Answered step by step

Verified Expert Solution

Question

1 Approved Answer

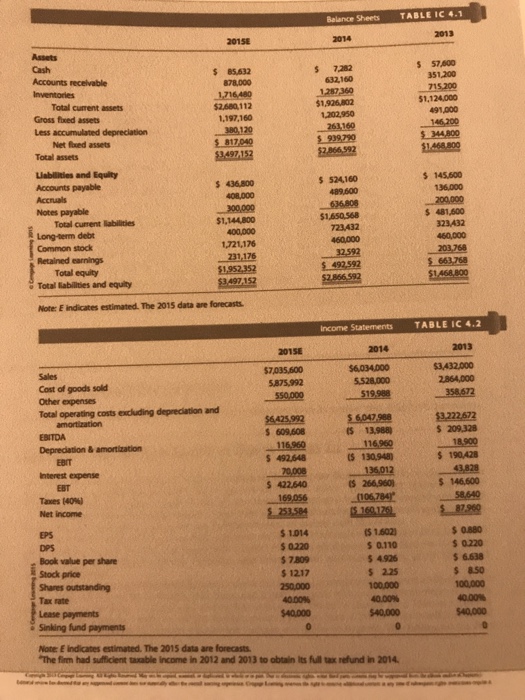

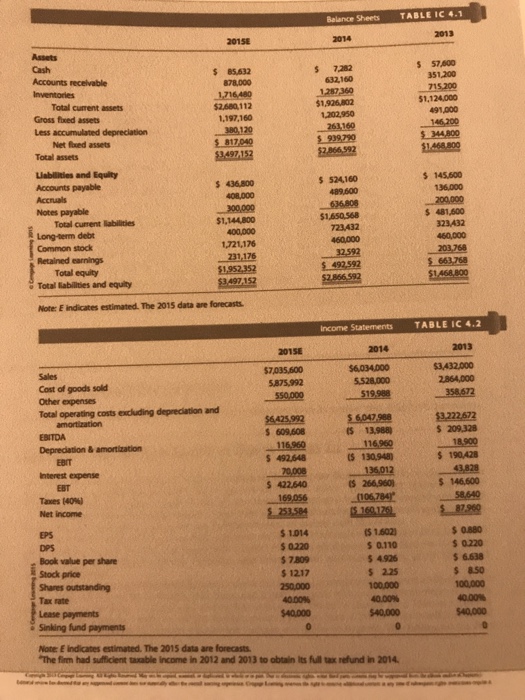

How do I calculate ROIC from this balance sheet and income statement for 2014 and 2015? I know that 2014 is -4.2%. I just cant

How do I calculate ROIC from this balance sheet and income statement for 2014 and 2015? I know that 2014 is -4.2%. I just cant figure out how to get that.

Balance SheetsTABLE IC 4.1 2013 $ 7282 632,160 57,600 351,200 $ 85,632 Accounts recelvable 1,716480 $2.680,112 1,197,160 51,124,000 491,000 Total curent assets $1,926,802 Gross fixed assets Net fued assets Total assets iablities and Equity Accounts payable s 436.800 s 524160 s 145,600 Notes payable $ 481,600 $1,650,568 723432 $1,144800 Total curent liabilities Long-term debt Common stock Retained earnings 1,721,176 Total equity Total labilities and equity Note: E indicates estimated. The 2015 data are forecasts Income Statements TABLE IC 4.2 2015E 2013 $7,035,600 Cost of goods sold Other expenses Total operating costs excluding depreciation and s 609,608 S 492,648 $ 422.640 S 13988 S 130.948) s 266,960 $ 209.328 s 190,428 S 146,500 Interest expense Taxes (40%) Net income $ 1014 0220 7809 $ 1217 0.880 $ 0220 6.638 s 8so S 1.602) Book value per share $ 4926 s 225 Shares outstanding Tax rate Lease payments Sinking fund payments Note E indicates estimated. The 2015 data are forecasts The firm had sufficient taxable income in 2012 and 2013 to obtain its full tax refund in 2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started