Answered step by step

Verified Expert Solution

Question

1 Approved Answer

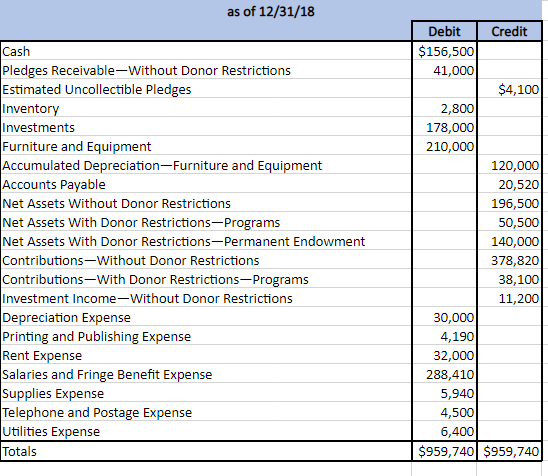

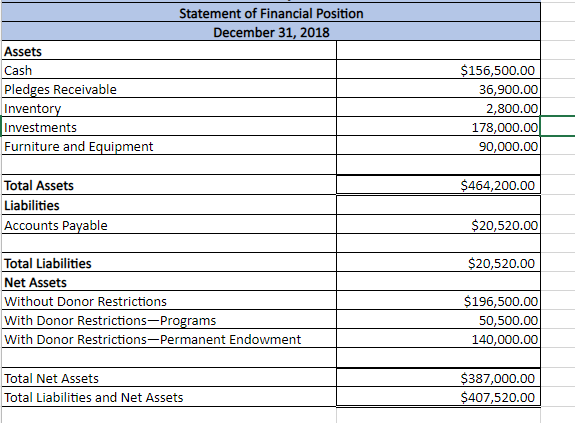

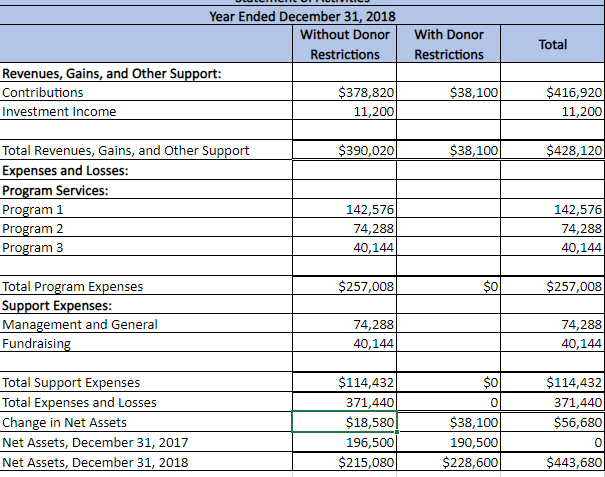

How do I calculate these four ratios, especially the investment performance? Statement of Financial Position December 31, 2018 begin{tabular}{|l|r|} hline Assets & hline Cash

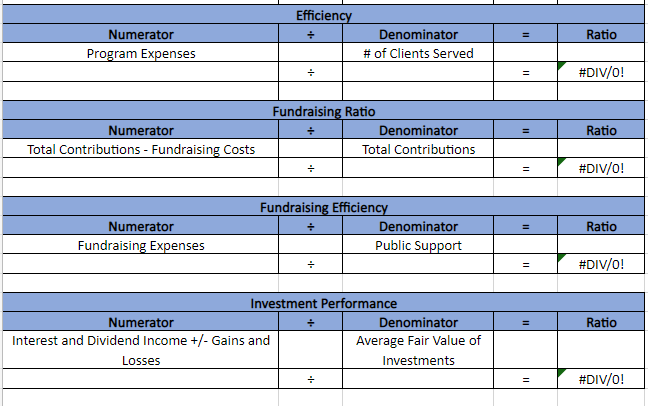

How do I calculate these four ratios, especially the investment performance?

