How do i calculate?

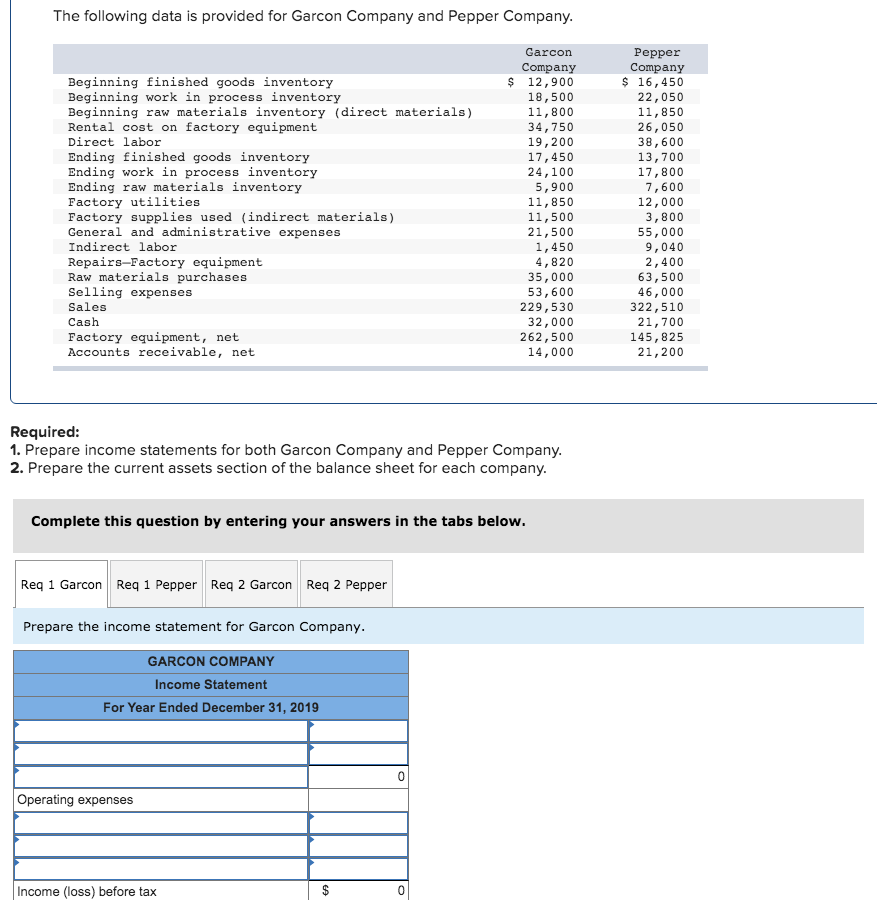

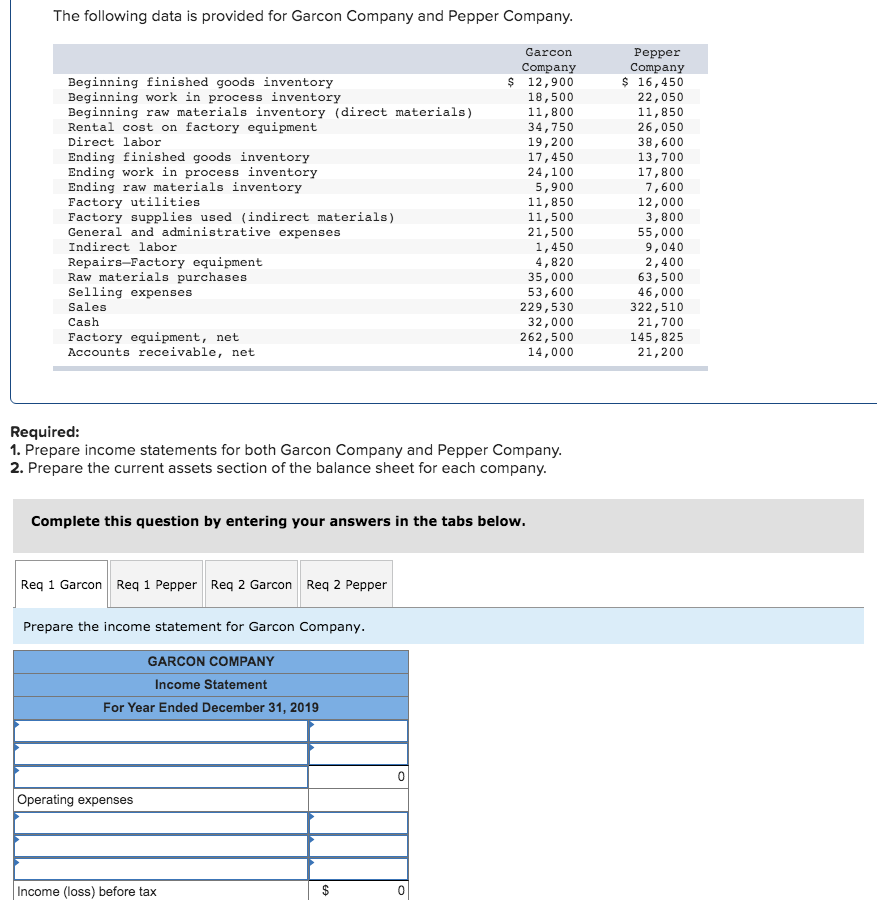

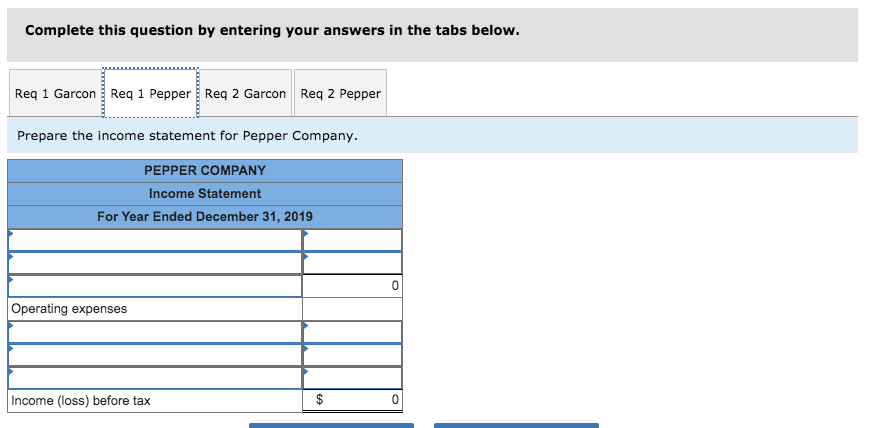

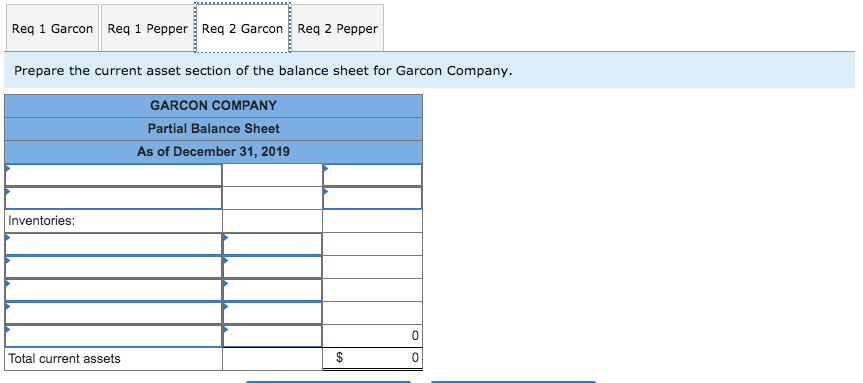

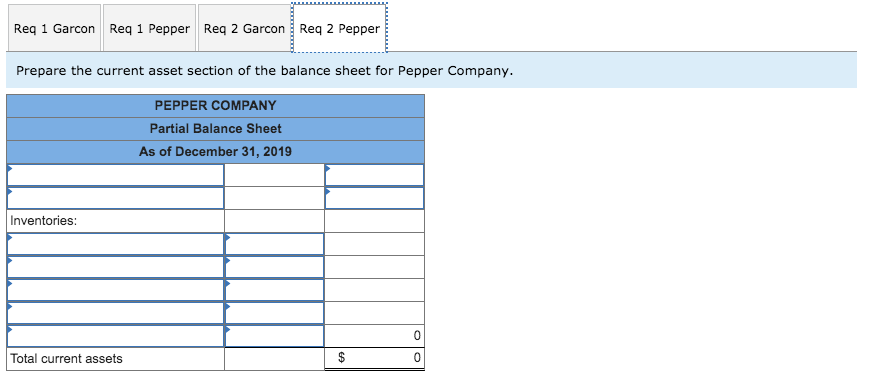

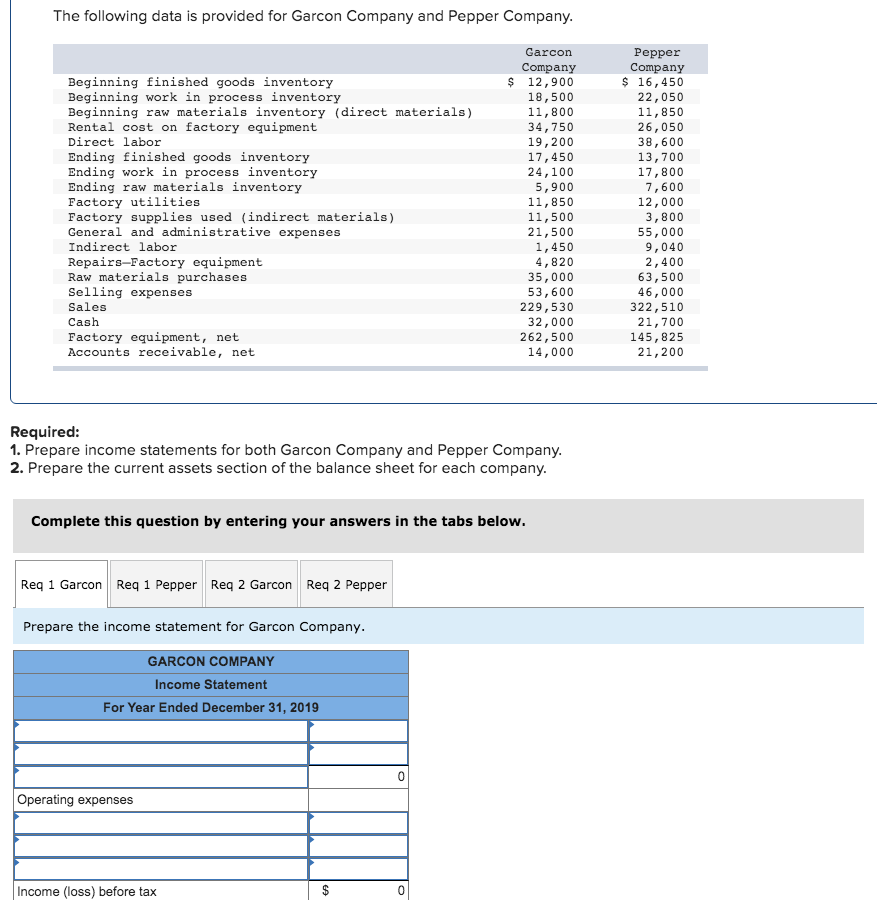

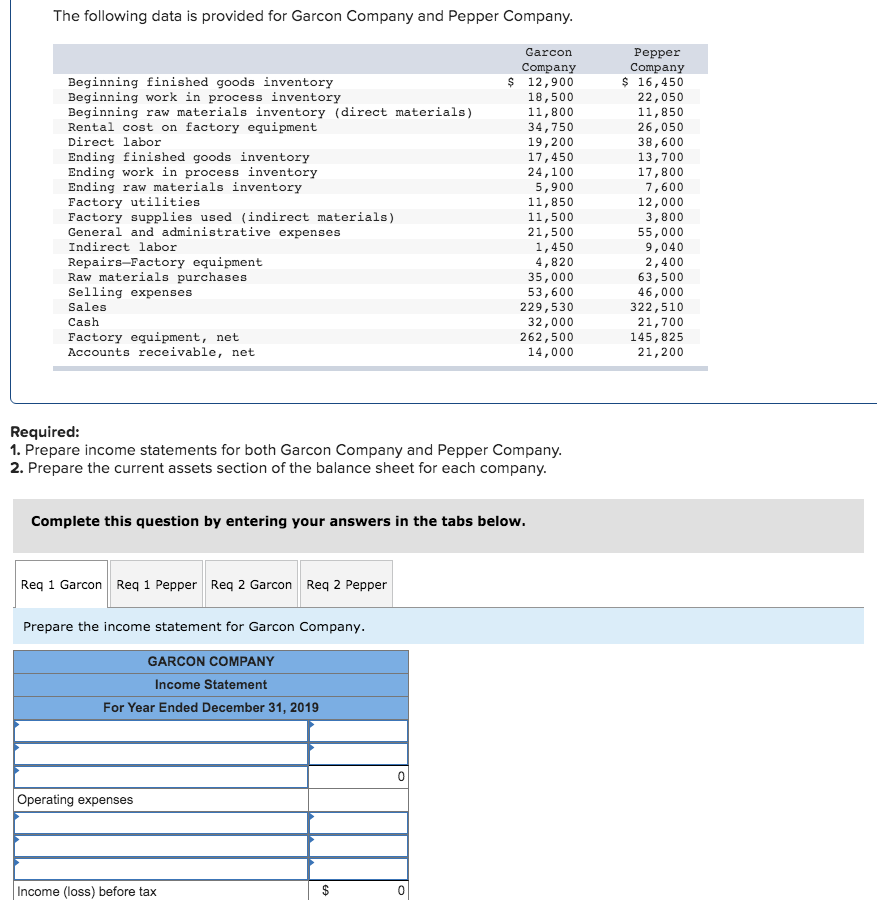

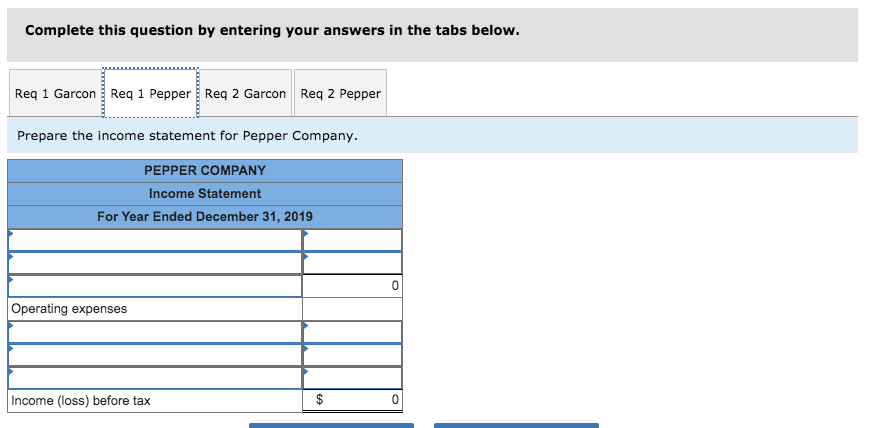

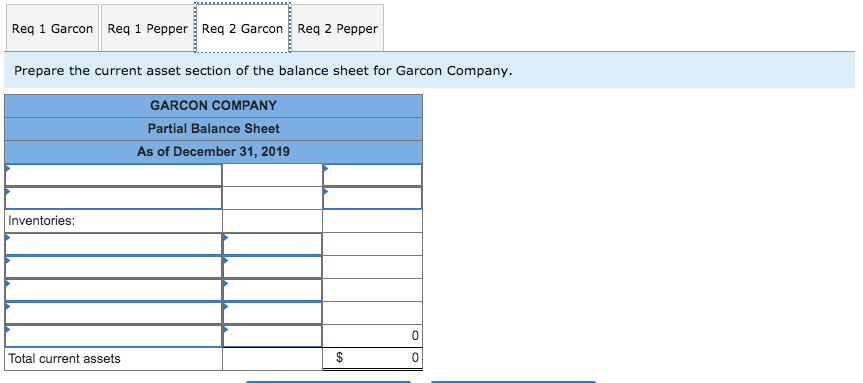

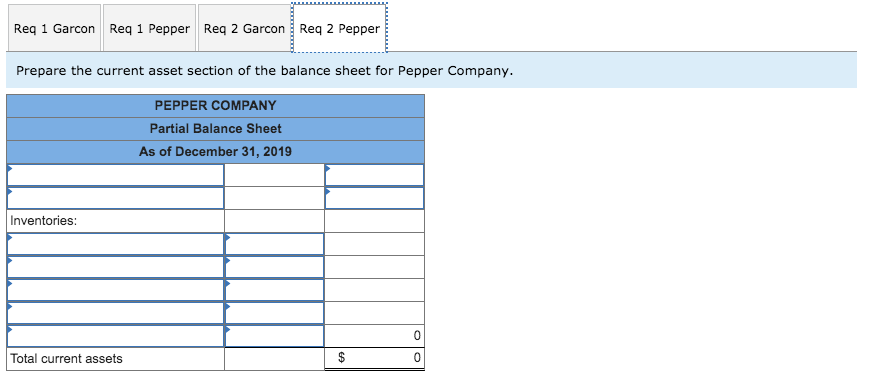

The following data is provided for Garcon Company and Pepper Company. Garcon pper Company $ 16,450 22,050 Company $12,900 18,500 11,800 Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment 