How do I calculate NPV of the proposed merger using the following information

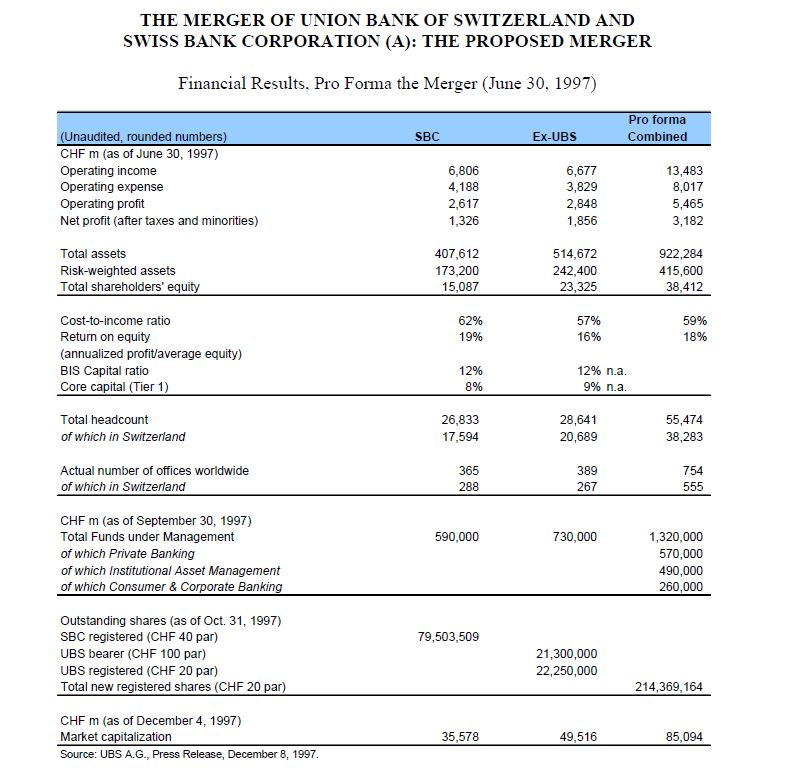

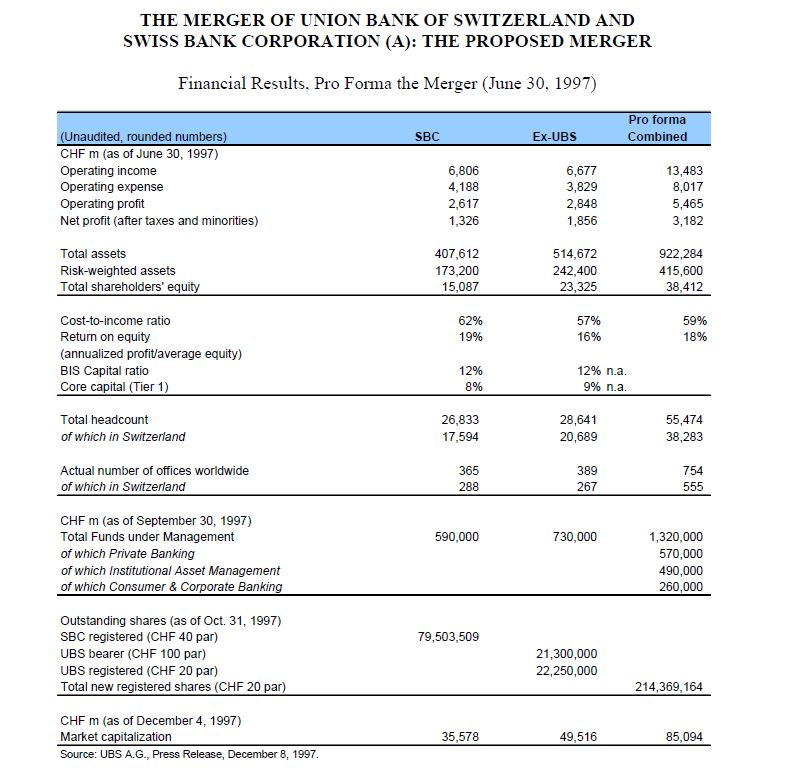

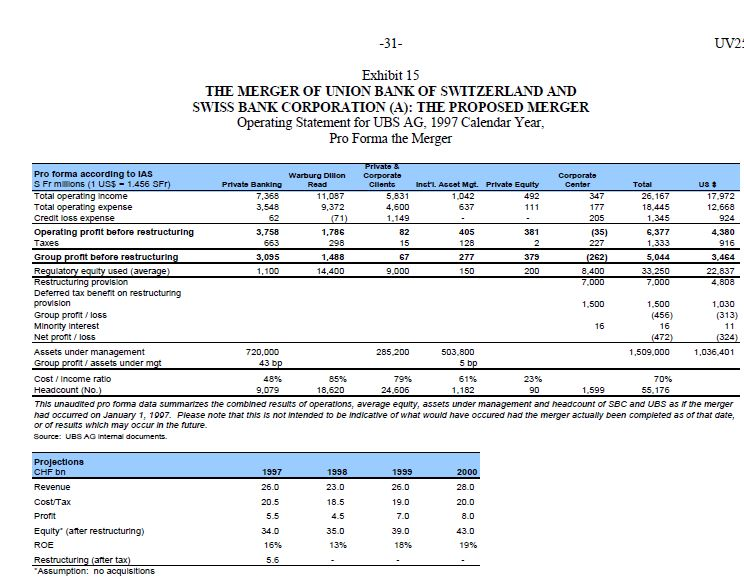

THE MERGER OF UNION BANK OF SWITZERLAND AND SWISS BANK CORPORATION (A): THE PROPOSED MERGER Financial Results. Pro Forma the Merger (June 30, 1997) Pro forma Combined SBC Ex-UBS (Unaudited, rounded numbers) CHF m (as of June 30, 1997) Operating income Operating expense Operating profit Net profit (after taxes and minorities) 6,806 4,188 2,617 1,326 6,677 3,829 2,848 1,856 13,483 8,017 5,465 3,182 Total assets Risk-weighted assets Total shareholders' equity 407,612 173,200 15,087 514,672 242,400 23,325 922,284 415,600 38,412 57% 16% 59% 18% Cost-to-income ratio Return on equity (annualized profitlaverage equity) BIS Capital ratio Core capital (Tier 1) 62% 19% 12% 8% 12% n.a 9% n.a Total headcount of which in Switzerland 26,833 17,594 28,641 20,689 55,474 38,283 Actual number of offices worldwide of which in Switzerland 365 288 389 267 754 CHF m (as of September 30, 1997) Total Funds under Management of which Private Banking of which Institutional Asset Management of which Consumer & Corporate Banking 730,000 1,320,000 570,000 490,000 260,000 590,000 Outstanding shares (as of Oct. 31, 1997) SBC registered (CHF 40 par) UBS bearer (CHF 100 par) UBS registered (CHF 20 par) Total new registered shares (CHF 20 par) 79,503,509 21,300,000 22,250,000 214,369,164 CHF m (as of December 