 23,000 23,000 23,000 Annual cash flows from operations (excluding depreciation) Cash flow from sale of machine 10,000 Required return on investment 10% Income tax rate 35% Depreciation method straight- line CCA rate declining balance for income tax purposes All CF occur at end of year except for the initial investment 1. Calculate the NPV of the investment. 22% Present Value of $1 S (1 + i In this table S=$1. Periods 2% 1 0.980 0.962 0.943 2 0.961 0.925 0.890 3 0.942 0.889 0.840 4 0.924 0.855 0.792 5 0.906 0.822 0.747 6 0.888 0.790 0.705 7 0.871 0.760 0.665 8 0.853 0.731 0.627 9 0.837 0.703 0.592 10 0.820 0.676 0.558 11 0.804 0.650 0.527 12 0.788 0.625 0.497 13 0.773 0.601 0.469 14 0.758 0.577 0.442 15 0.743 0.555 0.417 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0424 0.386 0.350 0.319 0.290 0.263 0229 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 18% 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.820 0.672 0.551 0.451 0.370 0.303 0.249 0.204 0.167 0.137 0.112 0.092 0.075 0.062 .0.051 1 -222000 23000 23000 23000 23000 8,256 NPV = 0.909 0.826 0.751 0.683 -222000 20907 18998 17273 15709 0.683 5,638.85 (143,474)