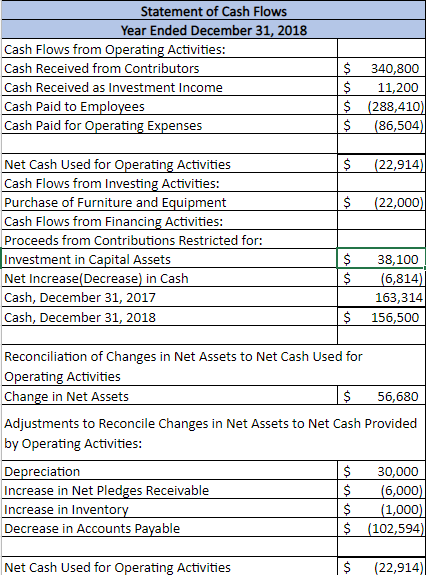

Statement of Financial Position December 31, 2018 \begin{tabular}{|l|r|} \hline Assets & \\ \hline Cash & $156,500.00 \\ \hline Pledges Receivable & 36,900.00 \\ \hline Inventory & 2,800.00 \\ \hline Investments & 178,000.00 \\ \hline Furniture and Equipment & 90,000.00 \\ \hline & \\ \hline Total Assets & $464,200.00 \\ \hline Liabilities & \\ \hline Accounts Payable & $20,520.00 \\ \hline & $20,520.00 \\ \hline Total Liabilities & \\ \hline Net Assets & $196,500.00 \\ \hline Without Donor Restrictions & 50,500.00 \\ \hline With Donor Restrictions-Programs & 140,000.00 \\ \hline With Donor Restrictions-Permanent Endowment & $387,000.00 \\ \hline & $407,520.00 \\ \hline Total Net Assets & \\ \hline Total Liabilities and Net Assets & \\ \hline \end{tabular} Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Cash Received from Contributors Cash Received as Investment Income Cash Paid to Employees Cash Paid for Operating Expenses Net Cash Used for Operating Activities $(22,914) Cash Flows from Investing Activities: Purchase of Furniture and Equipment $(22,000) Cash Flows from Financing Activities: Proceeds from Contributions Restricted for: Investment in Capital Assets $38,100 Net Increase(Decrease) in Cash \begin{tabular}{|cc|} \hline$ & (6,814) \\ \hline & 163,314 \\ \hline$ & 156,500 \\ \hline \end{tabular} Cash, December 31, 2017 Cash, December 31,2018 Reconciliation of Changes in Net Assets to Net Cash Used for Operating Activities Change in Net Assets Adjustments to Reconcile Changes in Net Assets to Net Cash Provided by Operating Activities: \begin{tabular}{|l|lr|} \hline Depreciation & $ & 30,000 \\ \hline Increase in Net Pledges Receivable & $ & (6,000) \\ \hline Increase in Inventory & $ & (1,000) \\ \hline Decrease in Accounts Payable & $ & (102,594) \\ \hline Net Cash Used for Operating Activities & & \\ \hline & $ & (22,914) \end{tabular} Investment Performance \begin{tabular}{|c|c|c|c|c|} \hline Numerator & & Denominator & = & Ratio \\ \hline InterestandDividendIncome+/-GainsandLosses & AverageFairValueofInvestments & & \\ \hline & & & = & \#DIV/0! \\ \hline \end{tabular} Statement of Financial Position December 31, 2018 \begin{tabular}{|l|r|} \hline Assets & \\ \hline Cash & $156,500.00 \\ \hline Pledges Receivable & 36,900.00 \\ \hline Inventory & 2,800.00 \\ \hline Investments & 178,000.00 \\ \hline Furniture and Equipment & 90,000.00 \\ \hline & \\ \hline Total Assets & $464,200.00 \\ \hline Liabilities & \\ \hline Accounts Payable & $20,520.00 \\ \hline & $20,520.00 \\ \hline Total Liabilities & \\ \hline Net Assets & $196,500.00 \\ \hline Without Donor Restrictions & 50,500.00 \\ \hline With Donor Restrictions-Programs & 140,000.00 \\ \hline With Donor Restrictions-Permanent Endowment & $387,000.00 \\ \hline & $407,520.00 \\ \hline Total Net Assets & \\ \hline Total Liabilities and Net Assets & \\ \hline \end{tabular} Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Cash Received from Contributors Cash Received as Investment Income Cash Paid to Employees Cash Paid for Operating Expenses Net Cash Used for Operating Activities $(22,914) Cash Flows from Investing Activities: Purchase of Furniture and Equipment $(22,000) Cash Flows from Financing Activities: Proceeds from Contributions Restricted for: Investment in Capital Assets $38,100 Net Increase(Decrease) in Cash \begin{tabular}{|cc|} \hline$ & (6,814) \\ \hline & 163,314 \\ \hline$ & 156,500 \\ \hline \end{tabular} Cash, December 31, 2017 Cash, December 31,2018 Reconciliation of Changes in Net Assets to Net Cash Used for Operating Activities Change in Net Assets Adjustments to Reconcile Changes in Net Assets to Net Cash Provided by Operating Activities: \begin{tabular}{|l|lr|} \hline Depreciation & $ & 30,000 \\ \hline Increase in Net Pledges Receivable & $ & (6,000) \\ \hline Increase in Inventory & $ & (1,000) \\ \hline Decrease in Accounts Payable & $ & (102,594) \\ \hline Net Cash Used for Operating Activities & & \\ \hline & $ & (22,914) \end{tabular} Investment Performance \begin{tabular}{|c|c|c|c|c|} \hline Numerator & & Denominator & = & Ratio \\ \hline InterestandDividendIncome+/-GainsandLosses & AverageFairValueofInvestments & & \\ \hline & & & = & \#DIV/0! \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started