how do i calculate?

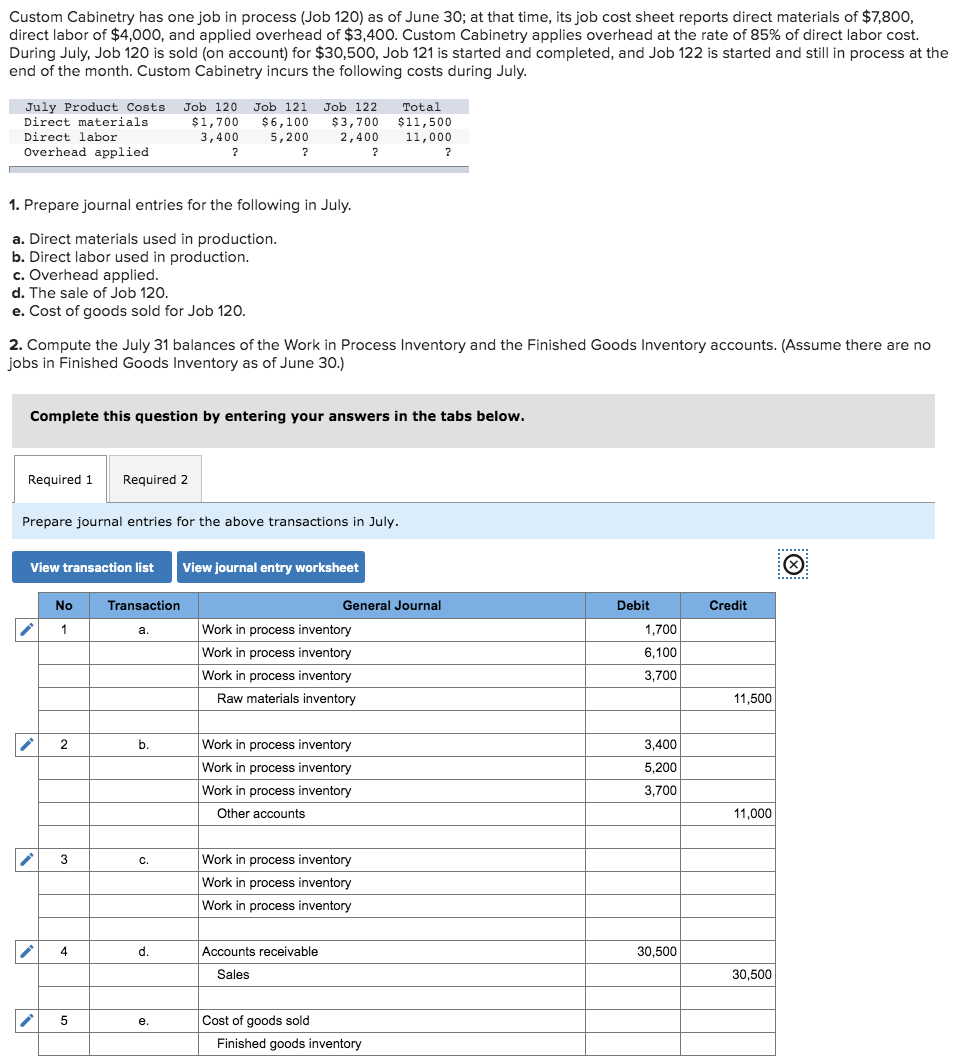

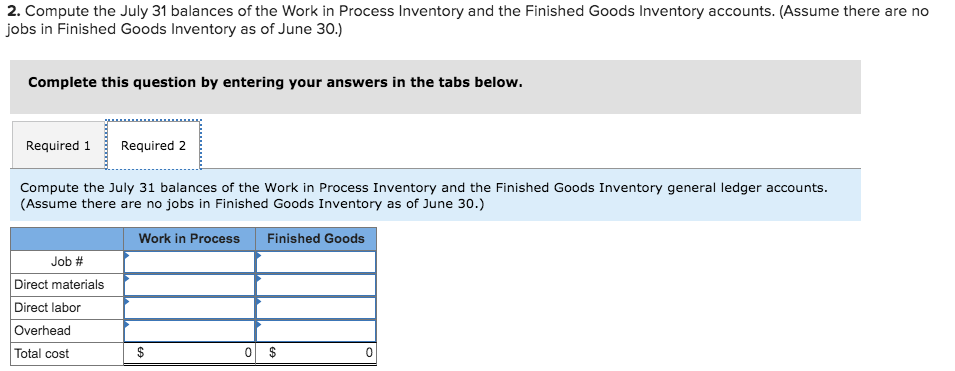

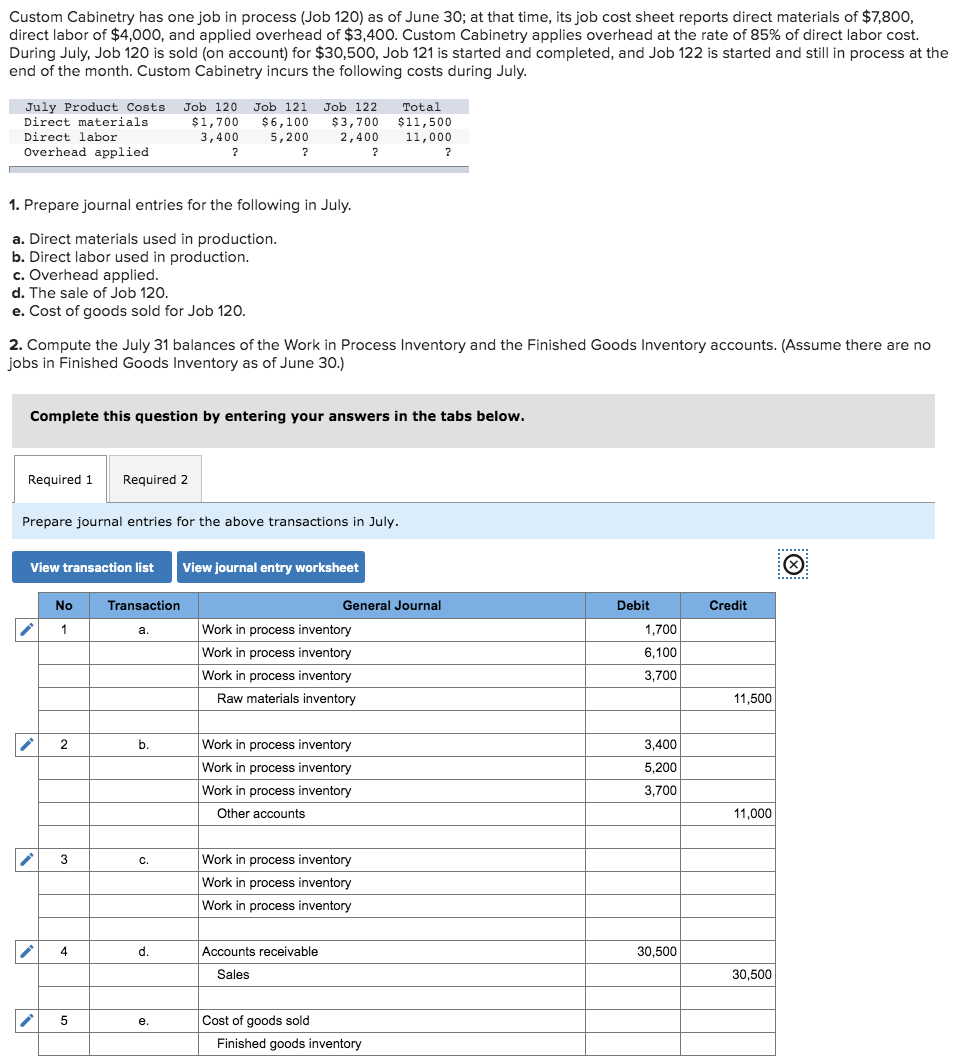

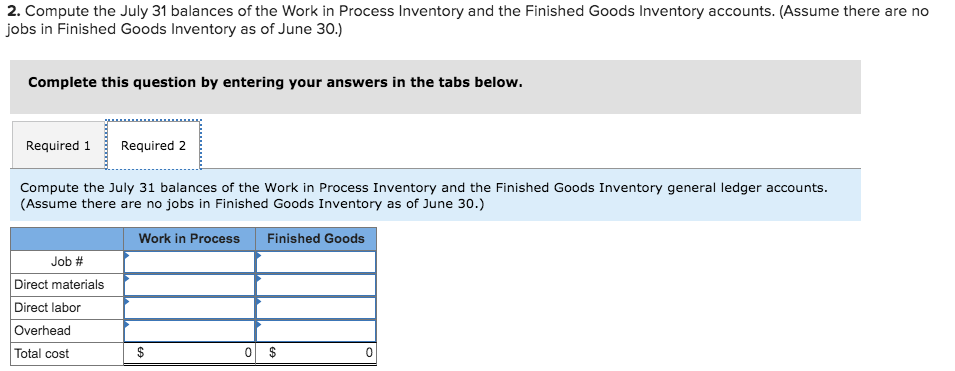

Custom Cabinetry has one job in process (Job 120) as of June 30, at that time, its job cost sheet reports direct materials of $7,800, direct labor of $4,000, and applied overhead of $3,400. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on account) for $30,500, Job 121 is started and completed, and Job 122 is started and still in process at the end of the month. Custom Cabinetry incurs the following costs during July. July Product Costs Job 120 Job 121 Job 122 Direct materials $ 1,700 $6,100 $3,700 Direct labor 3,400 5,200 2,400 Overhead applied 2 Total $11,500 11,000 1. Prepare journal entries for the following in July a. Direct materials used in production. b. Direct labor used in production. c. Overhead applied. d. The sale of Job 120. e. Cost of goods sold for Job 120. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (Assume there are no jobs in Finished Goods Inventory as of June 30.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries for the above transactions in July. View transaction list View journal entry worksheet No Transaction Credit General Journal Work in process inventory Work in process inventory Work in process inventory Raw materials inventory Debit 1,700 6,100 3,700 11,500 Work in process inventory Work in process inventory Work in process inventory Other accounts 3,400 5,200 3,700 11,000 3C. Work in process inventory Work in process inventory Work in process inventory d. 30,500 Accounts receivable Sales 30,500 e. Cost of goods sold Finished goods inventory 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (Assume there are no jobs in Finished Goods Inventory as of June 30.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory general ledger accounts. (Assume there are no jobs in Finished Goods Inventory as of June 30.) Work in Process Finished Goods Job # Direct materials Direct labor Overhead Total cost 0 $