11,850 26,050 38,600 34,750 19,200 17,450 24,100 Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses 13,700 17,800 5,900 11,850 11,500 21,500 1,450 4,820 35,000 53,600 229,530 32,000 262,500 14,000 7,600 12,000 3,800 55,000 9,040 Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses 2,400 63,500 46,000 Sales 322,510 21,700 145,825 21,200 Cash Factory equipment, net Accounts receivable, net Required: 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of the balance sheet for each company. Complete this question by entering your answers in the tabs below. Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper Prepare the income statement for Garcon Company. GARCON COMPANY Income Statement For Year Ended December 31, 2019 0 Operating expenses 0 Income (loss) before tax The following data is provided for Garcon Company and Pepper Company. Garcon pper Company $ 16,450 22,050 Company $12,900 18,500 11,800 Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment 11,850 26,050 38,600 34,750 19,200 17,450 24,100 Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses 13,700 17,800 5,900 11,850 11,500 21,500 1,450 4,820 35,000 53,600 229,530 32,000 262,500 14,000 7,600 12,000 3,800 55,000 9,040 Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses 2,400 63,500 46,000 Sales 322,510 21,700 145,825 21,200 Cash Factory equipment, net Accounts receivable, net Required: 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of the balance sheet for each company. Complete this question by entering your answers in the tabs below. Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper Prepare the income statement for Garcon Company. GARCON COMPANY Income Statement For Year Ended December 31, 2019 0 Operating expenses 0 Income (loss) before tax Complete this question by entering your answers in the tabs below. Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper Prepare the income statement for Pepper Company PEPPER COMPANY Income Statement For Year Ended December 31, 2019 Operating expenses $ 0 Income (loss) before tax Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper Prepare the current asset section of the balance sheet for Garcon Company. GARCON COMPANY Partial Balance Sheet As of December 31, 2019 Inventories: 0 0 Total current assets EA Req 1 Garcon Req 1 Pepper Req 2 Garcon Req 2 Pepper Prepare the current asset section of the balance sheet for Pepper Company. PEPPER COMPANY Partial Balance Sheet As of December 31, 2019 Inventories: $ Total current assets OO