4, 1997) Market capitalization Source: UBS A.G., Press Release, December 8, 1997 35,578 49,516 85,094 THE MERGER OF UNION BANK OF SWITZERLAND AND SWISS BANK CORPORATION (A): THE PROPOSED MERGER Financial Results. Pro Forma the Merger (June 30, 1997) Pro forma Combined SBC Ex-UBS (Unaudited, rounded numbers) CHF m (as of June 30, 1997) Operating income Operating expense Operating profit Net profit (after taxes and minorities) 6,806 4,188 2,617 1,326 6,677 3,829 2,848 1,856 13,483 8,017 5,465 3,182 Total assets Risk-weighted assets Total shareholders' equity 407,612 173,200 15,087 514,672 242,400 23,325 922,284 415,600 38,412 57% 16% 59% 18% Cost-to-income ratio Return on equity (annualized profitlaverage equity) BIS Capital ratio Core capital (Tier 1) 62% 19% 12% 8% 12% n.a 9% n.a Total headcount of which in Switzerland 26,833 17,594 28,641 20,689 55,474 38,283 Actual number of offices worldwide of which in Switzerland 365 288 389 267 754 CHF m (as of September 30, 1997) Total Funds under Management of which Private Banking of which Institutional Asset Management of which Consumer & Corporate Banking 730,000 1,320,000 570,000 490,000 260,000 590,000 Outstanding shares (as of Oct. 31, 1997) SBC registered (CHF 40 par) UBS bearer (CHF 100 par) UBS registered (CHF 20 par) Total new registered shares (CHF 20 par) 79,503,509 21,300,000 22,250,000 214,369,164 CHF m (as of December 4, 1997) Market capitalization Source: UBS A.G., Press Release, December 8, 1997 35,578 49,516 85,094