Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I answer these tax accounting questions? I'm very confused with basis periods and what to do with the second and third years and

How do I answer these tax accounting questions? I'm very confused with basis periods and what to do with the second and third years and when the business ceases. These are UK questions so the tax year will end on the 5 April.

I would appreciate a walkthrough this question as I have no clue how to do it.

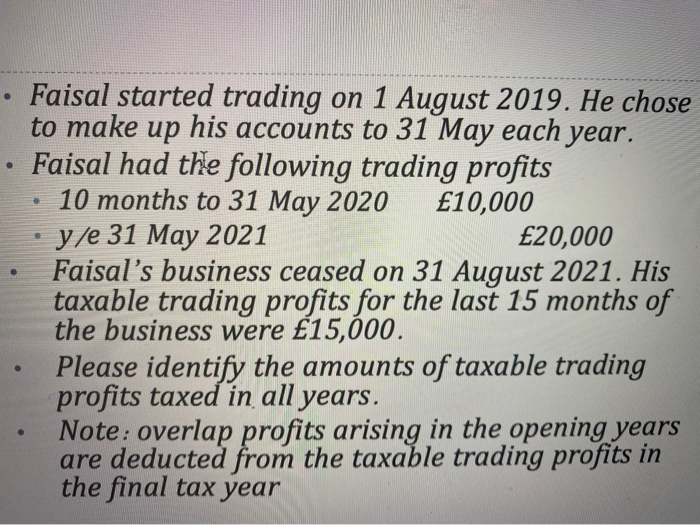

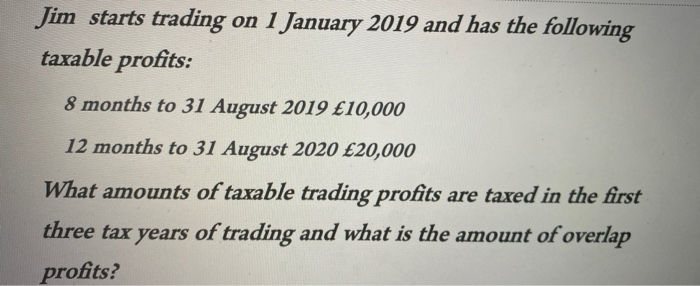

Faisal started trading on 1 August 2019. He chose to make up his accounts to 31 May each year. Faisal had the following trading profits 10 months to 31 May 2020 10,000 y/e 31 May 2021 20,000 Faisal's business ceased on 31 August 2021. His taxable trading profits for the last 15 months of the business were $15,000. Please identify the amounts of taxable trading profits taxed in all years. Note: overlap profits arising in the opening years are deducted from the taxable trading profits in the final tax year Jim starts trading on 1 January 2019 and has the following taxable profits: 8 months to 31 August 2019 10,000 12 months to 31 August 2020 20,000 What amounts of taxable trading profits are taxed in the first three tax years of trading and what is the amount of overlap profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started